While Supply Chain Slows, Logistics Real Estate Moves Fast: Report

The market is expected to remain exceptionally competitive, according to the latest report by Prologis.

Robust e-commerce and retail sales combined with supply chain challenges continue to drive demand for space in the industrial sector, which hit a record 3.9 percent vacancy in the third quarter as rents rose 7.1 percent quarter-over-quarter, according to Prologis.

READ ALSO: How the Supply Chain Crisis Impacts Industrial Real Estate

The supply chain bottlenecks are having an additional impact. The ongoing supply chain crisis slowed the flow of goods and caused a decrease in Prologis’ U.S. Industrial Business Indicator, which tracks customer activity in logistics real estate, from a record 71 in the second quarter to 66 for the third quarter. The IBI in the first quarter was 59. In another sign the supply chain issues were being felt, at least temporarily, the utilization rate for the third quarter stayed in the 84 to 85 percent range, though it remained in line with the long-term average.

The Prologis IBI report notes extreme competition for modern space is driving up rents to record levels, particularly in markets near integral ports and large consumer bases. Citing elevated demand, rising replacement costs and low supply, Prologis Research predicts rent will increase by nearly 19 percent this year. Part of that increased demand is also due to companies building resilience into their supply chains and moving from a “just-in-time” inventory strategy to a “just-in-case” supply chain strategy in an effort to prevent shortages seen during the pandemic. Prologis estimates this shift could drive inventories up by more than 5 to 10 percent at U.S. warehouses, creating even more demand for space.

“The combination of intense competition for few availabilities and construction cost growth in the 15 percent+ range is driving rents higher,” the report noted.

Construction, Absorption Up

U.S. absorption is also at a record high of 115 million square feet for the third quarter and 280 million square feet year-to-date – more than double the same time period last year. Prologis Research forecasts net absorption of 375 million square feet for the full year.

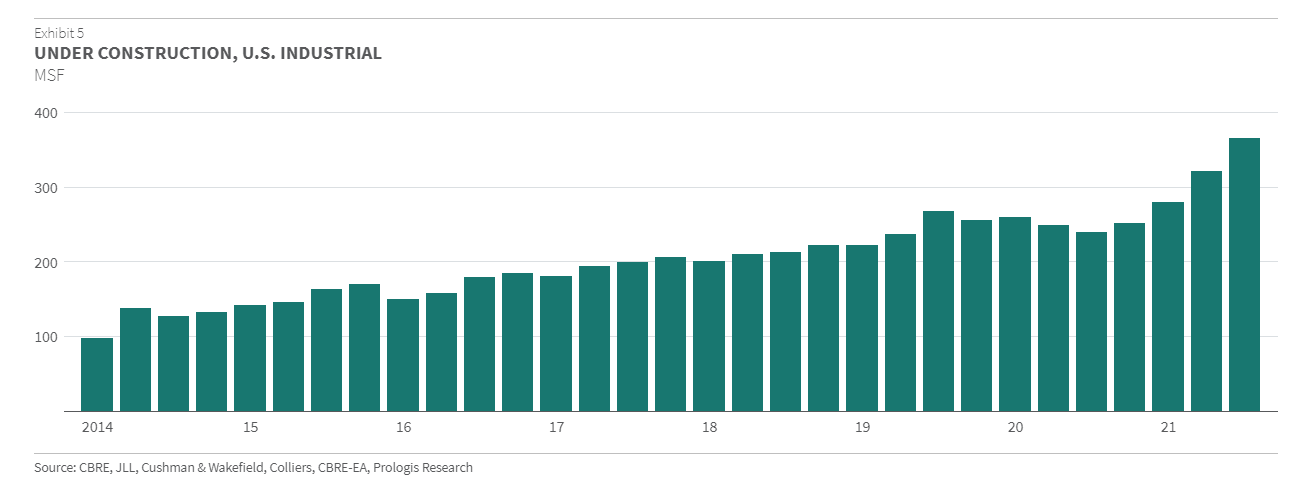

Despite increased construction, the global logistics provider also expects demand for industrial space to outpace new supply through the near term. Construction starts rose to an all-time high of 120 million square feet in the third quarter, with speculative development representing about 88 percent of all starts. Occupiers eager to score new facilities are making deals, with preleasing reaching a record high of 70 percent in the third quarter. But Prologis notes some tenants may have to wait a bit longer for new properties to come online as construction delays are spreading out deliveries.

Under Construction, U.S. Industrial. Chart courtesy of CBRE, JLL, Cushman & Wakefield, Colliers, CBRE-EA, Prologis Research

Stating “space is effectively sold out,” Prologis advises logistics customers to move fast to lock down space because of the construction delays and persistent shortages of properties. However, they might not get space in key markets as Prologis does not expect significant relief in supply-strained primary locations. Most of the new supply is concentrated in low-barrier secondary and tertiary markets and the outlying submarkets of inland markets.

“Looking ahead, we expect that market conditions will remain exceptionally competitive for customers looking to expand, making it essential to plan early and move quickly,” Prologis stated.

Read the full report by Prologis.

You must be logged in to post a comment.