Most Sectors Near Peak, But Crash Unlikely: RCLCO

A strong economy and healthy property market fundamentals will sustain positive operating and investment performance into 2018, the advisory firm projects in a new report.

By Scott Baltic, Contributing Editor

Though the report doesn’t use this term, the Q2 2017 State of the Real Estate Market Chartbook from RCLCO seems to indicate that the current CRE cycle might be heading for a soft landing.

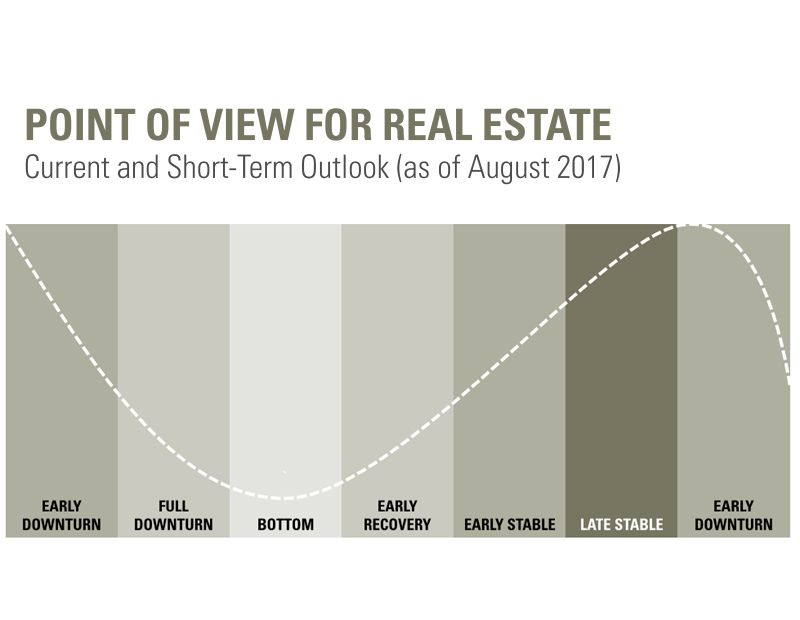

In the report’s words, “Multiple metrics and indicators suggest that we are in or nearing a ‘late stable’ stage of the market cycle for most property types in most geographies.” Multiple property types in some metro areas (for example, Washington, D.C., and Houston), as well as multifamily nationwide, “appear to have surpassed ‘peak’ conditions at this point, though we have no reason to expect a sharp downturn.”

“On balance, we anticipate moderating, though still generally positive, operating and investment performance for the duration of 2017 and into 2018, resulting largely from a strong economy and healthy property market fundamentals,” concludes RCLCO, of Los Angeles.

Over the next 12 months or so, RCLCO expects a continuing march toward “peak” conditions, as inventory remains at or near equilibrium with demand. “At this stage in the cycle, significant increases in rents, occupancy, and prices may be difficult to achieve.”

With little impact from the Trump administration’s policies, capital market conditions remain similar to those at EOY 2016. On the equity side, “moderating operating fundamentals appear to be neutralizing pressure on asset prices.” Foreign capital transactions appear to be on pace to roughly equal those in 2016.

As to debt, it continues to be available for stabilized properties, though tightening lending standards (a trend since about mid-2013) could make it harder to finance non-core assets, creating more opportunities for non-traditional capital players.

Separating out the product types

Retail operating performance benefits from very limited new construction, though some retail types and locations might suffer from “structural obsolescence” caused by e-commerce.

Industrial is the healthiest major property sector, because demand continues to outpace new supply.

In the hospitality sector, occupancy and RevPAR hit peak levels, as quarter-over-quarter transaction volume increased and cap rates expanded.

Office and multifamily projects continue to dominate transaction volume. For the second straight quarter, office absorption did not exceed deliveries, so flattening performance is expected in most markets.

Multifamily rents continue to grow, though the rate of increase is slowing. Investor interest remains strong, as shown by pricing, which rose by 8.6 percent year-over-year. Further, average multifamily vacancies in the five largest apartment markets (New York, Los Angeles, Chicago, Houston and Philadelphia) are still low—and even improved in the second quarter.

Nonetheless, the report cautions, “there is likely pent-up demand for single-family product” as new-household formation outpaces single-family starts.

The Chartbook was authored by RCLCO Managing Director Taylor Mammen and Senior Associate Taylor Kuntz.

Chart courtesy of RCLCO

You must be logged in to post a comment.