Economy Watch: Apartment Supply, Rents Will Continue to Grow in 2017

Continued employment growth will buoy a strong year for the apartment industry in 2017, according to a new Berkadia market forecast.

By Dees Stribling, Contributing Editor

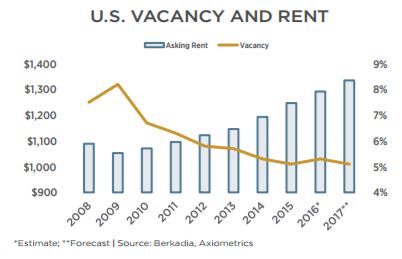

Apartments nationwide will enjoy a reasonably strong year in 2017, buoyed by continued employment growth (a rise of more than 2.7 million jobs, or 1.9 percent), Berkadia predicated in its 2017 Market Forecast. The company estimates vacancies nationwide will edge down 20 basis points to 5.1 percent, even as more than 320,600 new units are put on the market.

That’s despite the fact that, encouraged by rising employment in recent years, developers have accelerated multifamily construction. By 2016, apartment deliveries reached a post-recession peak, with 303,760 market-rate units coming online this year, reported Berkadia. The pipeline is still full, however, so in 2017 even more units will be completed, creating another post-recession high: 320,630 units, by the company’s estimate.

The trend toward inventory growth was especially pronounced in 2016, in such markets as Dallas-Fort Worth, Miami-Fort Lauderdale and Washington, D.C., which saw more than 10,000 new units each. Houston lead all metros, with multifamily additions totaling 21,310 units, even as hiring slowed in the energy industry. Construction in Dallas-Fort Worth during 2017 will put more than 29,600 new units on the market there.

Vacancies might average 5.3 percent nationwide now, but some markets are exceedingly tight, Berkadia reported. Vacancy decreased or held under 4 percent in eight markets this year: Central Valley, Calif.; Detroit; the Twin Cities; Sacramento; L.A. North; Salt Lake City; Orange County; San Diego; L.A. South; and Orlando.

Apartment owners moderated rent growth in 2016 to more sustainable levels, Berkadia also said in its report. Asking rents advanced 3.6 percent year-over-year on a national basis in ’16, with effective rents up 3.8 percent, and average concessions down 20 basis points to 0.7 percent of asking rent. In 2017, by contrast, owners will expand concessions to an average 0.9 percent of asking rent to further entice renters, and asking rents will increase 3.3 percent over the year, somewhat ahead of inflation but not in the same league as the go-go increases of the early 2010s.

You must be logged in to post a comment.