Electricity Prices: Fall 2019 Outlook

Although pricing trends vary widely among regions, alternative energy sources are putting increased downward pressure on U.S. electricity rates overall.

Electricity costs for commercial operators are generally trending downward in the third quarter across the U.S. as demand for cooling space is projected to be lower this year than in 2018, when it was 13 percent higher than the 2008–17 average, according to the U.S. Energy Information Administration’s latest estimates of energy prices.

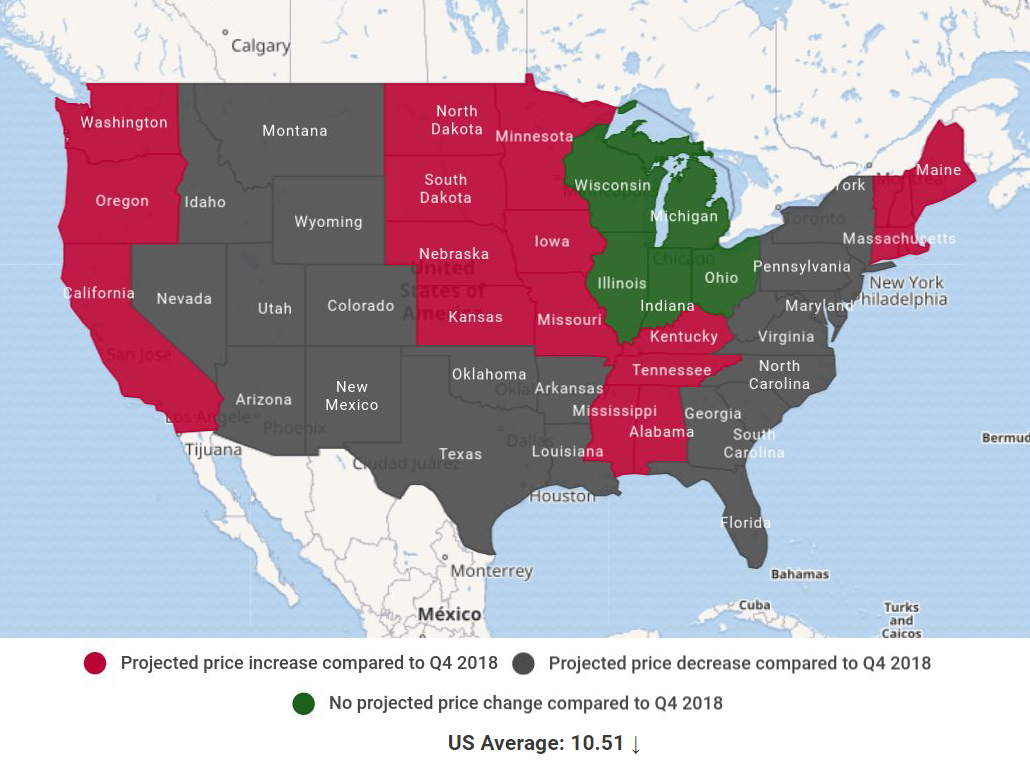

And in the fourth quarter, nine U.S.regions are evenly divided between four hikes and four decreases. Meanwhile, prices in the five states grouped together as the East North Central region—Wisconsin, Michigan, Illinois, Indiana and Ohio—are expected to hold steady.

That’s the result of more electricity generated from natural gas and renewables and a decreasing volume of power generated from carbon-intensive coal .

Broadly, EIA notes in its forecast released on Sept. 16 that electricity prices in the Southeast are less than 1 percent lower than 2018, while prices in New England are 28 percent lower. Texas, the agency reports, will account for 19 percent of non-hydro renewables generation in 2019 and 21 percent in 2020. That would overshadow California’s projected 15 percent share of non-hydro renewables generation this year and 14 percent in 2020.

Also noteworthy, the EIA forecasts that U.S. energy-related CO2 emissions are projected to decline 2.5 percent in 2019 and 1 percent in 2020 after rising 2.7 percent in 2018.

