NYU REIT Symposium: Finding Value in Disruption

Hosted by NYU Schack, the 22nd annual REIT symposium gathered preeminent decision-makers for a spirited dialogue about the forces impacting the sector. Among the event's headliners were Equity Group Chairman Sam Zell and Blackstone Global Head of Real Estate Jonathan Gray.

By Sanyu Kyeyune

In its 22nd iteration, NYU School of Professional Studies Schack Institute of Real Estate’s REIT Symposium came at a heady time for the U.S. business and economic environment, amid shocks to the retail sector (as evidenced by a slew of notable brands–Payless ShoeSource, JCPenney, Macy’s–shuttering stores nationwide) and sustained regulatory suspense.

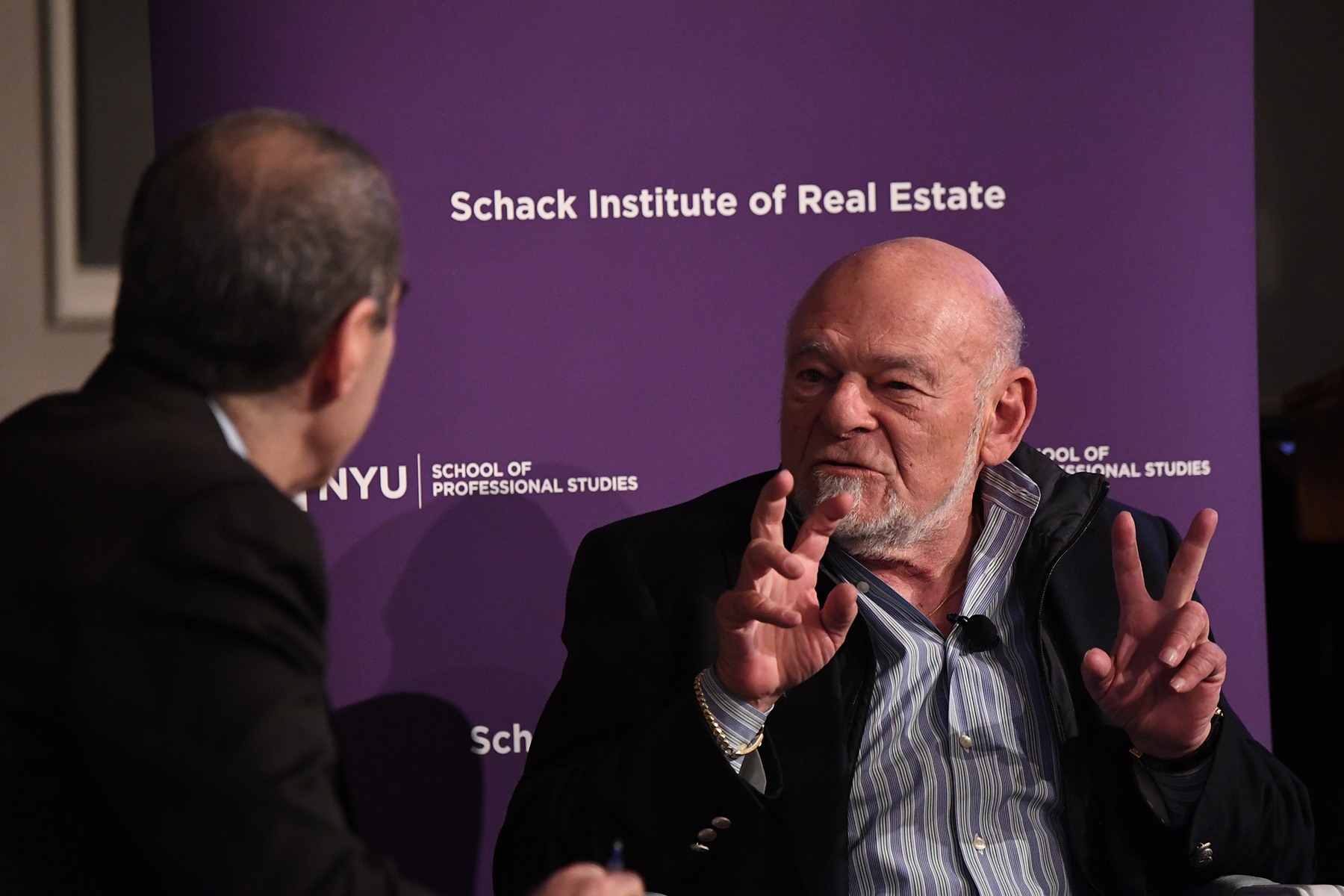

Sam Zell, Chairman, Equity Group Investments

In a one-on-one conversation, Equity Group Investments Chairman Sam Zell called foul on the lack of urgency in raising interest rates, noting also that Trump’s pro-growth stance has emboldened investors, but has yet to make progress in areas such as infrastructure and tax reform.

Still, Zell waxed optimistic about growth in U.S. real estate investment, supported in part by continued interest from China and the liquidity of domestic capital markets. “Corporate America has more cash…than at any time before,” he commented. Following his company’s 2014 takeover of office REIT Equity Commonwealth, Zell sold off 124 properties to rationalize the firm’s portfolio, resulting in a $2.1 billion cash windfall, which–in a characteristically opportunistic move–he plans to deploy outside of the office sector.

According to Blackstone Group’s Global Head of Real Estate Jonathan Gray, industrial distribution centers are the beneficiaries of retail disruption. In the past two years, Blackstone has been bullish on industrial investment, having acquired Austria-based Immofinanz’s entire logistics portfolio for more than $600 million after snatching up 16 U.K. warehouses for around the same figure. Gray referred to the “last-mile” concept, which will lead disruption by locating distribution centers in or around urban centers in order to shrink delivery timelines.

Jonathan Gray, Global Head of Real Estate, Blackstone (left), and moderator Barry Vinocur.

Unlocking Value

