Foreign Investment Moves Beyond the Gateways

Lofty prices and compressed yields are causing global buyers to prospect in other lucrative, business-friendly states such as Texas and Florida.

Singapore-based investors were highly active in U.S. commercial property markets last year, including CapitaLand, which scooped up a 3,787-unit multifamily portfolio for a total of $838 million last September. The 16 communities acquired by the real estate firm in the western U.S. include: Stoneridge at Cornell (top), a 233-unit asset in Portland, Ore. Image courtesy of CapitaLand Ltd.

Foreign investment has helped drive a nearly decade-long bull market in U.S. commercial real estate by picking up trophy skyscrapers, luxury hotels and massive development sites in cities like New York and Los Angeles. These days, cross-border buyers are still betting on America’s property markets, but they’ve discovered that there’s more to life than splashy deals in gateway cities.

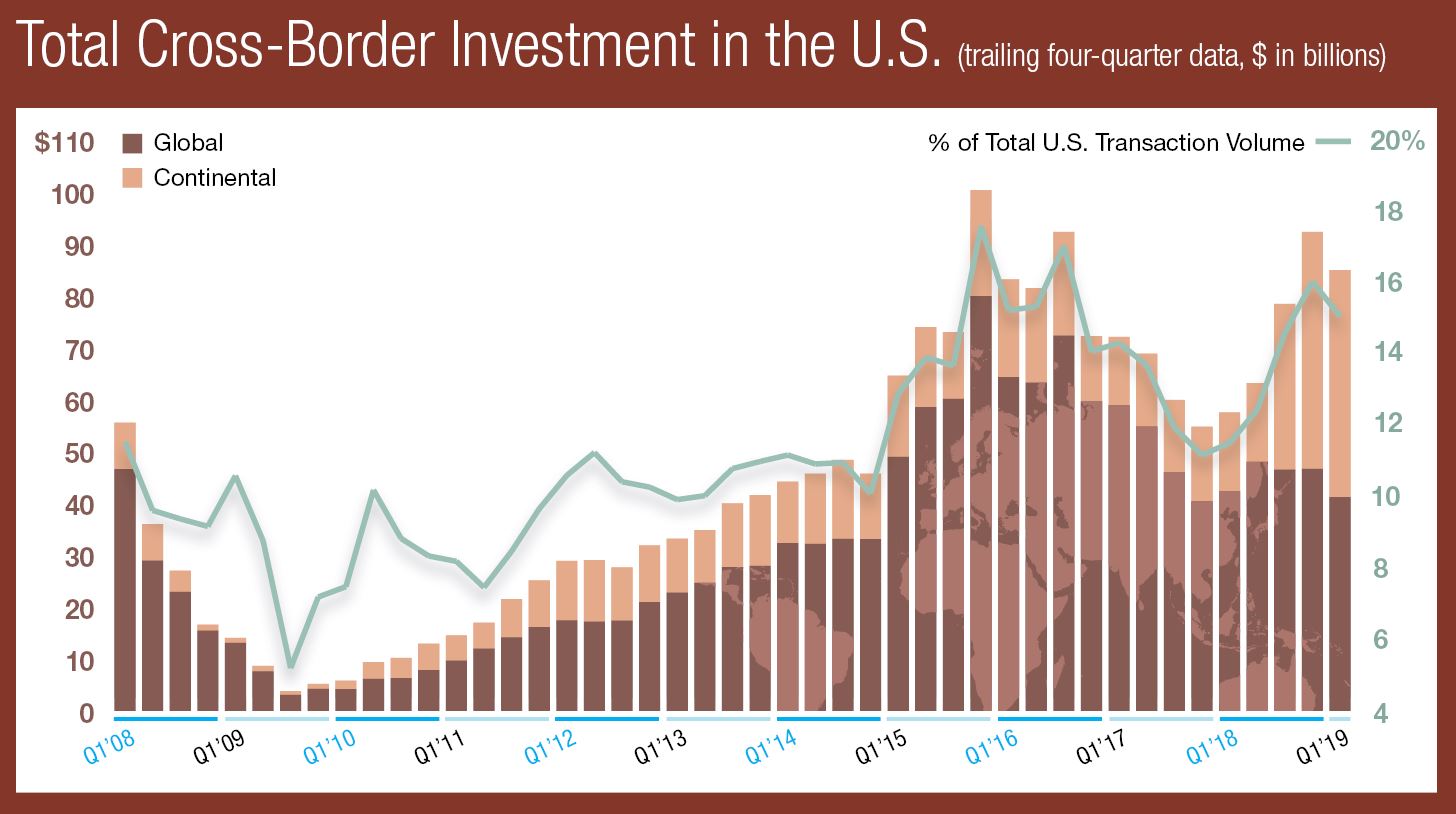

Cross-border investors plowed $92.5 billion into commercial properties across the U.S. in 2018, accounting for 16 percent of total deal volume, according to Real Capital Analytics Inc. That share fell to 8 percent, or $9.1 billion, in the first quarter of 2019, amid a general slowdown in the investment market. Also notable in early 2019 was the absence of mega-deals, the likes of Brookfield Property Partners’ $15 billion acquisition of GGP in 2018.

