Colony Capital’s Barrack to Step Back After $325M Merger

The firm has acquired Digital Bridge Holdings, whose CEO, Marc Ganzi, will succeed Colony's high-profile founder. The deal is poised to create a $60 billion global asset manager.

Colony Capital Inc. has acquired Digital Bridge Holdings, which invests in communications infrastructure firms, for $325 million. The merger will produce a firm that manages some $60 billion of global assets and will allow Digital Bridge’s co-founder and CEO Marc Ganzi to succeed Colony’s current CEO, Thomas Barrack, by 2021.

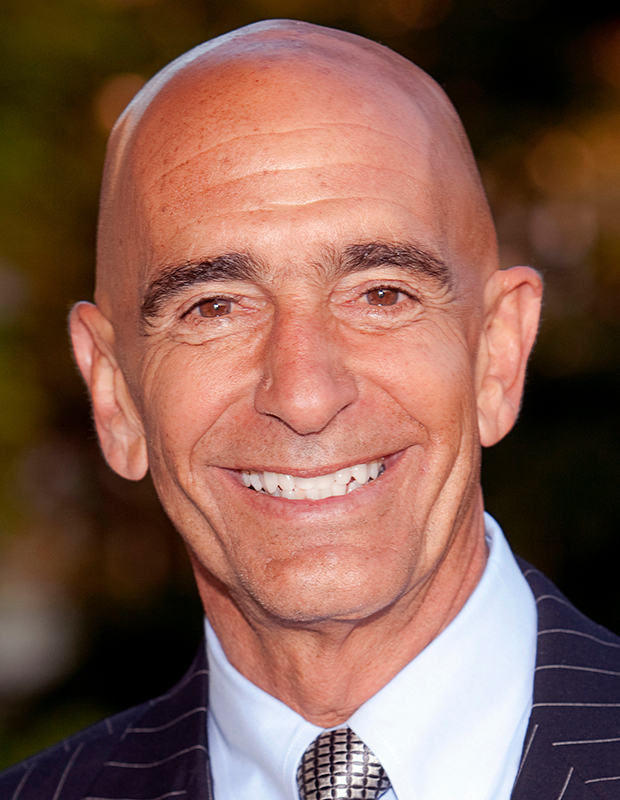

The succession plan calls for Barrack to return to the position of executive chairman at Colony, stepping down from the additional role of CEO that the high-profile dealmaker took on in November 2018. Barrack founded Colony in 1991 and built the company into a leading property investor with an extensive portfolio of industrial, healthcare, hospitality and equity and debt assets.

The merger builds on the existing partnership between the Los Angeles-based firm and Digital Bridge, founded in 2013 by Ganzi and Ben Jenkins, the firm’s chairman. Ganzi and Jenkins now serve as managing partners and investment committee members at Digital Colony. The two companies teamed up last year to launch Digital Colony Management, which raised an inaugural fund dedicated to the network infrastructure sector. That vehicle, Digital Colony Partners, held its final close at nearly $4.1 billion in May.

Wagering on a digital world

Colony’s acquisition is a wager on the growing synergy between real estate and digital technology, as the combined firm will hunt for assets and business including communications infrastructure, “smart” logistics properties, artificial intelligence, digital credit products and emerging markets infrastructure strategies, according to a statement.

Florida-based Digital Bridge manages nearly $20 billion of digital infrastructure globally, both directly and through Digital Colony Partners. That figure includes pro forma for a prospective $8.2 billion acquisition of Zayo Group Holdings, which provides bandwidth infrastructure in North America and Europe. Zayo agreed to be taken private by Digital Colony Partners and EQT Infrastructure in May.

Ganzi will work with Barrack and the Colony board and leadership team to carry out Colony’s current strategic plan during a transition period of 18 to 24 months.

Digital Colony Partners has so far closed four deals involving telecom towers, distributed antenna system solutions, colocation services and similar investments.

In March, Colony Capital scooped up a 54-building, 11.9 million-square-foot industrial portfolio from Dermody Partners in a $1.2 billion transaction.

You must be logged in to post a comment.