Why Private Equity Likes Sale-Leasebacks

Industrial assets are particularly ripe for this type of transaction, having accounted for more than half of deal volume in the first half of 2018, up from 35 percent in 2017, noted Krupa Shah, senior vice president of JLL's capital markets group.

By Krupa Shah

Krupa Shah

The first half of 2018 was strong for commercial real estate as transaction volumes exceeded expectations and reached $195 billion in the U.S. alone, according to JLL’s U.S. Investment Outlook. Overall interest in net-lease assets held steady at $24 billion, of which sale-leaseback transactions represented nearly 15 percent.

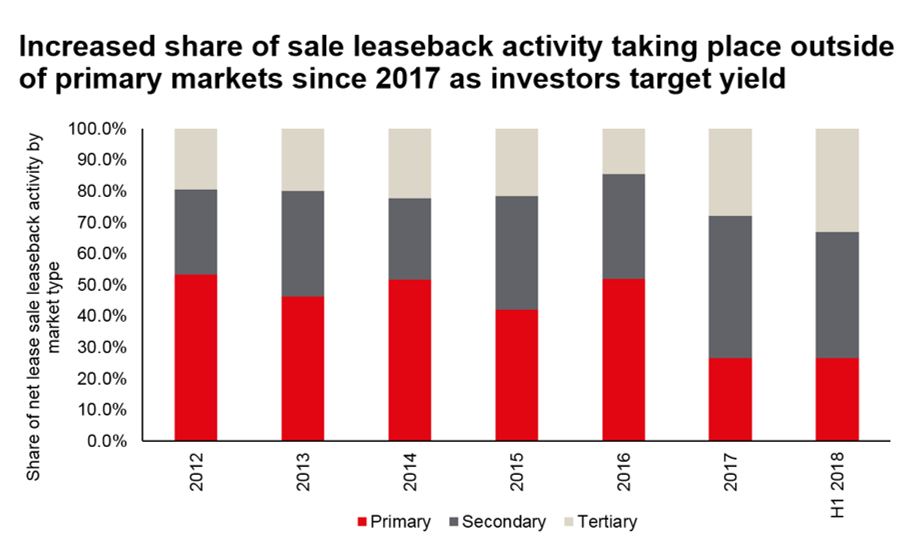

Companies continue to hedge against market uncertainties through the ongoing prevalence of sale-leaseback transactions. Specifically, we’re seeing increased sale-leaseback liquidity for lower- and middle-market companies in secondary and tertiary markets, largely driven by attractive risk-adjusted returns and the support of strong private equity sponsorship.

Note: Transactions larger than $5.0 million, includes entity-level transactions. (Source: JLL Research, Real Capital Analytics)

Private equity funds and add-on strategies

Private equity investors are increasingly targeting middle-market acquisitions—companies valued between $25 million and $1 billion—which accounted for 68 percent of U.S. private equity-backed deals through the second quarter of 2018, as compared to 58 percent for all of 2017, according to PitchBook. Many large platform companies have been pursuing middle-market companies due to the flexibility they offer for add-on acquisitions, being large enough to be impactful and still small enough to deter competition. These add-on acquisitions, where a private equity fund pursues a consolidation acquisition strategy to quickly integrate into existing operations and benefit from cost synergies, can often be an effective and capital-efficient way to grow a portfolio business. These types of deals accounted for 53 percent of middle-market deals through the first half of 2018.

As reported by PitchBook, U.S. private equity funds raised $61 billion for middle-market acquisitions through the second quarter of 2018. The average fund size of $847 million represented a 27 percent increase over the average for the full year 2017. Given the scale of opportunity in the middle market, 88 percent of capital raised is targeting this deal profile, with increasing activity taking place outside of primary markets where companies often own mission-critical real estate, such as industrial production/manufacturing facilities and logistics sites.

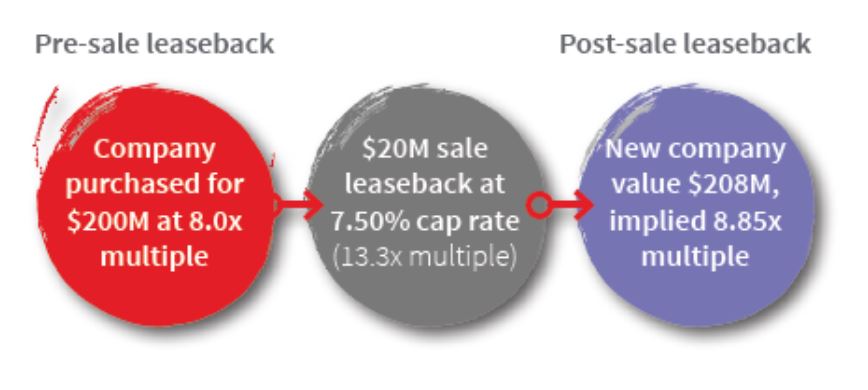

Sale-leasebacks have become a sought-after mechanism for private equity firms to finance and enhance those businesses, while also creating a positive arbitrage opportunity for private equity investors. By carving out real estate from a business concurrent with or post-acquisition, buyers can unlock a substantially higher value for the real estate. This is achieved through the disconnect between the lower EBITDA multiple (often 6x to 8x) paid to acquire the business and the higher EBITDA multiple (typically 12x to 14x) achieved from the sale of the real estate.

Source: JLL

Benefiting the seller

Sellers often use sale leasebacks as a preferred way to recapitalize, especially for non-rated, smaller or middle-market companies that may have trouble accessing capital markets. Executing a sale-leaseback allows them to lighten their balance sheet and use proceeds to pay off other liabilities. Furthermore, it allows these companies to focus on their core competencies and business growth.

Industrial assets are particularly ripe for this type of transaction, having accounted for more than half of sale-leaseback transaction volumes in the first half of 2018, up from 35 percent in 2017, according to JLL’s research. New pricing records and strong investor demand are driving owners to evaluate selling rather than holding their assets.

No sign of slowing down

Fundamentals remains strong in the real estate business, and the economy is continuing to support investment. While it remains to be seen how rising interest rates will ultimately affect private equity fundraising and investment, we do not predict a slowdown in this type of activity at this time.

You must be logged in to post a comment.