Overbuilding in Richmond?

With almost 20,000 units in the pipeline—more than a third of which are under construction—the metro is at risk of overbuilding. As new stock is putting a damper on growth, Yardi Matrix expects rents to rise by 3.5 percent in 2017.

By Bogdan Odagescu

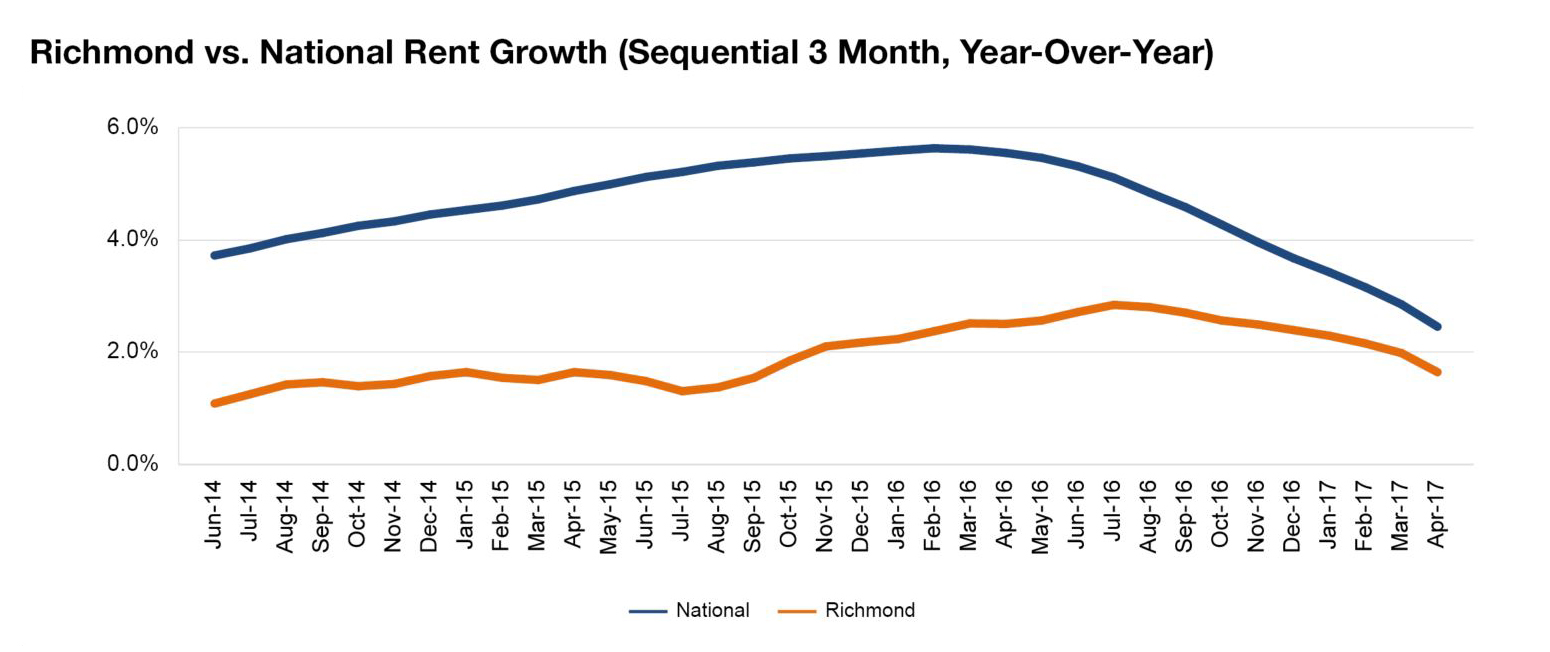

Richmond rent evolution, click to enlarge

Following several years of strong supply, Richmond’s multifamily market is shifting down a gear. Rents rose 1.6 percent year-over-year through April, continuing to trail the national average. With almost 20,000 units in the pipeline—more than a third of which are under construction—the metro is at risk of overbuilding.

Richmond’s economy is slowly but steadily expanding. Anchored by military bases, defense contractors and health-care providers, the metro’s job market is underperforming. However, with Virginia Beach becoming a Mid-Atlantic hub for transoceanic high-speed data cables, the area may develop into a tech hot spot. Projects are in the works to connect the region to the Netherlands, Spain and Brazil, and Dutch company NxtVn has announced a $2 billion data center park. Huntington Ingalls, the state’s largest industrial employer, is adding 3,000 jobs this year. The list of major developments includes Dominion Resources’ 20-story downtown Richmond headquarters, a $220 million arena in Virginia Beach and the $450 million Tech Center in Newport News.

With $830 million in assets changing hands, 2016 marked the sixth consecutive cycle high. Investors are focusing mainly on value-add opportunities. There were roughly 7,800 units under construction as of April, and the metro is well on track to surpass 2016’s level of completions this year. As new stock is putting a damper on growth, Yardi Matrix expects rents to rise by 3.5 percent in 2017.

You must be logged in to post a comment.