CBRE Reports Shifting Office Trends in Legal Sector

Rapidly advancing technology, shifting client demand, an aging workforce and competition are the key factors that triggered an essential shift in the legal services market, a recent CBRE report shows. But what does it take for the individual to become truly collaboration-oriented in this deeply traditional field?

The legal industry is deeply rooted in tradition, and legal work is considered an individual activity—hence the private office as a symbol of success and status. However, a number of distinctive trends have emerged in this field, and legal culture has started to adjust its real estate strategies to match today’s business environment. According to a new report from CBRE, advances in technology, shifting client demand, aging workforces and intense competition are the catalysts of change behind what’s to come, as well as key factors of attracting and retaining skilled young talent.

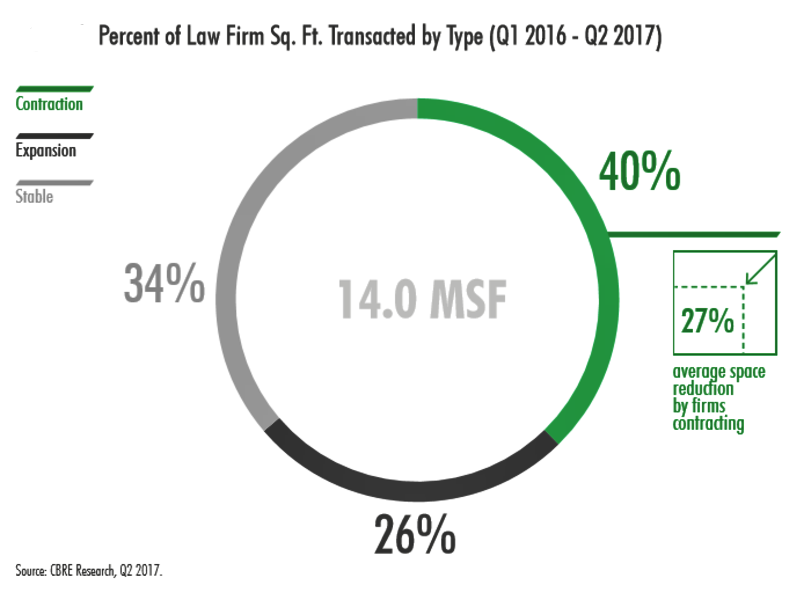

The legal sector has experiences remarkable growth since 2010, despite law firms being concentrated in high-priced business centers and trophy office buildings. These dynamics created an accentuated need for work effectiveness and lower real estate costs, which ended in the reduction of their leased square footage by an average of 27 percent and new workspace standards.

“Many law firms are employing new real estate strategies when lease expirations present opportunities, in particular, space contraction and workplace strategy,” CBRE’s Law Firm Practice Group Global Chair Jamie Georgas said in a prepared statement. “Law firms with leases expiring in the near term are reconsidering long-held assumptions about how their attorneys work and, when determining their space needs, the services and technology they need to be most effective.”

Tech-driven change

With technology remaining a key driver of today’s workforce, its rapid evolution will have a high impact on all legal tasks. Due to its minimalist and compact shape, the workplace itself has shrunk—wireless and smart gadgets allow employees to move around freely and work from virtually anywhere. Flexible office desks and lease structures complement the image of a modern work environment, as a staggering 43 percent of employees work remotely all the time.

Lawyers no longer have a monopoly on the law, as clients are provided with the alternatives of non-traditional law firms (paralegal technicians, legal document preparers, legal self-help sites or virtual assistants). Additionally, 55 percent of law firm clients are presently reviewing their legal suppliers. Paradoxically, the cost of legal services is rising, and the billable-hours model still stands. Somewhere in between, law firms need to globalize and remain competitive. Domestic law firms have already started to expand across borders and should continue to do so in order to optimize their real estate portfolio and costs, while also partnering with global providers that have expertise in real estate strategy.

