Who’s Winning the CRE Debt Wars?

Despite positive market fundamentals, competing in the late-cycle financing arena requires sharp skills and discipline.

With a growing number of new private lenders entering the debt space, the wall of capital for commercial real estate is getting taller and wider. According to JLL’s global debt market update for the third quarter of last year, more than two-thirds of all private closed-end debt capital raised since 2010 has targeted U.S. markets. So in order to compete in this highly active environment, lenders are zooming in on every opportunity and embracing controlled risk.

Kevin Fagan, director of commercial real estate research at Moody’s, stated that interest-only loans, which are on the rise, are more likely to default. Image courtesy of Moody’s

Debt origination rose to $277 billion in the first half of 2019, up 10.6 percent compared to the same period in 2018, the JLL report shows. In addition, mortgage delinquencies fell to their lowest level in the last 25 years at the end of the third quarter of 2019, according to the Mortgage Bankers Association. This is the result of a strong economy, ongoing low-interest rates and a highly liquid finance market.

“It’s getting harder to come up with new ways of saying that for just about every capital source, delinquency rates are at or near record lows,” said Jamie Woodwell, MBA’s vice president of commercial research and economics.

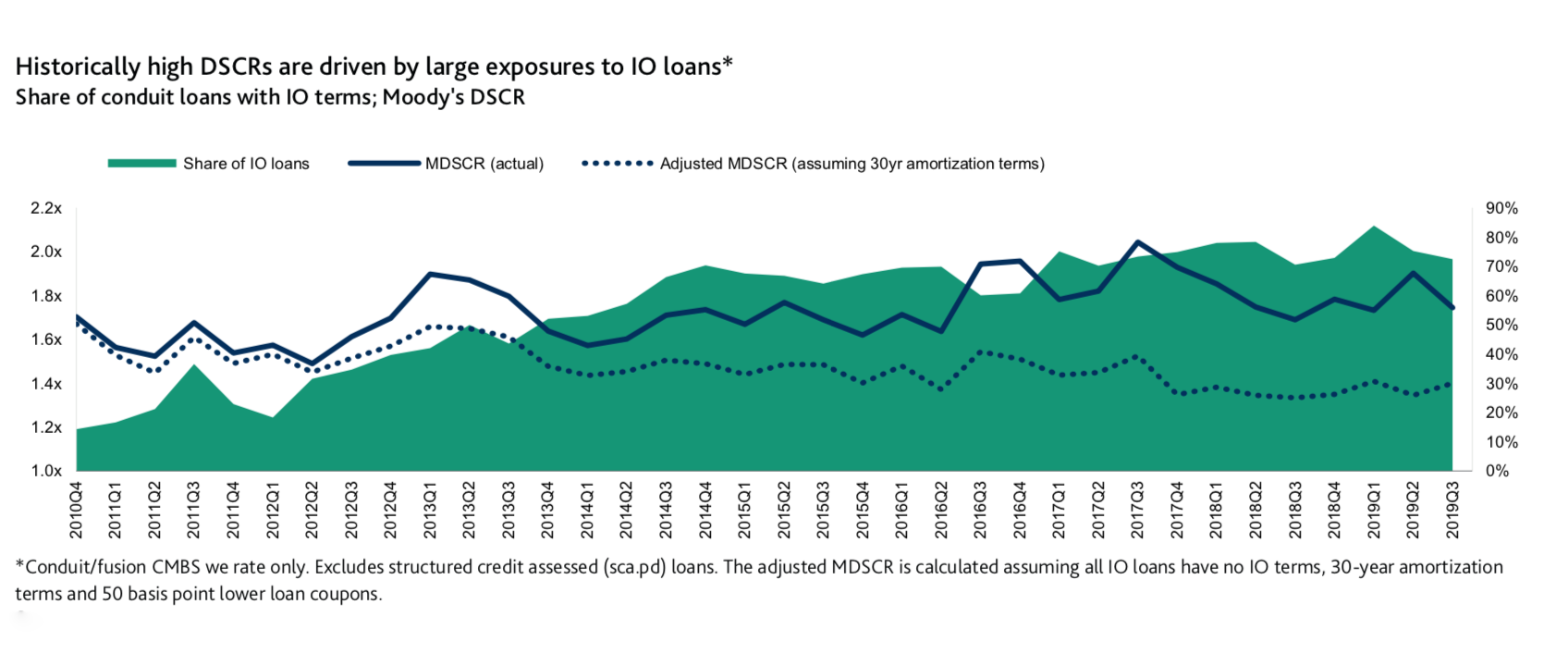

Kevin Fagan, director of commercial real estate research for bond rating firm Moody’s Investor Service, predicts that the impact of increased competition among lenders in the commercial mortgage-backed securities market could impact two key areas. The first is the percentage of CMBS issuance that is now interest-only, which has been growing over the last four or five years, Fagan notes. As recently as 2015, only about half of CMBS was IO compared with today when about 85 percent of issuance includes some portion of long-term interest-only underwriting.

“We’ve found that whether or not a loan is interest-only is an independent predictor of default and loss, meaning even if you have a higher debt service coverage ratio because you’re not paying principal or you started off with a lower loan-to-value, interest-only loans are still more likely to default,” Fagan warns.

In addition to the increase in IO underwriting, Fagan also points to an increase in the number of properties in CMBS pools that are single-tenant occupied. Over the last decade, office has replaced retail as the most dominant property type in CMBS and “a very large percentage of what we’re seeing has high exposure to single tenants,” he says.

