COVID-19 Dents Demand at Commercial Properties

Widespread remote work and limited business activity will continue to reduce consumption, but the impact on pricing remains to be seen.

As the COVID-19 stay-at-home orders continue throughout most of the United States and many businesses are still shuttered, the U.S. Energy Information Administration expects the largest impact on electricity consumption to occur in the commercial sector.

The short-term energy outlook for May forecasts a 6.5 percent decline in sales this year because of business closures and the expansion of remote work. For electricity sales to the industrial sector, EIA projects a 6.5 percent decline, likewise reflecting an increase from the 4.2 percent decline projected only last month. That estimate has jumped from the 4.7 decline projected by EIA only a month ago.

Remote work is significantly reducing energy demand at commercial properties, studies confirm. Image courtesy of Dai Ke via Unsplash

Compared to the industrial and commercial sectors, residential electricity sales will decline at a more modest pace—1.3 percent for the year, according to EIA’s May projections.

The agency cites milder weather, which it expects to be “offset slightly by increased household electricity consumption as much of the population spends relatively more time at home.”All told, total U.S. electric power sector generation will decline 5 percent this year, according to the EIA. Reduced fossil fuel generation, particularly at coal-fired power plants, accounts for most of that decline.

Experts hesitate to say whether this trend will translate to lower energy prices for commercial property owners and managers once properties return to normal operations. Although that transition is under way, a sizeable number of unknown variables make its timing and scope unclear.

Still, as the EIA notes in its May update, “Reduced economic activity related to the COVID-19 pandemic has caused significant changes in energy supply and demand patterns.”

A somewhat different dynamic appears to be influencing natural gas prices. Overall demand is currently projected to slip 3.9 percent, largely due to a falloff in demand from the industrial sector. Yet because this trend is expected to curtail production in the U.S., that reduced supply will also lead to price increases this year, according to EIA.

Demand Loads Down

A report from global energy consulting firm Wood Mackenzie projects that the North American power markets will likely experience disruptions stemming from COVID-19 for at least 18 months and the Rocky Mountain Institute found early in the pandemic that regional demand loads had declined 5 to 15 percent.

During the first days of New York and California’s shelter-in-place orders, both states recorded 3 to 7 percent decreases in peak demand and energy use compared to the previous week and previous years, according to the Electric Power Research Institute. EPRI noted the demand reductions were significant but added that electric power systems are resilient enough to handle the reductions while still meeting customers’ needs.

