Economy Watch: U.S. CRE Deal Volume Slows in Q2

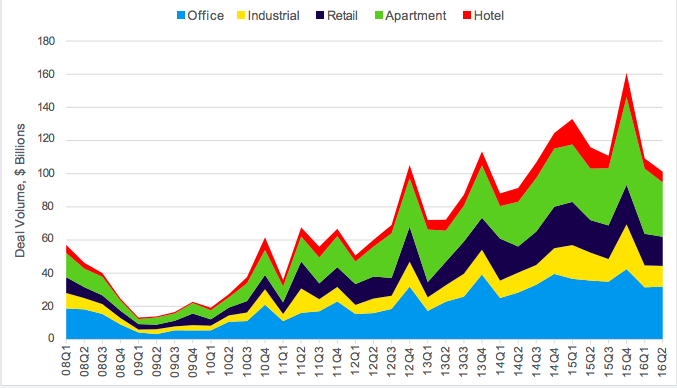

Despite a drop in transaction volume, second-quarter 2016 marks the eight consecutive quarter in which deal volume topped $100 billion, Ten-X reported.

By Dees Stribling, Contributing Editor

Capital markets cooled for the second consecutive quarter in second-quarter 2016, as overall U.S. commercial real estate transaction volume dropped 12.7 percent from a year earlier, to $101.2 billion, according to Ten-X’s latest report on capital trends in commercial real estate (Ten-X was formerly Auction.com.) Even so, the report posited that several fundamental economic indicators continue to reflect a relatively strong marketplace, including American CRE as a safe investment for foreign entities.

Also, confidence in the market remains relatively strong, with the second quarter of 2016 marking the eighth consecutive quarter in which deal volume topped $100 billion, noted Ten-X. Four of the five market sectors outperformed their 10-year deal volume averages by more than 20 percent, and continued investor demand in multifamily properties led the apartment sector to beat its average by a whopping 55 percent.

The multifamily sector was responsible for 32.3 percent of transactional volume in second quarter, much more than its 10-year average for overall market share. The other four sectors lagged behind, with hotels as truly the odd man out. In the hotel sector, total deal volume plummeted by more than 50 percent compared with the same period in 2015.

In the second quarter, cap rates dropped in four of the five asset classes, with retail and apartment reaching new cyclical lows of 6.4 percent and 5.6 percent, respectively. After a spike in first-quarter 2016, the industrial sector saw a 40 basis point cap rate decline, while hotel cap rates fell 30 basis points. Cap rates for all five asset classes have fallen below their respective 10-year averages, led by industrial, retail and apartment.

You must be logged in to post a comment.