New Sector for REITs Ushers in Hope

Why REIT executives are optimistic about the creation of a dedicated REIT sector.

By Chris Nebenzahl, Senior Analyst, Yardi Matrix

REIT industry executives are optimistic that the creation of a dedicated REIT sector within the S&P 500 could open the industry to a broader range of investors and potentially less volatility in pricing. The hope is that the new sector, which was created on Sept. 1 and took effect on Sept. 16, will make the industry less correlated to the broader banking and financial sector when it comes to pricing.

Although the sector addition has not resulted in significant changes in trading volume or REIT share prices, NAREIT economist Brad Case said he “expects to see a reduction in REIT volatility and correlation to the rest of the market.”

The change involves the Global Industry Classification Standards (GICS), which is widely accepted as the industry leader for equity classification. Since the inception of GICS in 1999, there have been 10 sectors for classifying equity securities. Up until now, REITs were a subsector within the financial and banking sector. Real estate has never before had its own sector within the GICS framework.

Since many investors buy stocks in an effort to mimic or beat the performance of the sectors, the immediate effect could be a reshuffling of the holders of REIT stocks. Some institutions focused on the financial sector might sell REIT shares, but the hope is that others increasing their REIT holdings will more than make up for this.

In the past, portfolio managers routinely underweighted REITs within their financial sector allocation, opting to invest a higher percentage of their funds in banks, insurance firms and diversified financial companies, as they were easier to analyze for seasoned Wall Street professionals. Few managers took the time to analyze the potential value REITs could offer to a fund. With the change to a new real estate sector, however, funds that strive to align with a given benchmark may be forced to add to their real estate allocation.

Not all REITs will fall under the new real estate sector. Mortgage REITs will remain part of the financial sector as they invest in securities and mortgage-backed products. Equity REITs currently make up roughly 95 percent of all publicly traded REITs and will be moving into the newly created sector.

Increased Capital

Adding the new sector to GICS should also bring significant fund inflows to REITs as they become more visible to investors. Industry experts project that REITs could see an increase of $30 billion to $100 billion in market capitalization as the sector grows and develops. One factor the increased visibility will likely bring to light is the strong performance of REITs compared to the market. REITs have outperformed benchmarks recently, as they have been insulated from a number of factors driving down other asset classes.

REITs are not as closely tied to energy prices, and thus the major drop in fuel costs has not put downward pressure on the REIT market. The negative effects of lower goods inflation have been felt across the economy; however, rental inflation, and thus REIT revenue, has been consistently robust of late. REIT revenue is also generally tied to domestic activity, and therefore REIT performance was not impacted by the strength of the dollar and the decline in exports that many other industries faced. Finally, mid- to long-term leases, which make up the majority of REIT revenue, allow for easily projected cash flow and steady income compared to other stocks in the market. Transparent and predictable performance often leads to excess returns, compared to volatile securities.

Reduced Volatility

The change could also bring about a reduction in volatility and correlation to the rest of the market for the real estate sector. Because commercial properties generally derive income from mid- to long-term leases, they are less vulnerable to short-term swings in economic sentiment. The values of privately owned commercial property portfolios are much less volatile than publicly owned properties, in part because pricing is not subject to the daily swings of the stock market. REITs have experienced significantly more volatility than privately held real assets.

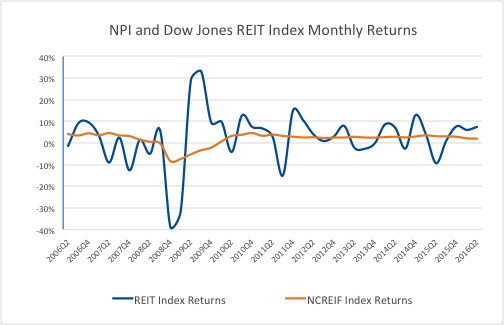

This can be seen by comparing the Dow Jones REIT index with the National Council of Real Estate Investment Fiduciaries’ Property Index (NPI), which encompasses 7,353 institutionally owned properties, mostly stable assets in top markets. The value of the NPI portfolio is roughly $505 billion. The REIT index is priced in real time, while NPI properties are appraised quarterly. Since September 2006, REIT prices have changed 10 percent or more–up or down–on a quarterly basis 10 times. The NPI had no such volatile swings.

During the financial crisis, REIT values dropped 65 percent from the first-quarter 2007 peak to the trough in the first quarter of 2009. The NPI fell 26 percent from peak to trough.

By stripping REITs out of the financial sector, public real estate companies may be less subject to the price movements that affect the stock prices of financial-sector companies. REITs’ correlation with the rest of the market may also decline as a result of the sector change. Within the financial sector, a material change in one large stock tends to have an impact on the entire sector. Now that REITs are no longer classified as financial companies, a significant drop in the share price of a big bank may not affect REITs in the same way it would have when REITs remained part of the financial sector.

While time will tell what the true impact of the sector change will be on the REIT industry, most signs point toward growth and expansion. Enhanced visibility and increased interest from fund managers will likely lead to more cash being invested in REITs. Private real estate companies may be incentivized to seek public offerings in the face of better performance, and REITs may expand their portfolios as a result.

Whatever the impact of the new sector, the returns of REITs will always depend on their fundamental performance. REIT prices have benefited in recent years from low interest rates and solid fundamentals that have produced strong rent growth. Some analysts expect interest rates to rise and rent growth to moderate over the next few years, which would inhibit growth in REIT prices.

You must be logged in to post a comment.