In point of fact, 22 percent of all conduit CMBS issuance in 2019 was for single-tenant properties, meaning more than half of the property is occupied by single-tenants. “That might be a by-product of competitiveness where CMBS is being more accepting of that risk concentration,” Fagan says.

The hospitality slippage

Invesco Managing Director Charlie Rose warns that lenders agreeing to single-purpose entity only carve-outs is a concerning trend. Image courtesy of Invesco

The issuance of commercial real estate collateralized loan obligations exceeded expectations. These securities are the newer and more improved form of collateralized debt obligations—the debt instrument that held securitized subprime mortgages and was a major contributing factor to the subprime mortgage crisis. According to Trepp, CLO issuance for the first eight months of 2019 was up 42 percent over the same period in 2018 and total issuance for 2019 was expected to reach $19.5 billion.

There are many differences between the two debt instruments. Fagan pointed out that the pre-crisis CDOs held mixed pieces of loans and tranches of other deals, while CLOs contain only whole loans. Generally, the existing underlying property covers the debt service of bridge loans used to reposition or renovate assets.

The only potential red flag, Fagan says, is “some deterioration” resulting from more underlying hotels in CLOs than there have been in the past. “Generally, we assign lower recovery rates to hotels for that space,” he says.

Even so, there are more managed portfolios than static ones in the space and managers have the flexibility to actively operate their properties, most of which have fairly strict reinvestment requirements. “There’s a little bit of slippage in terms of hotels,” Fagan admits, “but we haven’t had any issues with people relaxing on their business plans so far.”

Stretching for yield

Bryan McDonnell, managing director for PGIM, stated that the CMBS market reveals much more discipline than in the last cycle. Image courtesy of PGIM

Looking ahead, from 2020 to 2024, $130 billion to a little over $150 billion of non-bank-held mortgages are set to mature, with multifamily loans making up the largest share, according to MBA’s 2019 commercial and multifamily mortgage maturity survey.

Fagan pointed out a few bright spots. For example, bank regulations have served to restrict construction lending, which was beginning to outpace demand. Also, LTVs before the crisis were over 70 but now are just over 60 percent. “There does seem to be some kind of discipline where everybody’s not trying to climb over each other to get over the cliff,” he says.

The number of non-bank lenders and their associated lending volume has snowballed since 2016, rising sharply from about $32 billion of commercial and multifamily mortgages intermediated by investor-driven lenders to $52 billion in 2017, then $67 billion in 2018. In the first half of 2019 it was 10 percent ahead of the pace seen a year before, according to the MBA data. The top investor-driven lenders in this cycle tend to be sophisticated players like Blackstone, Deutsche Bank, Capital One and Wells Fargo.

Charlie Rose, managing director of the loan acquisition team for Invesco, a non-recourse floating-rate relationship bridge lender, says his firm has seen significant downward pressure on spreads in recent years, but those spreads seem to have “floored out,” and in some instances, ticked back up a bit this year.

The more concerning trends Rose sees include some lenders agreeing to “SPE (single-purpose entity) only carve-outs, deterioration of guarantor financial covenants and refinancings increasing as a percentage of deal volume as some borrowers are unable to hit target sales prices.”

Invesco closed approximately $3.2 billion in financing deals last year—including a $349 million loan for 110 William in New York—with a goal to exceed $4 billion in 2020. Rose also revealed that while a number of alternative lenders have reduced their return targets, Invesco has maintained a steady course.

Despite credit standards “creeping up in some corners of the bridge lending market,” Rose says leverage is generally moderate in the space that has seen steady loan demand as a result of the continued low interest rate environment.

“We certainly see some lenders who have raised expensive capital stretching for yield,” he added. “This is never a good sign for the capital markets, and we expect some distress to result and, ultimately, a consolidation in the bridge lending space.”

Moody’s research shows that historically high debt service coverage ratios are driven by large exposures to interest-only loans. The data in the chart excludes structured credit assessed loans. Image courtesy of Moody’s

Digging for gold

In the event of a downturn, Rose anticipates that the lending products most likely to suffer would be “loans with high operating leverage (including some of the ground-lease financing that has accelerated recently), and bridge lenders who are financing value-add business plans on lower-quality real estate in secondary markets.”

PGIM Real Estate Finance has a large global lending platform that invests across the risk spectrum and is best known in the U.S. for its investments on behalf of its parent company, Prudential Financial. Out of the more than $18 billion in financing transactions that PGIM was on track to close in 2019, approximately $9 billion was lending on behalf of third-party investors.

Bryan McDonnell, managing director for PGIM, points out that the company is seeing increased LTVs across the board. However, like Fagan, he notes that the CMBS market reveals much more discipline than the last cycle.

“Debt funds are an area that we’ve been watching closely,” McDonnell said. There are a lot of new debt funds in the market—many of which are focused on construction and value-add lending—and debt fund originations are actually outpacing those of life companies, which is significant. There’s been a lot of pressure on debt funds to raise capital and it’s worth keeping an eye on this market.”

Industry watchers across the board anticipate a long-term continuation of the current low interest rate, slow growth environment, meaning drawing yield from a turnip will likely come as a result of deep relationships, expertise and elbow grease.

“Many sector-specific structural trends have played out and there are not many property types that remain systemically undervalued,” McDonnell points out. “Each transaction needs to be evaluated closely on its own merit to find those where the debt is priced appropriately.”

You must be logged in to post a comment.