Commercial/Multifamily Mortgage Delinquency Rates Affected by the Pandemic

Two recent reports from the Mortgage Bankers Association shed light on COVID-19’s impact on commercial and multifamily real estate.

Across All Properties

Two of the latest Mortgage Bankers Association (MBA) reports released shed light on the various impacts the COVID-19 pandemic has had on different types of commercial real estate. The findings come from MBA’s new Commercial Real Estate Finance (CREF) Loan Performance Survey for August, and the latest quarterly Commercial/Multifamily Delinquency Report for the second quarter of 2020.

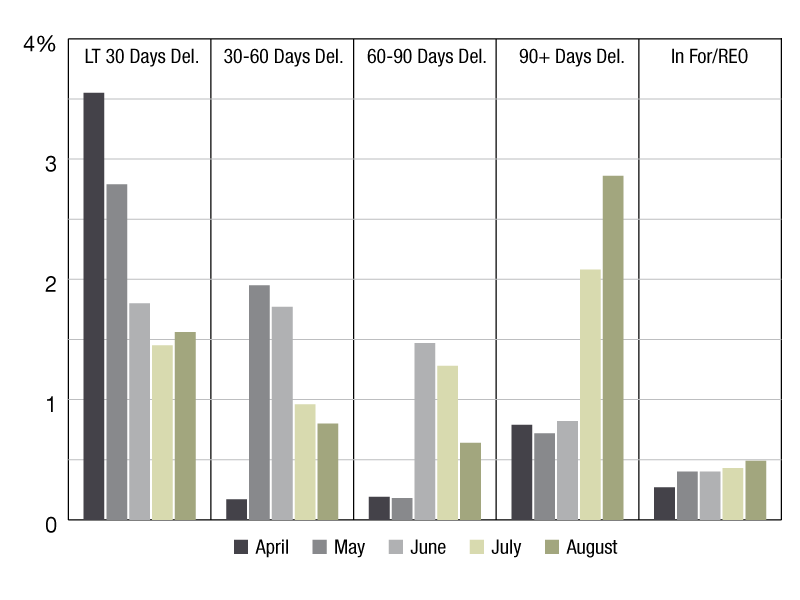

The onset of the COVID-19 pandemic had a dramatic and immediate impact on lodging and retail properties, which flowed through to the mortgages backed by those properties and led to a spike in delinquency rates in April and May. While delinquency rates for both hotel and retail properties have since stabilized–and even declined slightly in July and August for hotel-backed loans–they still remain elevated. The comforting news is that overall, the vast majority of the balance of loans backed by other major property types continues to perform well.

In August, there was relatively little change in overall commercial/multifamily delinquency rates, as well as continued declines in borrower inquiries and requests, with a comparatively high volume of executed actions.

As of Aug. 20, 93.6 percent of commercial/multifamily mortgage balances were current, down slightly from 93.8 percent in July and 93.7 percent in June. Lodging and retail loans continue to show the greatest impacts from the COVID-19 pandemic, with delinquency rates falling in August for lodging property loans and rising for retail. The share of lodging property loan balances that were non-current fell to 23.4 percent in August (from 26.2 percent in July and 27.3 percent in June). For retail property loans, delinquencies rose to 15.0 percent in August (from 13.9 percent in July and 14.7 percent in June).

Delinquencies of mortgages backed by most other major property types remained low: 98.3 percent of the balance of apartment loans were current (up from 98.1 percent last month), as were 97.8 percent of office loan balances (compared to 97.5 percent last month). The share of industrial loans that were current fell to 96.7 percent in August from 98.3 percent in July.

The U.S. economy continues to slowly recover from the dramatic drop in activity brought forth by the pandemic during the spring. High unemployment, and jobless claims consistently around 1 million a week, continue to cause hardships for many households – and especially for those in travel/tourism and retail. The development of a vaccine and/or widespread effective treatments will go a long way towards stabilizing the economy and helping the commercial/multifamily finance market stand on more firm ground. Most loans in most sectors continue to perform well, but the road ahead still remains cloudy.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.