A group of executives shared tactics for unlocking value for shareholders while executing growth strategies. Overall, they agreed that that retail in the U.S. was not overbuilt, but under-demolished. To buck this trend, Benjamin Schall, president & CEO of Seritage Growth Properties (which owns 266 properties totaling 40 million square feet), has led the conversion of several single-tenant Sears locations to best-in-class shopping centers and mixed-use properties.

“We have seen the most activity from three categories: the discount retailers, everyday uses–such as gyms and grocers–and experiential retail, like entertainment and dining,” Schall said. In the fourth quarter of 2016, Seritage leased 900,000 square feet of retail space, with demand coming from growing brands, including R.E.I., Planet Fitness, T.J. Maxx and Saks OFF 5TH.

Referring to Orlando-based National Retail Properties, moderator and Schack Associate Dean Sam Chandan said, “(Craig Macnab’s) strategy involves acquiring assets directly from retailers that are growing,” adding “I think it’s important to remind our audience that retailers are growing,” eliciting chuckles.

Macnab, chairman & CEO of the triple-net lease retail REIT, explained that his firm’s portfolio of 2,500 properties is 99% occupied because “small-box retailers–restaurants and convenience stores–are doing just fine.”

Conor Flynn (pictured at center), President & CEO, Kimco Realty Corp.

Reframing Retail

“The omnichannel wave is here to stay,” claimed Conor Flynn, president & CEO of Kimco Realty Corp., naming Home Depot among the companies that have responded to the trend with parallel in-store and online offerings. Flynn also counted a proposed border adjustment tax among the most damaging blows to retail employment.

Increasingly, REITs will look to spinoffs to create value for shareholders, shedding properties that no longer make sense for their portfolios. Creative strategies to reposition underperforming assets, such as revamping facades and altering the tenant mix, have proven successful for many of the REITs in attendance at the conference. In the current economic landscape, it will become more crucial for retail REITs to deliver an experience that cannot be replicated online. Meanwhile, organizations that are able to locate industrial facilities close to cities stand to benefit as e-commerce eclipses brick-and-mortar retail.

Images courtesy of NYU Schack Institute of Real Estate and Commercial Property Executive

You must be logged in to post a comment.