Net Lease Retail Cap Rates Flat in Q4, Up for the Year

Industry participants expect an active market in 2019, as well as higher acquisition yields, The Boulder Group reports.

By Gail Kalinoski

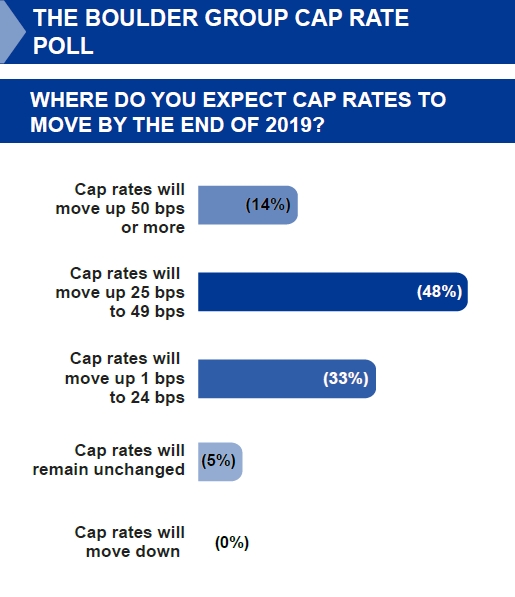

Cap rates in the single tenant net lease retail sector were flat in the fourth quarter of 2018 compared to the previous quarter, but 95 percent of active net lease participants expect cap rates to rise in 2019. Nearly half predict cap rates will increase between 25 and 49 basis points by the end of the year, according to a new report by The Boulder Group.

“As the Federal Reserve continues to implement its monetary policy, there is investor expectation that cap rates should trend upward in 2019,” Randy Blankstein, president & founder of The Boulder Group, said in a prepared statement. “Investors will carefully monitor the capital markets and the effect on pricing as more rate hikes are expected from the Federal Reserve in 2019.”

None of those net lease participants surveyed by The Boulder Group for the Fourth Quarter 2018 Net Lease Report expect cap rate compression. One third of respondents expect cap rates to move up between 1 and 24 basis points, with the remaining 14 percent predicting cap rates to increase by 50 basis points or more.

None of those net lease participants surveyed by The Boulder Group for the Fourth Quarter 2018 Net Lease Report expect cap rate compression. One third of respondents expect cap rates to move up between 1 and 24 basis points, with the remaining 14 percent predicting cap rates to increase by 50 basis points or more.

“We were not surprised by the results of the poll,” Blankstein told Commercial Property Executive. “Those in the industry have been expecting some cap rate expansion.”

In the fourth quarter of 2018, the national asking cap rate for net lease retail properties was 6.25 percent, the same as in the third quarter. The net lease office sector saw an increase of 2 basis points to 7.02 percent and industrial rose by 5 basis points to 7.07 percent. Despite the flat fourth quarter, retail net lease cap rates increased by 18 basis points for the year. Cap rates for net lease office properties were essentially unchanged in 2018, with a nominal 2-basis-point increase, while industrial properties declined by 16 basis points overall.

More properties marketed

The fourth quarter saw a 9.6 percent increase in the number of net lease retail properties for sale, going from 4,347 in Q3 to 4,766. By comparison, both office and industrial had fewer properties on the market in the fourth quarter of 2018. Net lease office properties on the market dropped by approximately 6.5 percent from 504 in the third quarter to 472 in the fourth quarter. Net lease industrial properties were down nearly 6 percent, going from 384 properties being marketed in the third quarter to 361 in the last quarter.

“Sellers are still in the process of positioning their non-core holdings,” Blankstein told CPE. “Additionally, as we are in the late stages of the current real estate cycle, some property owners who are approaching the end of their investment hold period are bringing properties to the market to take advantage of the historically low cap rate environment.”

“Ahead of these increases in the supply of net lease properties for sale, the net lease market strongly favored sellers in recent years,” Blankstein added. “However, the market has shifted into more of a neutral position.”

The spread between asking and closed cap rates was 31 basis points, the largest spread since the second quarter of 2017. The spread for short-term leased properties with non-investment grade tenants was even greater (51 basis points) in the fourth quarter of 2018.

“Investors who are willing to take on the risk of shorter term leases have been able to take advantage of this shift,” Blankstein noted. “Properties with short-term leases and without investment grade tenants or strong residual real estate had the greatest change in cap rates in the current rising rate environment.”

The Boulder Group, a Chicago-based investment real estate services firm specializing in transaction and advisory services for single tenant net lease properties, expects investor demand for net lease assets to remain active in 2019. The recent volatility in the stock market and other alternative investments helps net lease assets, which are perceived as safe and secure investment options. They are still commanding historically low cap rates, the report noted, with new properties that have strong credit tenants considered the most attractive in the net lease environment.

The firm recently sold a portfolio of two BioLife Plasma properties for $16.3 million in the fourth quarter—6830 Village View Drive in West Des Moines, Iowa, which sold for approximately $8.6 million and 540 Pleasant Grove Road in Mount Juliet, Tenn., which sold for about $7.6 million. The properties are reflective of some of the desirable traits that attract net lease investors—long-term leases, rent escalations and no landlord responsibilities for maintenance and operations.

Blankstein also told CPE that private and 1031 buyers made up more than 70 percent of the net lease retail sales across all price points in the fourth quarter.

Images courtesy of The Boulder Group

You must be logged in to post a comment.