Why Private Buyers Lead the Net-Lease Pack

JLL Capital Markets Senior Vice President Eric Suffoletto explains why private capital is outpacing REITs, institutional investors and other players in the single-tenant space.

By Eric Suffoletto

Private capital has always been a major component of the net lease investment sector, but the appetite for deals is markedly on the rise. So far in 2018, private buyers are outpacing institutional investors, REITs and owner-occupiers as the leading purchasers of net-leased real estate.

Private capital has always been a major component of the net lease investment sector, but the appetite for deals is markedly on the rise. So far in 2018, private buyers are outpacing institutional investors, REITs and owner-occupiers as the leading purchasers of net-leased real estate.

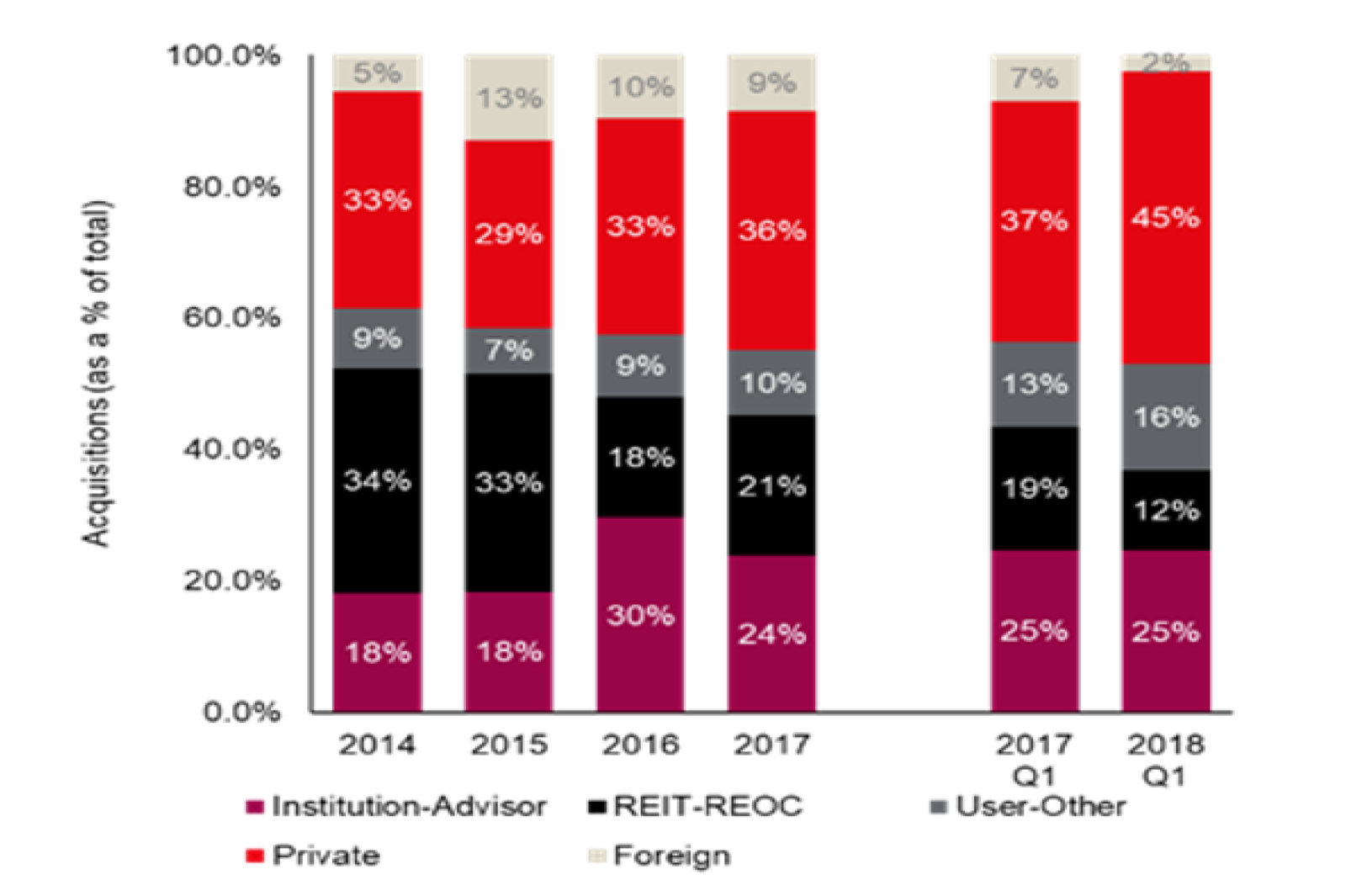

Private investors increased their investment activity in 2017, accounting for 36 percent of all net lease acquisition volume, a 300-basis-point increase over 2016. So far in 2018, private capital is on pace for a 45 percent share of the market, its largest ever. Contrast this to REITs, which as recently as 2014 were on par with private investors in net lease market share (33 percent) but, as of Q1 2018, accounted for just 12 percent of overall market activity.

So, what is driving the upward trend in net lease purchases among private investors? There are three main drivers. First, the ongoing need for tax exchange transactions; second, an overall increase in capital allocation; and, third, the private investors’ ability to nimbly place capital where they want, unlike institutions which are often bound by mandates and stricter underwriting.

1031 Power

Tax-deferred exchanges, also known as 1031 tax exchanges, are a major driver of private capital purchases in the broader commercial real estate market and allow sellers to defer accrued taxable gains through reinvesting proceeds in a qualifying “like-kind” asset within a specified time period. Net lease properties are highly popular as like-kind purchases because they allow investors to efficiently reinvest capital gains in proven, creditworthy, income generating assets that require little or no hands-on management.

Share of acquisition volume by property category, 2014 through Q1 2018; transactions larger than $5 million, including entity-level transactions. Source: JLL Research, Real Capital Analytics.

Tax deferred exchanges tend to see higher activity volume in periods of economic expansion when there are favorable market conditions within real estate and transaction activity is at its strongest, such as the market we are in now.