Millennials have become the largest generation in the U.S. workforce, and more recently, Generation Z has come of employable age. Therefore, the profile of the typical employee has changed drastically. And despite national unemployment reaching an all-time low, fewer younger people are opting for law careers. This dynamic has widened the generation gap—pronounced by the fact that legal professionals work beyond retirement age—with 16 percent of partners retiring in the next five years and 38 percent in the next decade. However, a collaborative, communication-oriented workplace design—one in which the modern workplace would fuel the social needs of the young workforce—is just what the law field needs. The workspace should also embody the employer’s values, using design to communicate the company’s brand.

The rules of optimization

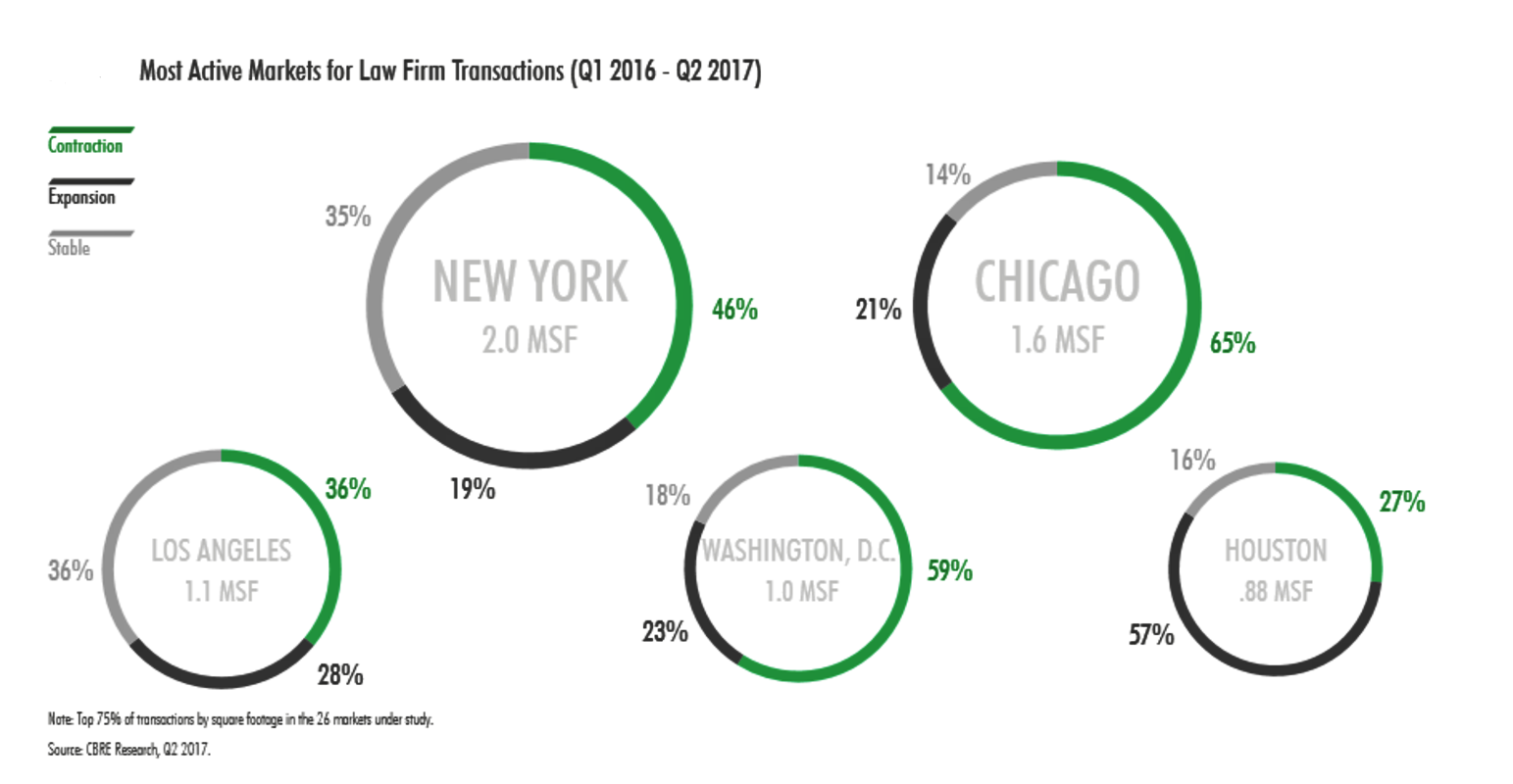

The most active metros, such as New York City, Los Angeles, Miami, Chicago and Washington, D.C., house the largest number of law firms, but at the same time, they have the highest asking rents. CBRE noted that law firms leased more than 14 million square feet of space between the first quarter of 2016 and the second quarter of 2017, of which 66 percent represents space expansion or contraction. What really stands out is the fact that Am Law 100 firms shrunk their leased space through contraction (approximately 2 million square feet), while boutique law firms opt for lease expansion.

There are several optimization techniques that will reimagine the legal sector’s office space, including the size reduction of the typical office space to glass-front, one-size offices where seniority will be conveyed by the configuration of the workspace. Additionally, the number of secretaries servicing a group of attorneys is expected to decrease.

