Office Vacancy Rates Up as Pipeline Poised to Cool

Although the brunt of the impact has been postponed, vacancy rates continue to climb as key markets are hard hit.

With vacancy rates going up across the nation, only a number of markets seem well positioned for the next few years. The national average full-service equivalent listing rates in February clocked in at $38.31 per square foot, remaining almost flat compared to the previous month.

The national vacancy rate increased by 160 basis points year-over-year, reaching 15.0 percent, thanks to the widespread adoption of remote work and expiring leases. Due to the long-term nature of office leases, significant increases in vacancy have been postponed, despite the shock of health crisis-generated lockdowns having happened 12 months ago. Locally, the most significant changes in vacancy were recorded in Austin (up 720 basis points year-over-year), San Francisco (up 480 basis points) and Seattle (up 450 basis points).

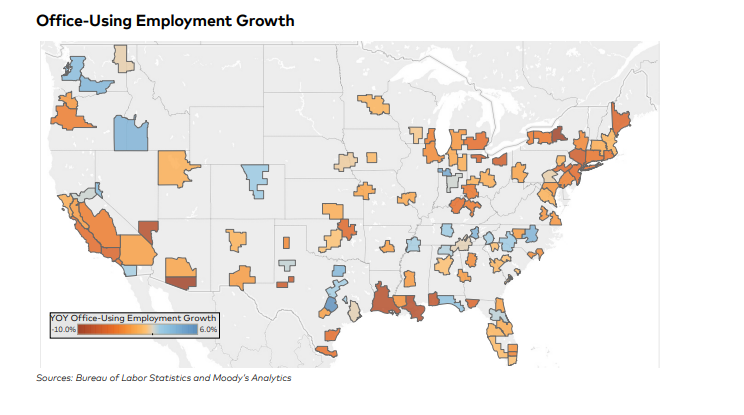

Office-using employment decreased by 3.4 percent year-over-year as of January—as recovery in the sector has largely stalled. However, larger availability of vaccines slowly points to upcoming return-to-office plans for most companies, which could provide a breath of fresh air to office-using employment.

Some 163.2 million square feet of office space was under construction nationwide as of February. Although the pipeline is still substantial, changes in market dynamics will likely lead to a significant drop in development. With 59.4 million square feet of office space expected to be delivered in 2024 and 2025, the market looks likely to go back to post-financial crisis numbers. Markets such as Austin, Nashville and Charlotte will likely continue to see increases in office stock, buoyed by affordable leasing rates and strong long-term appeal.

Read the full CommercialEdge report.

You must be logged in to post a comment.