Economy Watch: Personal Income, Spending Spike in April

Consumer spending increased in April, which is a good thing for the retail sector if it keeps up.

By Dees Stribling, Contributing Editor

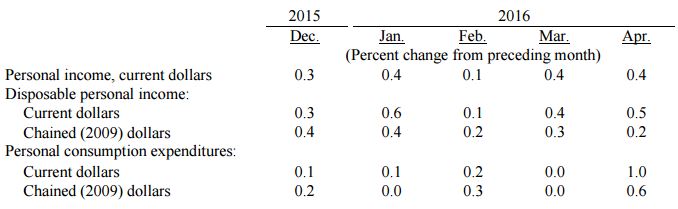

Personal income increased $69.8 billion, or 0.4 percent in April, according to the Bureau of Economic Analysis on Tuesday. Personal consumption expenditures (PCE, or what the government calls people out spending their money) increased $119.2 billion, or a full 1 percent, which is a good thing for retail prospects, if it keeps up.

Price increases were part of the equation, but hardly the whole story. Real PCE (PCE adjusted to remove price changes) increased 0.6 percent in April, in contrast to a decrease of less than 0.1 percent in March.

The PCE price index increased only 1.1 percent year-over-year due to the precipitous decline in oil prices since this time last year. The core PCE price index (which excludes food and energy) increased 1.6 percent year-over-year in April. Both are more-or-less in line with other inflation metrics, such as the core rate of inflation as reported by the Bureau of Labor Statistics.

Americans were also able to save some of their income in April, though not as much as in March. The BEA also reported that personal saving (disposable personal income minus personal outlays) was $751.1 billion in April, compared with $809.4 billion in March. The personal saving rate, which is personal saving as a percentage of disposable personal income, was 5.4 percent, compared with 5.9 percent.

You must be logged in to post a comment.