Tech Tenants Remain Biggest Force in Office Leasing

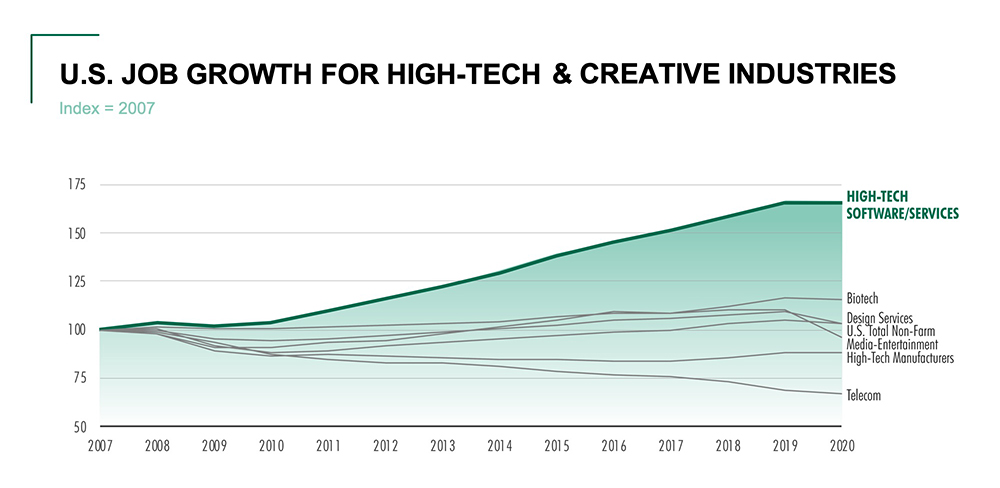

From 2010 to 2019, 1.5 million technology jobs were created. Only 58,000 have been lost in 2020.

Markets with a heavy technology presence have been resilient through the downturn and are poised for post-pandemic growth, the latest CBRE annual Tech-30 report notes.

READ ALSO: Life Sciences Real Estate Demand Thrives: CBRE

In fact, the tech industry is expected to play a key role in rebuilding the economy, despite 58,000 job losses and a sharp rise in sublease rates since the COVID-19 crisis began. Before the pandemic, the technology sector was the biggest force in office-leasing activity in North America, with office rents increasing in all but one of the Top 30 tech markets in the past two years, including five that posted double-digit percentage gains.

This year’s report is unique, given the COVID-19 situation, while setting a baseline for what the tech industry was and where it may be headed in the future, according to a statement by Colin Yasukochi, executive director of the CBRE Tech Insights Center, during a media briefing about the Tech-30 report. “Our analysis shows that the tech industry has been very resilient through this economic downturn and very critical to our transition to a more digital lifestyle that we’re all sort of forced into,” he added.

Yasukochi noted that from 2010 to 2019, 1.5 million tech jobs were created and only 58,000 were lost in 2020.

“The tech industry itself has remained very strong,” he said, adding that the industry suffered very limited job layoffs, which were mostly concentrated in areas such as the transportation, hospitality, restaurant and retail sectors.

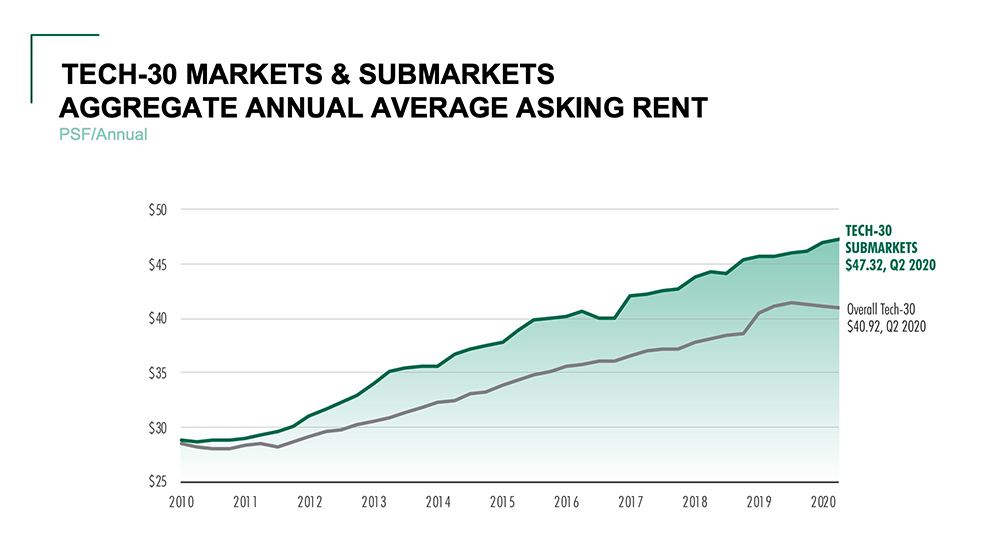

Yasukochi said that even with the slowdown, the tech industry during the first half of the year represented about 20 percent of the total U.S. office leasing activity—about the same as 2019, when it was 21 percent. Over the past two years, five overall markets and 11 submarkets had double-digit rent growth. Net absorption was positive in 26 overall markets and 26 submarkets.

