Economic Consensus Masks Many Uncertainties

While economists foresee little chance of a recession in the near term, potential policy changes could impact the course of the U.S. economy and commercial real estate values, notes Yardi Matrix Associate Director of Research Paul Fiorilla, reporting on the NABE's Annual Meeting.

By Paul Fiorilla

Economists largely agree that the U.S. economy will continue the moderate growth path it has traveled the last several years. But the consensus among prognosticators obscures a dilemma: The economy is behaving in ways it hasn’t in the past and nobody is entirely sure as to why. Among the issues vexing economists include why—when employment gains are so healthy—workforce participation remains low, while GDP growth and inflation remain subdued.

Economists largely agree that the U.S. economy will continue the moderate growth path it has traveled the last several years. But the consensus among prognosticators obscures a dilemma: The economy is behaving in ways it hasn’t in the past and nobody is entirely sure as to why. Among the issues vexing economists include why—when employment gains are so healthy—workforce participation remains low, while GDP growth and inflation remain subdued.

The uncertainty about these issues is more than academic. A better understanding would help the Federal Reserve set a course for interest rates and could serve as a springboard to policy solutions on issues such as tax reform, health care and immigration. No such consensus exists, of course, which produces wildly varying policy proposals.

In a much-scrutinized keynote speech last week at the National Association of Business Economics’ 2017 Annual Meeting in Cleveland, Federal Reserve Chair Janet Yellen used the word “uncertain” or “uncertainties,” or phrases that suggest uncertainty, more than a dozen times. Yellen was outlining a vaguely hawkish policy agenda, in which policy rates will continue to increase slowly, while leaving wiggle room to quickly change directions if the situation warrants.

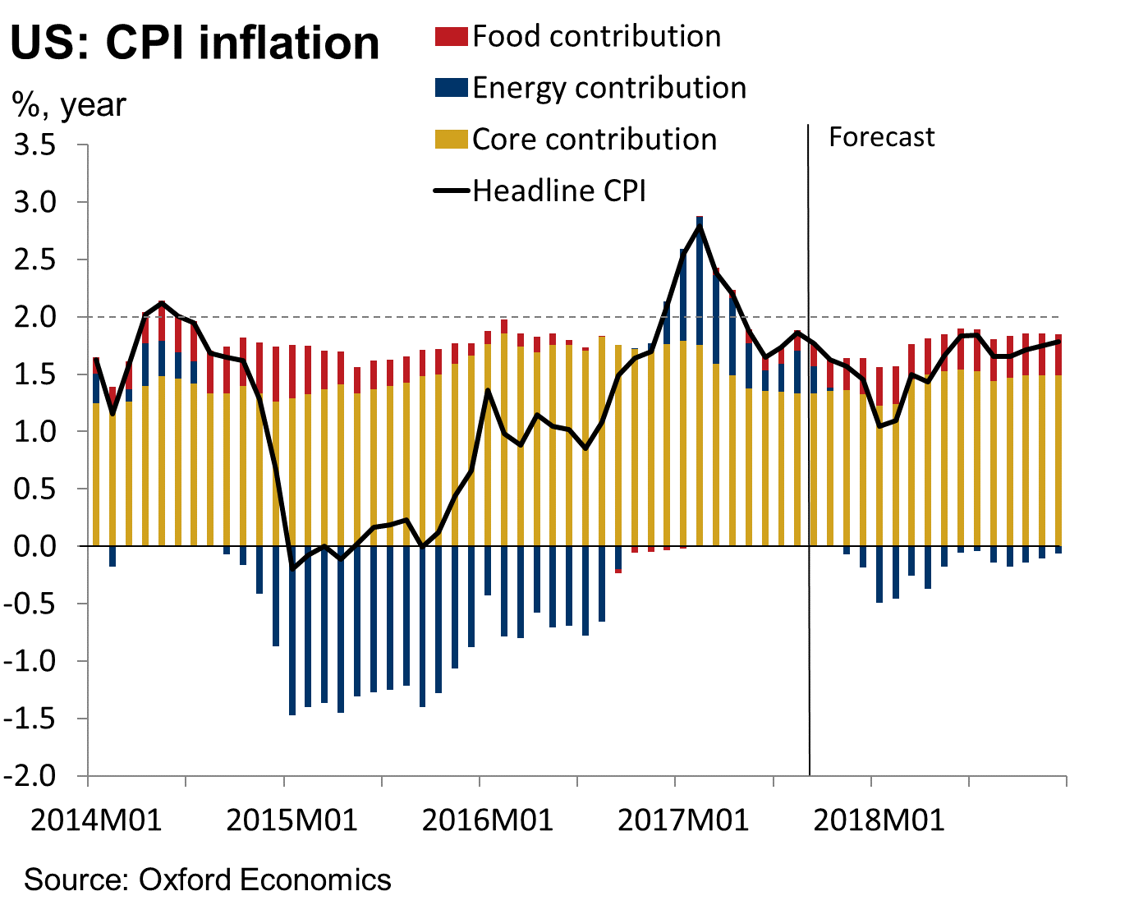

Inflation Stubbornly Low

Yellen focused on issues pertaining to inflation and labor in her address. Although it’s been nearly 100 months since the last recession (the average period between recessions since World War II is 58 months), with strong job growth that has brought unemployment to 4.4 percent, the inflation rate has been persistently below the Fed’s 2 percent target. In the years following the Great Recession, this wasn’t seen as unusual since it took years for the economy to recover. But the persistence of low inflation eight years into the recovery is a puzzle.