Considering the skepticism with which many investors seem to view retail, it may have come as a surprise that the sector is a magnet for offshore investors. Retail absorbed more foreign capital than any other property type in the trailing 12 months through the first quarter of 2019, comprising 34 percent of total deal volume. Apartment properties are also popular, taking 18 percent of the total, RCA data shows. Though typically prized by foreign investors seeking reliable cash flow—not to mention a touch of prestige—CBD office assets accounted for just 17 percent of the total. Suburban office properties clocked in at just 9 percent of the total.

In other words, global buyers continue to flock to the U.S., lured by the country’s strong economy and stable, liquid markets. “The U.S. has particularly attractive markets for commercial real estate,” noted Gunnar Branson, CEO of the Association for International Real Estate.

As Branson observes, the U.S. has an outsize share of the metros most coveted by institutional investors. Of the 30 or so cities favored by institutional investors, the U.S is home to as many as 12.

Also included in the CapitaLand portfolio purchase was Marquessa Villas, a 336-unit community in Corona, Calif. Image courtesy of CapitaLand Ltd.

Beyond the gateways

It’s not just the global cities—defined as metropolitan areas with a certain scale and critical mass of institutional real estate—that are targets of foreign investment. The gateway metropolises retain their appeal, but lofty prices and compressed yields are prompting investors to diversify.

“They’re venturing into secondary markets to get a good economic deal,” commented Michael Campbell, CEO of The Carlton Group, the New York City-based investment banking firm. The company recently closed a transaction for a Singaporean investor involving a multifamily development just south of Daytona Beach, Fla. A city of 69,000 located on Florida’s central Atlantic coast about 90 miles northeast of Orlando, Daytona Beach decidedly falls outside the definition of a market that a global investor would ordinarily be expected to pursue. Yet the deal illustrates that the potential for returns can be a higher priority for a buyer than a prestigious address. “It doesn’t have to be a trophy deal in Manhattan where they have to pay expensive prices—although there are still guys out there who are willing to do that,” Campbell said.

The definition of gateway markets is being extended to lucrative, business-friendly states such as Texas and Florida, noted Chris Harris, a Dallas-based senior vice president at Walker & Dunlop. Cross-border investors are still active in coastal hubs, he said, “but they’ve expanded their geographic focus to other major markets that are showing significant job growth and population growth.”

Based on independent reports of properties and portfolios $2.5 million and greater. Data believed to be accurate but not guaranteed. All data and statistics are the sole intellectual property of Real Capital Analytics Inc., and no sale, transfer, sub-license, distribution or commercial exploitation of the data is permitted without the express permission of RCA. Source: Real Capital Analytics Inc.

Home teams

As foreign investment branches out into secondary markets, activity in the multifamily sector continues to heat up—with investment volume rising 5 percent year-over-year during the 12-month period through the first quarter, according to RCA.

Canada’s investment giants, perennially prolific buyers of U.S. assets, are on a hunt for American residential properties. Last year, Brookfield Asset Management and its U.S. apartment platform, Fairfield Residential, raised a multifamily value-add fund with total equity commitments of $1 billion. This past April, Toronto-based Tricon Capital Group struck a deal to acquire a 23-property multifamily portfolio, primarily in the Sunbelt, for around $1.4 billion.

Investors from Asia and the Middle East are also circling the multifamily market. Singapore’s CapitaLand, the largest developer in southeast Asia, made its first foray into the sector last September. In an $835 million deal, the firm acquired a 3,787-unit bundle of suburban communities located in the Denver, Los Angeles, Portland, Ore., and Seattle metropolitan areas. Starwood Capital Group was the seller, according to Yardi Matrix records.

Bahrain-listed Investcorp has emerged as one the most aggressive buyers of multifamily assets in the U.S., by snapping up roughly 7,700 units during a recent 12-month period. The global alternative investment manager announced in June that its U.S. real estate investment team had acquired a five-state, 11-property portfolio for $370 million. The properties are located in markets where Investcorp had previously notched multifamily deals: Orlando and Tampa, Fla.; Raleigh, N.C.; Atlanta; Philadelphia; and St. Louis.

“Condos are becoming more of an accepted investment class in the U.S.,” Harris noted. “Foreign residents understand condos better than domestic people, so they’re very comfortable with for-sale multifamily.”

Gobbling up industrial

Cross-border investors poured $12.9 billion into warehouse and flex properties from the first quarter of 2018 through the same period of 2019. That amounts to a year-over-year jump of 37 percent.

“Everyone wants to be in industrial,” said Branson. “It’s done very, very well since the recession for a lot of reasons—not the least of which is the expansion of internet-based retailing. Every aspect of that supply chain has impacted industrial.”

Among the marquee industrial deals of the past year was the $1.1 billion acquisition of a 16.5 million-square-foot portfolio by Mapletree Investments Pte, backed by Singaporean state investor Temasek Holdings. Announced in October 2018, the transaction encompassed 16.5 million square feet in the U.S. and Europe. The U.S. portion included 40 buildings, primarily in Chicago, Dallas and Seattle.

The property type is likely to remain a top choice. In a late 2018 survey, 80 percent of AFIRE’s member firms—most of them headquartered outside the U.S.—indicated a desire to boost their industrial exposure. That’s an even larger portion of the AFIRE membership than the 71 percent of firms reporting that they were eyeing additional multifamily properties. “I think people are more interested now in making money than they are putting a picture up in their entry hall saying, ‘We invested in this building,’” Harris remarked.

You’ll find more on this topic in the CPE-MHN 2019 Guide to Investing.

You must be logged in to post a comment.