Pebblebrook Sells DC Hotel for $142M

After acquiring LaSalle Hotel Properties in November, the REIT embarked upon a disposition program that so far has included eight properties and is expected to continue over the next 18 months.

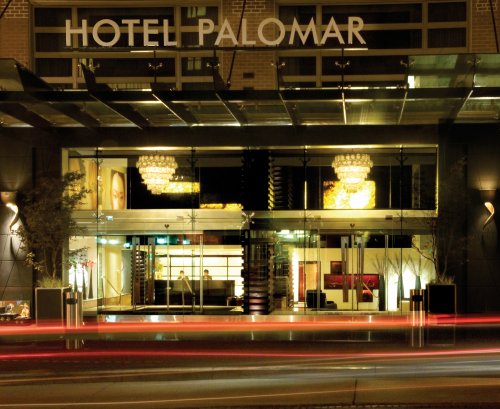

Nearly three months after Pebblebrook Hotel Trust completed its $5.1 billion acquisition of LaSalle Hotel Properties, the Bethesda, Md.-based REIT continues with its disposition program. The latest property to go is the 335-key Hotel Palomar Washington, DC, which sold for $141.5 million to an undisclosed buyer.

The Hotel Palomar sale comes about two weeks after Pebblebrook closed on the disposition of another Washington, D.C., hotel—the 343-key Liaison Capitol Hill, which sold for $111 million. Proceeds from the sales will be used for general business purposes, which may include reducing the company’s outstanding debt.

“We are extremely pleased with the success we’ve had in executing our strategic disposition plan and expect to make significant additional progress on our plan in 2019, particularly in the next four to six months, taking advantage of the attractive private market values of our real estate, which are at a significant premium to our current public market valuation,” Thomas Fisher, Pebblebrook’s chief information officer, said in a prepared statement on Monday, Feb. 25th, when the REIT released its fourth-quarter 2018 earnings report and provided guidance for 2019.

The company, a REIT that acquires and invests primarily in upper upscale, full-service hotels located in major urban markets and resort areas, now owns 61 hotels totaling approximately 14,600 guestrooms in 10 states and Washington, D.C. Other markets the REIT is active in include Boston, Los Angeles, Chicago, Atlanta, Philadelphia, Seattle, San Francisco, San Diego and several Florida locations including Naples, Key West and Coral Gables.

More dispositions details

During Tuesday’s earnings call with analysts, Pebblebrook executives noted the REIT has now sold seven legacy LaSalle hotels for a total of nearly $1.1 billion and one legacy Pebblebrook hotel since the Nov. 30 merger. That property, the Minneapolis Grand Hotel, sold for $30 million in December.

Jon Bortz, chairman, president & CEO, stated on the call that the company expects to sell another $350 million in assets this year and between $400 million and $900 million over the next 18 months or so.

“We’ve been very pleased with the sales prices we’ve achieved so far and we’re confident in our ability to achieve our 2019 objectives, based upon strong current interest and the depth of interest in the kinds of hotels we plan to sell this year,” Bortz said on the call. “As we move through 2019, we’ll be evaluating additional disposition candidates for either later this year or 2020 sales.”

Bortz said asset management and operating teams had been conducting portfolio-wide tours and reviews since September to determine which hotels did not fit into company’s long-term vision and could be candidates for disposition. While he did not give names or locations, he did provide a clue during the analysts’ call.

“We continue to be focused primarily on the two coasts—east and west. And we continue to hold a West Coast bias,” he said. “And you should expect additional sales from the portfolio will be predominantly from either the East Coast or Central markets.”

Merger background

In November, Pebblebrook received a $1.8 billion term loan to help provide the funding it needed to complete the pending merger with its Bethesda neighbor, LaSalle. The loan went toward paying off LaSalle’s outstanding debt and other closing and transaction costs associated with the $5.1 billion merger. One of the costs revealed during the analysts’ call was a $112 million termination fee it paid to private equity giant Blackstone. That’s because throughout much of 2018 Blackstone was expected to acquire LaSalle. Last May, LaSalle had declined three unsolicited offers from Pebblebrook in favor of an all-cash $4.8 billion bid by Blackstone. That merger agreement was terminated on Sept. 6; the same day Pebblebrook and LaSalle announced they had entered into a definitive merger agreement.

Image courtesy of Kimpton Hotels

You must be logged in to post a comment.