Theories abound on why inflation remains low, including the impact of foreign trade, health care cost containment, energy and food costs, reduced utility costs, pricing transparency brought about by e-commerce and labor market slack. Most of those factors, though, are temporary and don’t fully explain ongoing lower cost increases.

“Economists’ understanding of exactly how and why inflation expectations change over time is limited,” Yellen said.

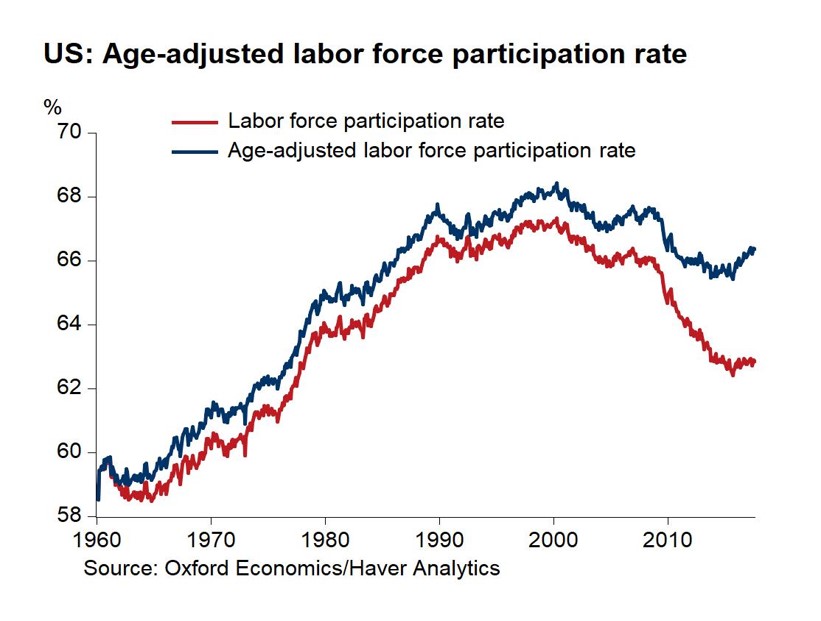

Labor Market Slack

Persistent labor market slack is also becoming harder to explain, with low unemployment and indicators such as the labor turnover rate signifying a strong market. One possibility is that what appears to be full employment (which traditionally would herald above-trend wage increases) is misleading, given the still-high number of workers in part-time jobs and the low workforce participation rate. Only 78 percent of 25- to 54-year-olds are working, still 2 percentage points below the 2007 cycle peak and 400 basis points below the level in 2001, per the Bureau of Labor Statistics.

“On balance, the unemployment rate probably is correct in signaling that overall labor market conditions have returned to pre-crisis levels,” Yellen said. “But that return does not necessarily demonstrate that the economy is now at maximum employment because, due to demographic and other structural changes, the unemployment rate that is sustainable today may be lower than the rate that was sustainable in the past.”

One policy suggestion that has support from economists on both ends of the political spectrum is the expansion of the Earned Income Tax Credit (EITC), which provides a benefit of up to $6,269 for low-income workers. The idea is to boost incentives to young workers in their 20s, when labor force attachment is developed.

The Trump administration’s economic policy is centered around getting the underemployed and workforce dropouts back into the fold. Office of Management and Budget Director Mick Muvaney told an audience at NABE that the administration’s tax plan (which had yet to be announced) would gradually increase GDP from 2.3 percent in 2017, to 3 percent in 2020, and thereafter. Mulvaney said that lower corporate and personal taxes, repatriation of overseas revenue, reducing regulatory burdens on business, reducing welfare payouts and other policy changes would incentivize workers to take full-time jobs and companies to invest more in the U.S.

GDP growth is a function of the increase in laborers and higher productivity. Asked where the growth in the workforce would come from to produce high projected growth rates, Mulvaney pointed to the low workforce participation rate.

Whether it is feasible to expect workers that have dropped out of the labor pool to return is an open question. It remains unclear why some workers have not returned, given the tight labor market. A rising number of people are on disability and work part-time or in transitory jobs. To some extent, there is a mismatch between the jobs and the skills of the labor force. Austan Goolsbee, economics professor at the University of Chicago Booth School of Business, said a key element was lagging educational achievement that has coincided with the stagnation of wages in recent decades.