The formal lobbies and meeting spaces will become more practical and functional, and client reception areas will bear a welcoming signature, due to concierge reception with customized services and hosted events. Dedicated lunchrooms will become a place where employees can socialize, while formal collaborative areas will make way for smaller, multipurpose meeting rooms. Last, but not least, as the workspace moves toward being paperless, the era of cluttered desks and scattered filing areas has come to an end.

“Law firms are optimizing their real estate portfolios to avoid excess expenses on antiquated workplaces that value space per attorney over client and employee expectations,” Georgas said in prepared remarks. “To minimize risk around uncertain headcount requirements, many law firms are focused on creating agile workplace strategies through configurable office design and flexible lease structures.”

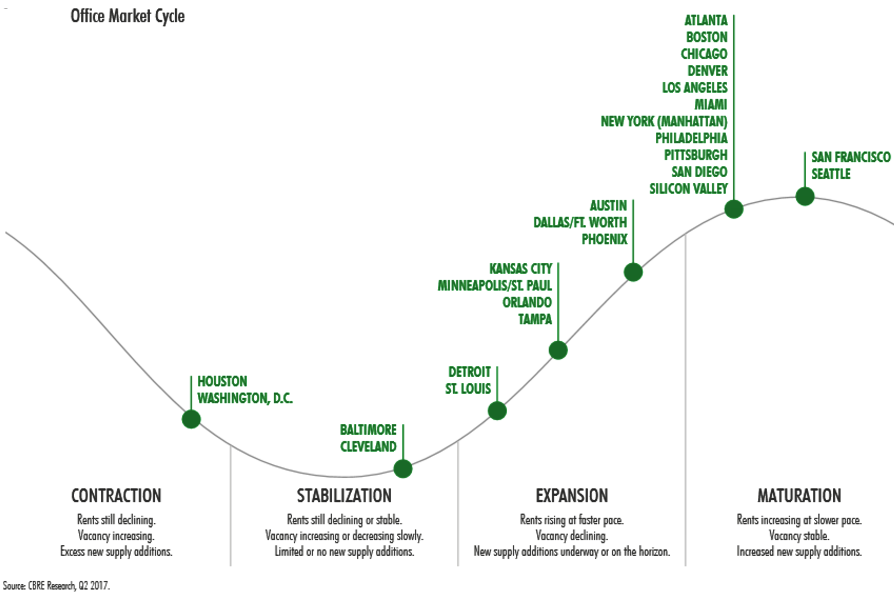

With 29 million square feet of law firm leases set to expire between 2018 and 2022, the companies are naturally headed towards improvement. More than half of these leases are in the largest metros and count an average of 125,000 square feet of rentable space. And with the office market changing in different ways—New York and Chicago’s increasing rents and low vacancy compared to Houston’s oversupply of sublease space—law firms are left with multiple options, such as relocation, expansion, contraction or even rebranding.

Images courtesy of CBRE

You must be logged in to post a comment.