The top markets with rent growth of 10 percent or more between the second quarter of 2018 and the second quarter of 2020 were Charlotte, N.C., followed by New York, Seattle, Silicon Valley and Atlanta. Submarkets seeing the highest rent increases during that period were Oakland/East End in Pittsburgh, Downtown West in Toronto, SOMA in San Francisco, Sorrento Mesa in San Diego, Calif., and Midtown in Atlanta. Top submarkets for net absorption during the period were Lake Union in Seattle, RTP/I-40 Corridor in Raleigh-Durham, N.C., Tech Corridor in Salt Lake City, Tempe in metro Phoenix and University City in Philadelphia.

Sublease concerns

As the impacts of the coronavirus and subsequent economic downturn began to hit the office market in the second quarter, overall U.S. leasing activity dropped 44 percent and tech leasing activity declined by 46 percent from the 2019 average.

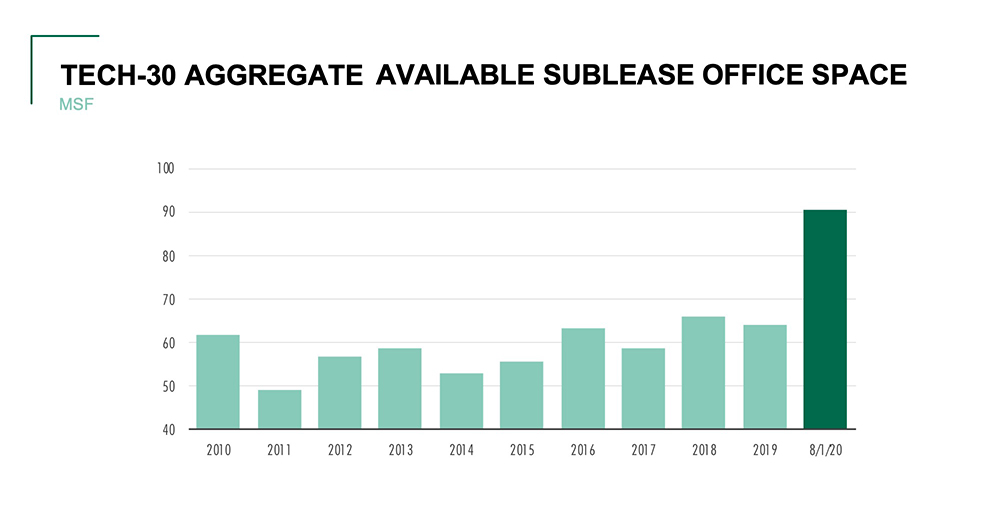

Yasukochi and others also noted the sharp increase in available sublease space in the U.S. and Canadian office markets is a trend that will need to be watched very closely as it evolves. The surplus office space in Tech-30 markets increased by 42 percent, or 27 million square feet, from year-end 2019 to August 2020, and tenant demand was cut in half. The report notes that available sublease space “varies considerably by market and is directly associated with the concentration of venture-backed tech companies and those serving severely weakened economic sectors.”

Tech companies currently account for 25 percent of the 91 million square feet available sublease space across the Tech-30, a 14 percent increase from 2017. CBRE states sublease space is one indicator of future market performance. The Tech-30 market with the highest risk is San Francisco, with a 5.9 percent sublease availability rate and the highest concentration of sublease availability from tech companies. Other markets with higher-than-average risk, but still much lower than San Francisco, were Salt Lake City and Seattle. The report measures the overall risk across Tech-30 markets at medium risk, with a 2.1 percent sublease availability of total inventory.

“Sublease space is fast to come on and off the market so it’s something we are closely monitoring,” said Lexi Russell, director of research and analysis for Northern California and Mountain Northwest.

Top-Growth tech markets

Todd Husak, managing director leading CBRE’s Tech & Media Practice, said several indicators such as robust venture capital investment point to more growth ahead for the tech industry. He noted the industry has also established its value by providing products and services needed to ensure business productivity and continuity.

CBRE also identified several Tech-30 markets well-positioned for resiliency during and after the pandemic, based on a concentration of large-cap tech companies, moderate office rents and a growing tech labor pool. Silicon Valley tops that list followed by Washington, D.C., Vancouver, Atlanta, Dallas/Fort Worth, Raleigh-Durham and San Diego. While some of those are in the Top 10 of the Tech-30 markets, some place lower on that list. The Top 10 are: Vancouver; San Francisco; Austin, Texas; Seattle; New York; Toronto; Dallas/Fort Worth; San Diego; Los Angeles and Denver.

The report also identifies the next 10 tech markets to watch as: Waterloo, Ontario, Canada; Ottawa, Ontario, Canada; Cincinnati; Kansas City, Kan.; Las Vegas; Colorado Springs, Colo.; Houston; Sacramento, Calif.; South Florida and Tampa, Fla.

You must be logged in to post a comment.