Another issue is location. Job growth is concentrated in select urban areas. Half of all jobs created in the U.S. are in 75 of the country’s 3,000 counties, per the McKinsey Global Institute. It’s not clear whether workers outside those markets know about open jobs, have the education to fill them or the means or motivation to move.

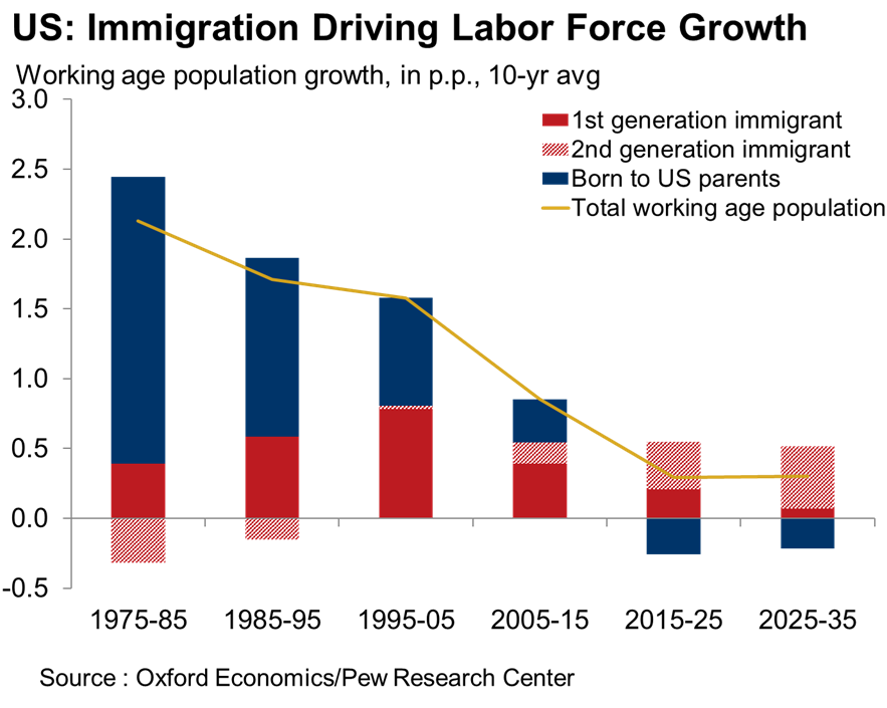

Immigration Essential For Growth

One traditional source of growth in the labor pool in America is immigration, but whether that continues is uncertain, given the Trump administration’s push to expel people who came to the country illegally and plans to reduce legal immigration. Those policies are particularly difficult to square with demographics and the need for skilled young workers. Reducing immigration would eliminate one of the economic advantages of the U.S. compared to developed countries in Europe and Asia, where stagnating or declining populations of young, productive workers has led to weak growth.

Due to the declining birth rate, the proportion of new workers entering the U.S. labor force that were born to American parents has gradually diminished in recent decades and will turn negative over the next 20 years, notes Gregory Daco, chief U.S. economist for Oxford Economics. Lower immigration and protectionist trade policies are risks that could erode GDP growth, he said.

Consensus: More of the Same

The consensus of NABE economists calls for continued moderate GDP growth, robust employment growth, a slight uptick in inflation and rising Fed policy rates. Although the economists foresee little chance of a recession in the near term, the balance of risk is on the downside due to potential policy mistakes in areas such as immigration and tariffs.

Rates will rise as the Fed increases policy rates and begins to unwind its massive $4.5 trillion securities portfolio that was accumulated through its two quantitative easing (QE) programs in the wake of the global financial crisis. Yellen said the QE programs reduced interest rates by about 100 basis points, but the unwinding of the Fed portfolio will not push bond yields up a corresponding amount because it will be slow and gradual. Higher rates could increase the cost of debt and push commercial real estate prices down.

Yellen said uncertainty was reason to act on the cautious side and continue to gradually push rates higher, which should prevent inflation from rising too far above the 2 percent target and prompt the Fed to act in a way that would create the risk of recession. Higher rates also give the Fed room to maneuver if GDP growth was to dip in the future.

“(S)tandard empirical analyses support the (Federal Open Market Committee’s) outlook that, with gradual adjustments in monetary policy, inflation will stabilize at around the FOMC’s 2 percent objective over the next few years, accompanied by some further strengthening in labor market conditions,” Yellen said. “But the outlook is uncertain, reflecting, among other things, the inherent imprecision in our estimates of labor utilization, inflation expectations and other factors. As a result, we will need to carefully monitor the incoming data and, as warranted, adjust our assessments of the outlook and the appropriate stance of monetary policy.”

You must be logged in to post a comment.