Lower rates ahead

West South Central (Texas, Oklahoma, Arkansas, Louisiana): Commercial customers in these four states paid a little less for electricity in the second quarter, which clocked in at 8.15 cents per kilowatt-hour versus 8.17 last year. Rates in the third quarter are projected to fall to 7.93 cents per kWh from 8.12 in the third quarter last year. The fourth quarter will continue on with this trend, with rates projected to drop to 7.68 from 7.94 in the same period last year.

South Atlantic (Maryland, Delaware, West Virginia, Washington, D.C., Virginia, North Carolina, South Carolina, Georgia, Florida): In the second quarter of 2018, electricity prices rose slightly from 9.30 cents per kWh in 2018 to 9.38 cents this year. Prices are likely to edge up to 9.21 during the third quarter from 9.18 cents in same period last year. EIA predicts fourth quarter rates will be slightly lower, falling to 9.36 this year from 9.41, posted in the fourth quarter of 2018.

Mountain: (Montana, Wyoming, Nevada, Utah, New Mexico, Arizona, Colorado, Idaho): The average price of 9.88 cents per kWh during the second quarter of 2018 slipped to 9.64 in the same period this year. The third quarter is also shaping up for a slight decrease from 10.01 last year to 9.92 cents per kWh this year. The fourth quarter will follow suit, dropping from 9.36 cents per kWh in 2018 to 9.32 this year.

Middle Atlantic (New York, New Jersey, Pennsylvania): Prices in the fourth quarter are projected to drop from to 11.64 from 12.08 during the same period of 2018. That continues the pattern of the second and third quarters. In 2018, second-quarter prices in the region averaged 12.22 cents per kilowatt-hour compared with 12.19 this year. EIA’s estimates for the third quarter call for average prices of 12.94 cents per kWh, a decline from 13.17 last year.

Expect to pay more

Projected electric price projections by region, fourth quarter 2019. Source: U.S. Energy Information Administration

Pacific (Washington, Oregon and California): Higher rates are also on the horizon for the fourth quarter, which is projected to reach 14.45 per kWh versus 14.10 in the same quarter last year. In the third quarter, EIA predicts rates for this region will increase to 16.25 versus 15.81 a year ago. The Pacific states collectively posted a price increase rising to 14.11 cents in the second quarter of 2019 from 14.02 in the second quarter of 2019.

New England (Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut): Retail electricity prices rose from 15.92 per kilowatt-hour in the second quarter of 2018 to 16.16 per this year. This is on track to continue in the third quarter with prices expected to rise to 16.44 cents kWh, up from 16.19 last year. The fourth quarter promises more of the same with rates expected to rise to 16.61 kWh, up from 16.44 last year.

East South Central (Kentucky, Tennessee, Mississippi, Alabama): EIA projects the region’s prices to close slightly higher at 10.70 cents per kWh, up from 10.54 during the fourth quarter last year. A comparable uptick is expected for the third quarter, to 10.53 cents per kWh from 10.34 in 2018. Prices rose year-over-year during the second quarter, from 10.48 cents per kilowatt-hour in 2018 to 10.71 cents per kWh this year.

West North Central (Minnesota, North Dakota, South Dakota, Iowa, Nebraska, Kansas, Missouri): Small increases have marked the region’s average electricity prices throughout 2019, and the pattern is on track to continue. Electricity prices in the second quarter rose slightly to 10.07 cents per kWh from 10.03 in the second quarter a year ago. The third quarter is projected to follow a similar trend with rates rising slightly to 10.45 cents per kWh above the third quarter of 2018. EIA also predicts fourth quarter electric rates to hit 9.33 cents per kWh, a small increase from a year ago.

Price break

East North Central (Wisconsin, Michigan, Illinois, Indiana, Ohio): EIA predicts that year-over year electric rates will hold steady at 10.10 cents per kWh during the fourth quarter. That represents a change of direction for the region, as the region recorded price upticks for both the second and third quarters.

You must be logged in to post a comment.