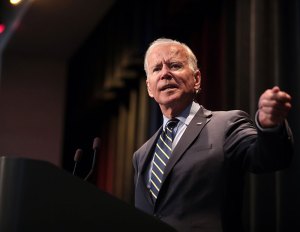

Industry Responds as Biden Kicks Off Tenure

From a more assertive climate policy to promises of rent relief and infrastructure spending, the new administration's agenda is shaping up to be consequential for property owners and developers.

The real estate industry is taking stock of a new administration and its first moves as Joe Biden settles in at the Resolute desk as the 46th president, bringing an ambitious agenda on a wide range of issues, from affordable housing to improved transportation.

The multifamily industry is already adjusting to Biden’s executive order, signed just hours after he was sworn in on Wednesday, extending the Centers for Disease Control and Prevention’s nationwide eviction ban until at least March 31. The president’s proposed $1.9 trillion coronavirus rescue package is also expected to provide relief to apartment renters and landlords, although some senators are pressing for the bill to be scaled back.

READ ALSO: Analysis: CRE and Washington’s New Agenda

“There are many serious issues facing the nation, but job number one is winning the ongoing battle against the health and economic consequences of the pandemic,” Jeffrey DeBoer, president & CEO of The Real Estate Roundtable, told Commercial Property Executive. “In addition, we expect robust debate and activity around housing availability, infrastructure and immigration reform and expanding opportunities for all Americans.”

The Washington, D.C.-based organization released a detailed policy wish list for the Biden-Harris administration in December, including COVID-19 relief, debt restructurings and workouts, tax policy changes and other measures impacting the real estate industry.

Climate control

Biden moved quickly to address climate and energy policy, a key consideration for real estate owners and operators given that buildings and their construction account for 39 percent of energy-related carbon dioxide emissions globally, according to the United Nations Environment Programme.

Among his first acts in the Oval Office, Biden signed an executive order on Wednesday recommitting the U.S. to the Paris Agreement, the 2015 international treaty designed to curb climate change. The landmark accord, which the U.S. formally exited last November, aims to limit the increase in the global average temperature to well below 3.6 degrees Fahrenheit compared to pre-industrial levels, and ideally no more than 2.7 degrees.

In its policy document, the Roundtable calls for federal leadership to provide standardized protocols and tools for policymakers on the state and local levels to pursue “net zero” and “carbon zero” goals. Other recommendations include more transparent U.S. Department of Energy participation in the energy code development process; incentives to promote retrofits of aging buildings; and deep decarbonization projects in buildings owned and leased by the federal government.

Building bridges

Infrastructure spending is also high on the agenda for the real estate and construction industries, which would benefit directly from federal investment in fixing roads and bridges and building more transportation capacity.

Then-candidate Biden proposed last July to spend $2 trillion over four years on climate-friendly infrastructure as part of a broader economic recovery plan. On Thursday, Pete Buttigieg, former mayor of South Bend, Ind., and Biden’s nominee for transportation secretary, told the Senate during his confirmation hearing that he plans to support the ambitious program.

“I think it’s a great time for infrastructure,” said Carlo A. Scissura, president & CEO of the New York Building Congress, a construction industry association. “It’s a bipartisan piece (of legislation) that can happen immediately.”

Scissura noted that Biden and newly elevated Senate Majority Leader Charles Schumer (D-N.Y.) have already indicated they intend to press forward with Department of Transportation approvals for the Gateway Program, a long-stalled project that aims to deliver critical rail infrastructure between Newark, N.J., and Manhattan’s Penn Station. “There are simple approvals that can happen tomorrow,” he said.

He added that Biden is expected to put forward a major infrastructure-oriented stimulus plan that will provide direct funding to New York’s Metropolitan Transportation Authority (MTA) and Port Authority. “In terms of real estate, at least in New York, having an MTA that’s fully funded and a capital plan that’s fully funded is crucial for the future of the region,” Scissura said, noting that the plan is also poised to boost other cities across the country.

Codes and zones

On the other hand, the change of administrations has sparked concerns among industry insiders who believe that Biden will seek to repeal Section 1031 “like-kind” exchanges, a tax code provision that allows real estate investors to avoid capital gains taxes on certain sales. Congress’s Joint Committee on Taxation projected that the rule would save property investors $51 billion between 2019 and 2023.

Biden proposed ending like-kind exchanges last July. “I believe it could affect over 50 percent of transactions,” noted Francis Greenburger, chairman & CEO of real estate investment and development firm Time Equities Inc. “Sale revenue from properties sold to 1031 investors is a major market. Once these sales stop, developers will no longer be able to use their profits from these sales to reinvest in new development and construction and the entire real estate economy will be drastically affected.”

Changes to the federal Opportunity Zone program could also be in store. Scott Meyer, chief investment officer at PTM Partners, a real estate investment and development firm, noted that he expects the new administration to follow the recommendations of the Government Accountability Office by authorizing the Treasury Department to collect data on Opportunity Zone funds and their underlying investments.

“While there are real costs associated with governmental filing and review, the ability to quantifiably measure Qualified Opportunity Zone investing’s positive impact will ensure the longevity of the program,” he commented.

Meyer added that, in light of the continued disruption caused by COVID-19, the Internal Revenue Service issued a notice on Tuesday that gives investors, funds and businesses focused on the zones additional time to meet certain requirements under Section 1400Z-2 of the Internal Revenue Code. He expects that the new administration will not undo this action, which was one of the final acts of the Trump-Pence administration.

Leaving the IRS action intact would signal that Biden and Vice President Kamala Harris are proponents of the Opportunity Zone program—a feature of the 2017 Tax Cuts and Jobs Act—and could look to further enhance its accessibility to investors as well as spur job growth in the low-income areas, Meyer commented.

You must be logged in to post a comment.