Coworking’s Rapid Growth Set to Be Tested

The industry is evolving, with new business models emerging, such as property owners creating their own shared space studios, according to Yardi Matrix's Paul Fiorilla.

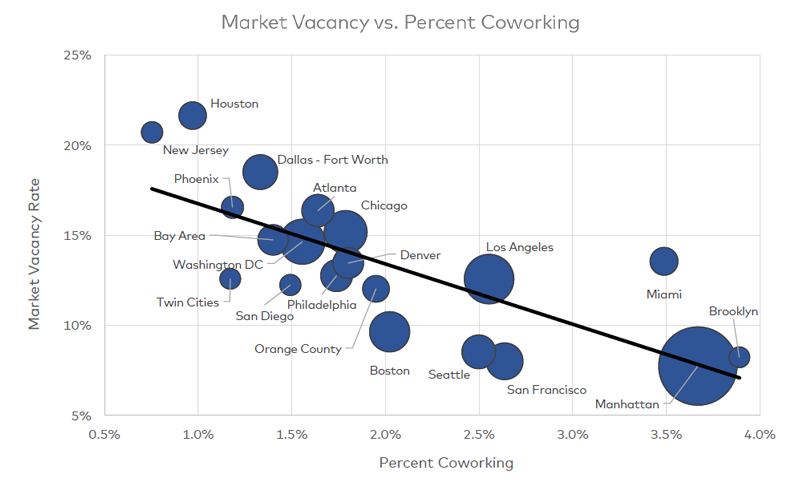

Although headlines about the coworking industry this year have been dominated by the ongoing travails of The We Company (WeWork), the industry is growing rapidly. The top 50 office markets contained a total of 93.2 million square feet of coworking space as of September, or 1.7 percent of total office space, according to a study of Yardi Matrix’s office database.

READ THE FULL YARDI MATRIX REPORT

Two prior Matrix studies (of 20 markets) show the footprint has grown 40 percent from 2018 and 100 percent from 2017. Those markets had 57.5 million square feet of coworking leases as of October 2019, up from 40.4 million square feet in the fourth quarter of 2018 and 26.9 million square feet in the fourth quarter of 2017.

Coworking has accounted for one-third of office leases in the U.S. over the last 18 months, according to the 2019 Colliers report “U.S. Flexible Workspace and Coworking.”

Coworking remains a large-market phenomenon. The top six traditional primary commercial real estate markets—New York; Los Angeles; Washington, D.C.; Chicago; Boston; and San Francisco—account for 44.1 million square feet of coworking leases, or 47 percent of total space.

The industry is evolving, with new business models emerging, such as property owners creating their own shared space studios. Yardi Matrix has identified more than 1,500 coworking properties outside of traditional office buildings, roughly 30 percent of the total facility count in our database.

You must be logged in to post a comment.