Capital, Capital, Capital

Largely driven by the economy, investment allocations in the broad commercial real estate market are up across the board, and supply-demand balance in the real estate market. Many private investors are also reacting to a lack of comparable risk-reward yield investments in bond markets. Net-leased real estate investments made in strong locations with good credit tenants in place can provide stable income over long term lease terms, in most instances.

Where are they placing capital? Private investors continue to demonstrate a preference toward the retail sector when looking for investments. Since 2017, 42 percent of all purchases by private investors have been retail properties, compared to 25 percent by institutional investors. Institutional investors are much more selective when pursuing retail assets, preferring to focus on larger deals and portfolio opportunities.

Private investors continue to be nimbler in their strategies, and can leverage opportunities across a wider swath of the retail sector, including assets that are less vulnerable to disruption caused by e-commerce, such as convenience stores, quick service restaurants and pharmacies.

A truly national marketplace

Over the last 24 months, increased transaction volume and competitive pricing in the net lease sector has forced buyers of all types to reevaluate their acquisition criteria. Increased competition for high-quality assets in primary markets has resulted in significant cap rate compression and enhanced pricing for net leased properties of that profile. This has forced many institutions to to secondary and even tertiary markets where competition has historically been less intense and yields are generally more attractive.

However, since private investors do not have to adhere to rigid underwriting guidelines or acquisition criteria, they have continued to remain active in primary markets while also pursuing yield in secondary and tertiary markets on a case by case basis. Emblematic of this constant shift in investor demand, almost half of private investor capital in Q1 2018 was deployed in the Sun Belt region, a segment of the market often previously overlooked by investors seeking opportunities in markets along the coasts or in the southeast.

Private investors’ willingness to pursue investment in all markets has a double benefit because more properties fall into the sweet spot of their typical deal range, roughly $1 million to $20 million, providing more buying opportunities and less competition from institutional buyers.

You must be logged in to post a comment.