Self Storage Rents Continue Slow Decline

A new wave of completed projects and oversupplied markets put pressure on rents, which have dropped 1.7 percent on a national level.

Although self storage rents showed some signs of recovery in the past few months, oversaturated metros and a new wave of completions have led to a decline in the month of April. On a year-over-year basis, street-rate rents dropped by 1.7 percent for the average 10×10 non-climate-controlled and by 2.2 percent for climate-controlled units of similar size.

Listed rates took a downturn in more than half of the top markets tracked by Yardi Matrix. Heavy construction led to a large decline in Charleston, where rent rates fell by 7.6 percent for non-climate- and 6 percent for climate-controlled units. The existing inventory per capita is more than 10 square feet, which is almost twice the national average.

Rents also dropped significantly in Portland, for both climate- and non-climate-controlled units, by 7 and 5 percent. Additionally, after several consecutive years of heightened construction, the new-supply pipeline also fell 4.1 percent over the previous month. Nevertheless, the metro still leads the nation in development (25.1 percent) and with continuous population growth (around 24,000 through 2019), the city is predicted to absorb the new storage supply.

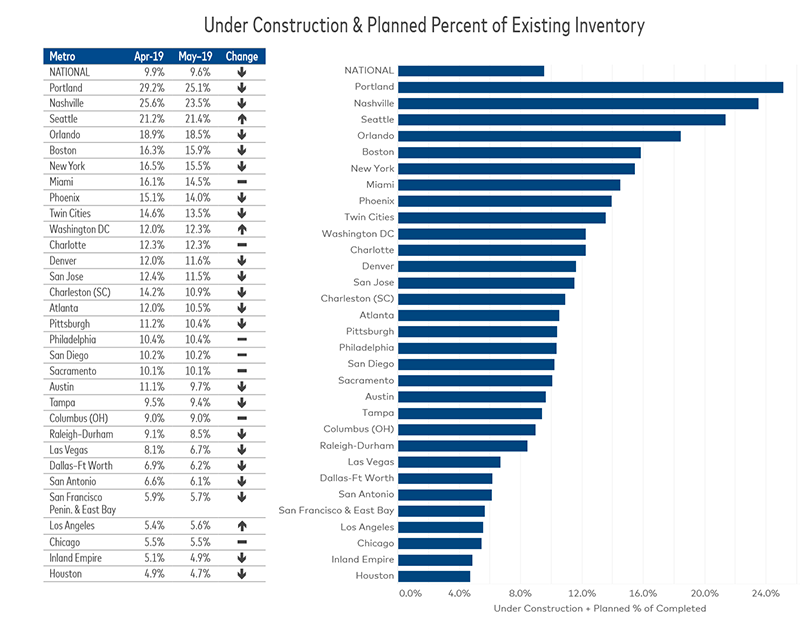

On a national level, projects under construction or in the planning stages accounted for 9.6 percent of total inventory, representing a 30-basis-point slide over the previous month. The downturn is attributed mainly to the significant number of newly completed projects—for instance, due to new deliveries, New York City’s new-supply pipeline dropped by 1 percent, from 16.5 to 15.5 percent month-over-month. However, considering that New York is an anomaly, because of its size and population density, demand remains high; the existing inventory per capita is still only around 3 square feet. The metro currently has 46 stores under construction and 84 in the planning stages.

Overall, only three of the markets tracked by Yardi Matrix experienced increased development activity on a month-over-month basis: Seattle, Los Angeles and Washington D.C.

You must be logged in to post a comment.