GPT, TPG Enter Strategic Partnership

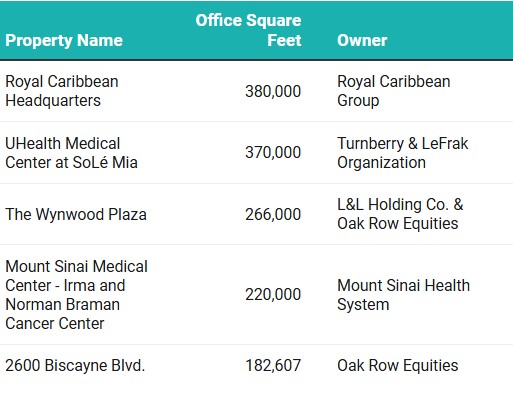

Strategic Office Partners' portfolio comprises high-quality, single-tenant office assets totaling 1 million square feet.

By Keith Loria, Contributing Editor

New York—TPG Real Estate has acquired a 75 percent interest in a portfolio of six office assets valued at $187.5 million, from Gramercy Property Trust, and the two have formed a new partnership, Strategic Office Partners.

“We see a compelling investment opportunity in the office net lease sector and believe that this portfolio of high-quality assets in strong growth markets is poised to benefit from positive fundamental trends,” Avi Banyasz, TPG Real Estate’s co-head, said in a prepared release. “We look forward to working with Gramercy, a best-in-class owner and operator, whose extensive experience in the space will prove valuable as we work together to manage and expand the platform.”

The newly formed $400 million equity partnership will be initially financed with a $200 million non-recourse secured credit facility from an institutional lender as well as equity from Gramercy Property Trust and TPG Real Estate.

The portfolio is comprised of high-quality, single-tenant net lease office assets totaling approximately one million square feet in the Los Angeles MSA, San Francisco Bay Area, the San Diego MSA, Nashville, Tenn., and Minneapolis.

“We are excited to partner with TPG Real Estate, which is a best-in-class private equity investor,” Ben Harris, Gramercy Property Trust’s president, said in the release. “Gramercy will look to leverage its extensive asset management experience from managing its own portfolio and the portfolios of third party clients to enhance the value of the platform over time.”

The portfolio had a weighted average remaining lease term of 3.6 years at closing weighted by square footage. The buildings have an average tenant tenure of more than 11 years, and half of the assets have been occupied by the original tenant since construction.

You must be logged in to post a comment.