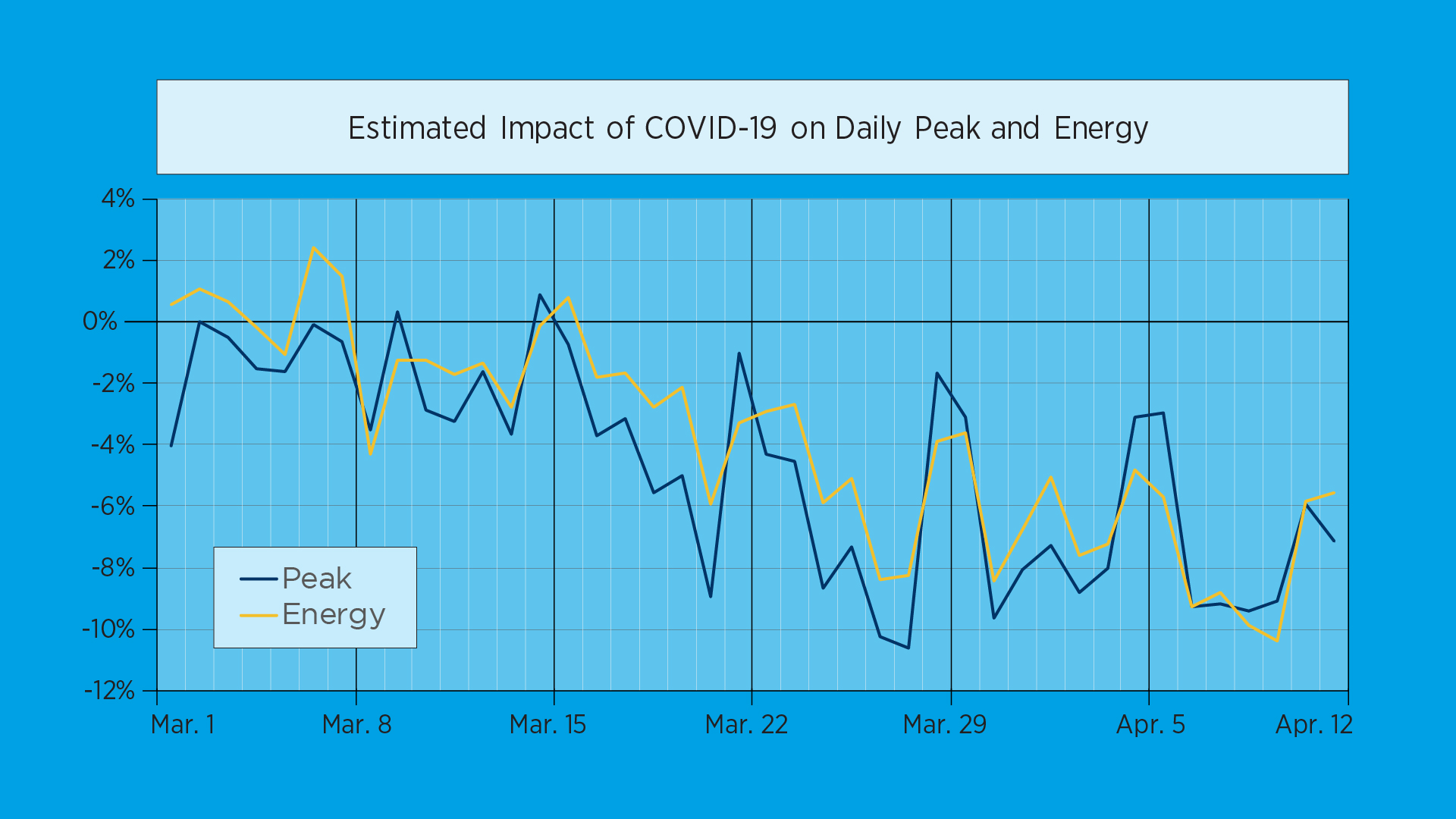

Weekday peak loads have declined 10 percent on average since March 24, reports PJM Interconnection, the largest grid operator in the U.S., which coordinates transmission in 13 eastern and central states and Washington, D.C. Total energy consumption has declined a slightly more modest 7.9 percent, PJM reported on May 12.

A chart shows the impact of shelter-in-place orders on demand in 13 states and Washington, D.C., served by PJM. Graphic courtesy of PJM Interconnection

Part of the load analysis includes inputting actual temperatures into the forecast model to remove weather as a variable in an effort to determine the COVID-19’s impacts on demand and peak as accurately as possible, noted Jeff Shields, a PJM spokesperson.

“In the next phases, we will start to understand … the longer-term impact,” he said. “The longer-term effect is really a moving target.”

Shields said as the grid operator they don’t see the shift from commercial demand to residential; that would come from the local utilities. But with many Americans teleworking and educating their children at home, it’s not surprising that weekday electricity demand has changed. PJM notes that demand has initially resembled a snow-day pattern, with the electricity use peaking later in the morning. “It really is something we have to watch every day, and then again when the economy starts to reopen,” Shields said.

Residential electricity bills will likely increase as workers consume more energy during the day, said Mark Dyson, a principal at Rocky Mountain Institute. But, he added, the short- to medium-term increase in consumption is unlikely to increase rates.

Asked whether the COVID-19 crisis would affect the prices commercial building operators would pay for electricity over the next several quarters, Dyson replied: “There may be some upward pressure on rates in the medium term. As electricity use declines, most utilities will need to recover their fixed costs over a lower sales volume, potentially leading to slightly higher rates. But there will be a lag, as utilities generally have to seek approval for rate changes.”

Dyson said he does not anticipate any supply-demand issues once the majority of commercial properties are operating again.“As consumption picks back up, utilities will resume standard planning and operating practices to match electricity supply and demand,” he said.

Renewable Energy Impacts

Renewable energy will grow faster than other energy sources this year but the pandemic is creating uncertainty about the degree of growth. Image courtesy of Lauren and Michael Evans via Unsplash

The EIA report notes that the forecast for lower overall electricity demand will lead to decline in the fossil-fuel generation, especially at coal-fired power plants. Dyson said generation from coal plants will likely fall faster than generation from gas plants.

“As utilization from coal plants falls, asset owners will face increasingly poor economics of continued operations, with falling revenue likely insufficient to cover ongoing operations and maintenance costs. Coal plant owners may choose instead to retire plants to avoid going-forward operations costs,” Dyson said.

While EIA expects renewable energy to be the fastest-growing source of electricity generation this year, up 11 percent, the effects of COVID-19 and the resulting economic slowdown are likely to have slow the growth of new generating capacity in the short term. EIA is projecting a 20.4-gigawatt surge in wind capacity and an additional 12.7 gigawatts of utility-scale solar capacity this year but cautions that a high degree of uncertainty surrounds those estimates.

Dyson said that many U.S. renewable energy projects will enter service in 2021 rather than this year. “Solar PV and wind project construction in the U.S. is still moving forward, although slowed by the impacts of COVID-19 on supply chains and project developers’ ability to work efficiently under social distancing requirements and stay-at-home orders,” he said.

Notwithstanding the pandemic’s short-term effects, mid- and long-term demand for utility-scale renewable projects will continue to grow. A combination of attractive project economics and green energy goals set by states, cities and corporate customers will create a favorable atmosphere for renewable sources, Dyson said.

“In the residential and commercial PV market, we have seen a near-term slowdown in project installations but we are already seeing anecdotal evidence of future increased demand for rooftop projects given new consumer priorities for resilient electricity supply.”

You must be logged in to post a comment.