Where Are the Next Life Sciences Hubs?

JLL evaluated 110 U.S. markets for its just-released report on this fast-growing industry.

The Charlotte-Concord-Gastonia region topped JLL’s list of emerging life sciences markets in the U.S., while the Los Angeles-Long Beach-Anaheim market led the way in compensation.

As the life science industry grows stronger and more vital amid the battle with COVID-19, the firm has released its Life Sciences Emerging Markets Index, outlining these regions and the factors that are propelling them forward.

READ ALSO: Foreign Investment Update: Where Capital Will Travel in 2021

JLL indicates that the life science sector is “poised for a paramount shift” and that both investors and occupiers in the life science real estate sector are positioned to benefit from the change, particularly since the country’s leading life sciences clusters—the Greater Boston area, San Francisco and San Diego—have high barriers to entry for investors and limited leasing opportunities.

JLL evaluated 110 U.S. markets in its research, analyzing a variety of metrics to determine which cities are on the upswing. “This paper is meant to start a dialogue rather than provide an exhaustive list or overall ranking,” Audrey Symes, director of research, Healthcare, Life Sciences and Advisory with JLL, told Commercial Property Executive. The firm started with the momentum index, a twofold indicator examining both employment growth and wage positioning. According to the report, “Fortunate wage positioning and employment acceleration reinforce each other, magnetizing the market’s clustering effect.”

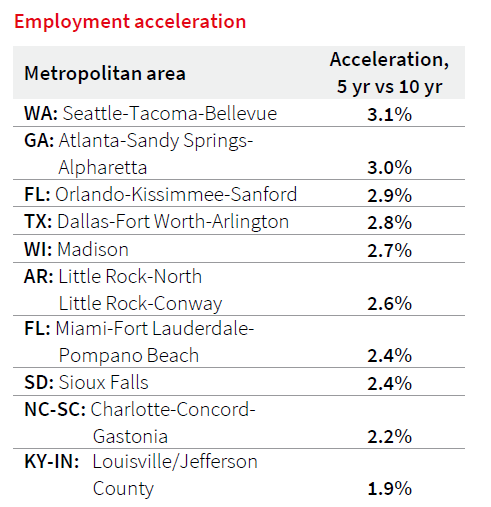

The Seattle-Tacoma-Bellevue metro area leads the way with a 3.1 percent employment acceleration score (a metric measuring the difference in compound average growth in life science employment between 2010 to 2015 and 2015 to 2020). The Atlanta-Sandy Springs-Alpharetta metro area was second, with 3 percent, and Orlando-Kissimmee-Sanford followed with 2.9 percent.

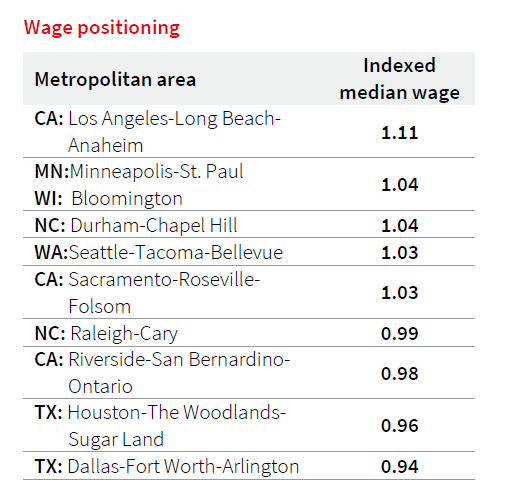

In terms of compensation, as noted in the report, “Wages falling within 10 percent of the national median are a sweet spot for life sciences markets–on the high end, the premium can encourage talent migration, while on the lower end, companies can capitalize on the comparative savings.” The Los Angeles-Long Beach-Anaheim market tops the list with a 1.11 median wage, followed by the Minneapolis-St. Paul-Bloomington, Wis., Region and Durham-Chapel Hill, N.C., which are tied at 1.04.

The right workforce

JLL notes in the report that the most important key to success for a local life science cluster is a strong, reliable talent pool. A substantial source of qualified workers provides life sciences companies with the foundation to flourish so they can, among other vital activities, reel in funding. JLL evaluated the markets that have exceeded in terms of concentration of science, technology, engineering and math professionals. According to the research, the New York-Newark-Jersey City region leads the country by quite a margin, with 1,183,889 STEM degrees, followed by Los Angeles-Long Beach-Anaheim with 683,770 STEM degrees. The Chicago-Naperville-Elgin area ranks third with 539,328 STEM degrees.

“The report highlights the fact that now that the life sciences industry has reached a new height of maturity, with technological sophistication, scale and dissemination that was not available even 10 years ago, more markets can generate technological advances through their pools of STEM talent despite not having a local MIT or Stanford,” Symes said.

Possibilities

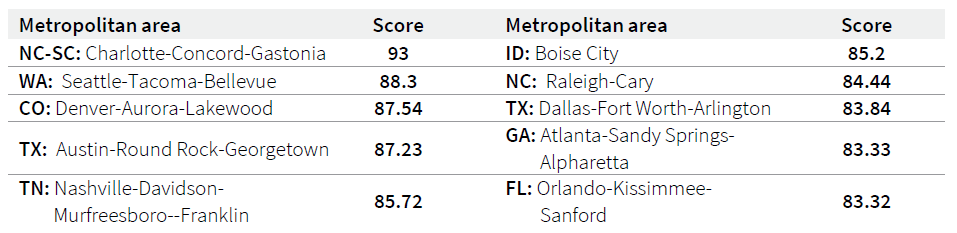

According to JLL, “For an emerging life sciences market to reach full maturity, talent and momentum must combine and synthesize. The best way to ensure that is to provide the foundation for an appealing long-term lifestyle for young professionals, so that they will put down roots and spend their prime career years nurturing the local life sciences ecosystem.” In an effort to rate potential, JLL assessed recent GDP growth, as well as projections for Millennial population, income, and housing stock growth. Taking all those factors into consideration, the Charlotte-Concord-Gastonia region ranked the highest with a score of 93. Seattle-Tacoma-Bellevue came in second place with a score of 88.3 and Denver-Aurora-Lakewood followed with a score of 87.54.

“Though Boston, San Francisco, and San Diego will always occupy a vaulted place within the life sciences pantheon, the incredible dynamism of the industry is jump-starting new markets that are of growing interest to life sciences investors and companies alike thanks to their lifestyle, cost of living, and demographic advantages,” according to the JLL report. “Prompt entry into these markets offers robust upside as they evolve towards drawing significant public and private funding.”

JLL Life Sciences Emerging Markets Index – Potential. Source: Bureau of Economic Analysis, Esri, JLL Research

Symes added that, if asked to choose a front-runner among the featured markets from the report, she believes Houston has significant potential, based on new development activity and local partnerships, as does Raleigh, N.C., based on rising interest in domestic/local supply chain management. While Houston, Raleigh and other rising life sciences markets pose no threat to the stature of leading hubs Boston, San Francisco and San Diego, they certainly pose new prospects.

“I think that these (top) three markets will always provide leadership for the industry at large, and thus, for commercial real estate,” Symes concluded. “The most exciting aspect of the next decades in life sciences is that more markets will begin to contribute, which will lift the entire industry to new heights.”

Read the full report by JLL.

You must be logged in to post a comment.