The Fed’s Rate Hikes: Questions Remain Despite Short-Term Stability

Chairman Jerome Powell's press conferences improve communications with the financial markets, but the Fed's policy of flexibility raises uncertainties about future rate changes, writes Chris Nebenzahl, associate director of research for Yardi Matrix.

Chris Nebenzahl

In the weeks that followed the December, 2018 Federal Open Markets Committee meeting, during which the committee increased the Fed Funds Target rate to 2.25 percent–2.5 percent, Fed Chair Jerome Powell announced that the Fed would be flexible regarding future monetary policy. While the committee intends to raise rates twice in 2019, Powell indicated that monetary policy decisions would be data dependent. The comments sparked a rally across asset sectors, but how will this decision impact policy going forward, and has the shift toward flexibility been in the works for some time?

When Fed Chair Jerome Powell announced last year that he would hold a press conference following each of the eight FOMC meetings, general speculation was that he was establishing a precedent to allow the committee to increase interest rates faster, while continuing to maintain transparency and open communication with the market. Since the tightening cycle began, all interest rate increases corresponded with a meeting press conference. The Fed was committed to a smooth and steady path for interest rate increases, and by indicating and explaining each increase, the market was easily able to build in the impact of higher rates. Powell continued the precedent through the first year of his term as chairman. His decision to hold press conferences after each meeting increases communication between the FOMC and the market, however it creates slightly more uncertainty regarding when the committee will raise or lower rates.

More frequent press conferences now allow the committee to make decisions with much less lead time, and as a result the Fed can be much nimbler with its monetary policy decisions. Strong global growth and easing trade tensions may push long term interest rates upward, giving some cushion between long and short-term rates. If this were to happen, the Fed would likely choose to move again. As economic volatility remains high and potential for a recession increases, however, the Fed will also be able to hold its rate steady, explain its decision to the market on a regular basis and cut rates if economic conditions warrant.

Why is the Fed Changing its Tune?

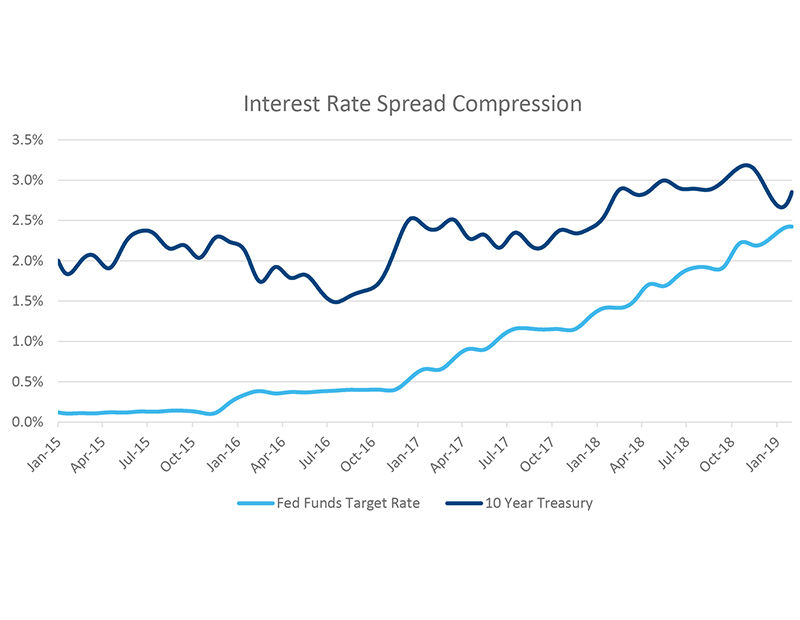

When the Fed raised interest rates for the first time this cycle in December of 2015, the spread between the Fed Funds Target rate and the 10-year Treasury was roughly 200 basis points. With each passing quarter and subsequent Fed rate increase, the spread has tightened, and currently sits at roughly 15–40 basis points. While the Fed is not mandated to follow the yield curve, the inability for long term rates to break out above 3 percent has drawn the attention of many economists. Inverted yield curves often lead to economic downturns, and by shifting to more flexible policy, the FOMC is openly acknowledging the impact of the yield curve.

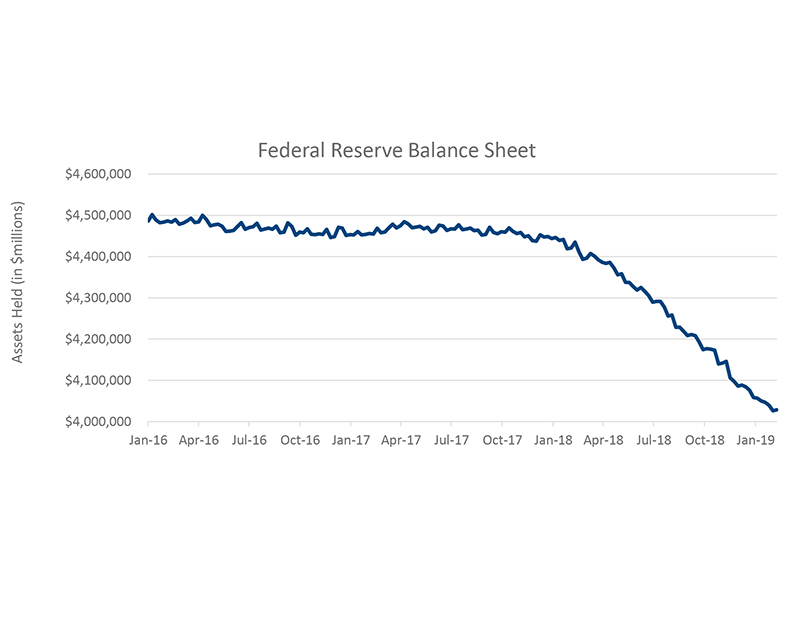

The Fed is also actively discussing the early termination of its process to unwind its balance sheet. After expanding the balance sheet to nearly $4.5 trillion through three rounds of quantitative easing, the Fed began allowing some maturing securities to roll off in mid-2016. Over the past two and a half years, roughly $500 billion in assets have matured without the proceeds being reinvested, however more than $4 trillion remain on the Feds books.

The Fed is also actively discussing the early termination of its process to unwind its balance sheet. After expanding the balance sheet to nearly $4.5 trillion through three rounds of quantitative easing, the Fed began allowing some maturing securities to roll off in mid-2016. Over the past two and a half years, roughly $500 billion in assets have matured without the proceeds being reinvested, however more than $4 trillion remain on the Feds books.

Coming out of the December meeting, Fed officials including Loretta Mester and Lael Brainard have indicated that the Fed may end the runoff in the near future, well ahead of the initial schedule. If the Fed chooses to end its roll-off of securities, it will signal further policy easing from the central bank. There has been no official announcement regarding the Fed’s balance sheet, but their softening tone on interest rate increases, and the potential end to its balance sheet reductions underscore the growing possibility of slower long-term economic growth.

Coming out of the December meeting, Fed officials including Loretta Mester and Lael Brainard have indicated that the Fed may end the runoff in the near future, well ahead of the initial schedule. If the Fed chooses to end its roll-off of securities, it will signal further policy easing from the central bank. There has been no official announcement regarding the Fed’s balance sheet, but their softening tone on interest rate increases, and the potential end to its balance sheet reductions underscore the growing possibility of slower long-term economic growth.

You must be logged in to post a comment.