Auction.com Launches New CRE Nowcast

New pricing index leverages Google Search data and Auction.com transactions to give commercial real estate investors and brokers real-time market intelligence.

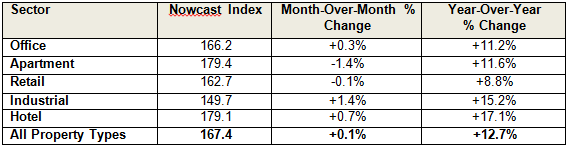

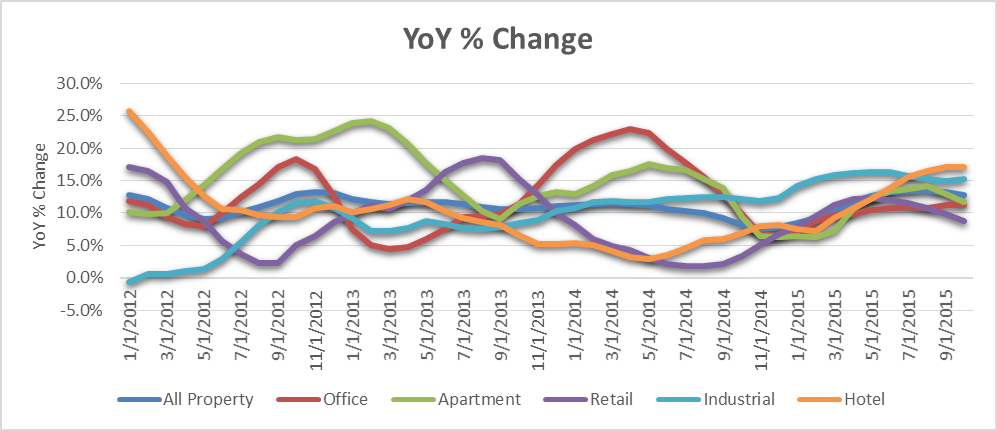

Auction.com, the nation’s leading online real estate marketplace, has launched the first Commercial Real Estate (CRE) Nowcast, a new pricing index that combines Google Trends data, Auction.com’s proprietary transaction database and investor surveys to forecast CRE pricing trends in real time. The CRE Nowcast reveals that commercial valuations in October have increased by 20 basis points from September, the smallest increase in nearly five years, with price declines in two of five property segments.

Three property segments saw valuations increase in the month: Office (+50 basis points), Industrial (+200 basis points) and Hotel (+120 basis points), according to the new pricing index. Retail valuations were off slightly, down 20 basis points, while Apartments was the weakest of all sectors, down 250 basis points.

“While it’s certainly too early to speculate about whether CRE market prices have peaked, the relatively weak showing in this month’s index certainly bears watching,” said Auction.com Executive Vice President Rick Sharga. “Year-over-year price growth is still healthy across the board, and sales volume remains strong, so we could be looking at a one-month anomaly rather than the beginning of a downward trend.”

Auction.com Chief Economist Peter Muoio cautioned against reading too much into a single month of data. “This could just be the market taking a bit of a breather from its strong run-up,” he said. “That wouldn’t be much of a surprise following August’s stock decline and with the continued uncertainty regarding whether the Fed will raise interest rates any time soon.”

Auction.com plans to issue its CRE Nowcast at the beginning of each month after combining transactional data, related online search activity indicating purchase intent and investor survey results. The company runs multiple versions of the Nowcast model and layers in additional variables every day to improve its accuracy in predicting pricing trends across CRE sectors in key U.S. markets. Future iterations will include regional, local and individual asset-based price indicators. By analyzing current market conditions as opposed to only historical data, Auction.com is able to provide more relevant and timely insight to real estate investors, economists and government entities alike.

October Nowcast Results: All price indexes are rebased at 100 from January 2010

The Auction.com CRE Nowcast is a new price index covering the entire U.S. commercial market, including individual price trends for each major market sector– Office, Apartments, Retail, Industrial and Hotels.

The Auction.com CRE Nowcast is based on data modeling developed by Google Chief Economist Hal Varian, who defines “nowcasting” as “contemporaneous forecasting” – the ability to predict what is happening as it occurs. Following Google Capital’s investment in Auction.com last year, the company consulted with Varian and applied his theories by combining publicly available and anonymous Google Trends data with its own proprietary transactional data to create a model for accurately predicting current commercial real estate activity. This data is supplemented with “real human” input through Auction.com’s partnership with Situs and their Real Estate Research Report (RERC).

You must be logged in to post a comment.