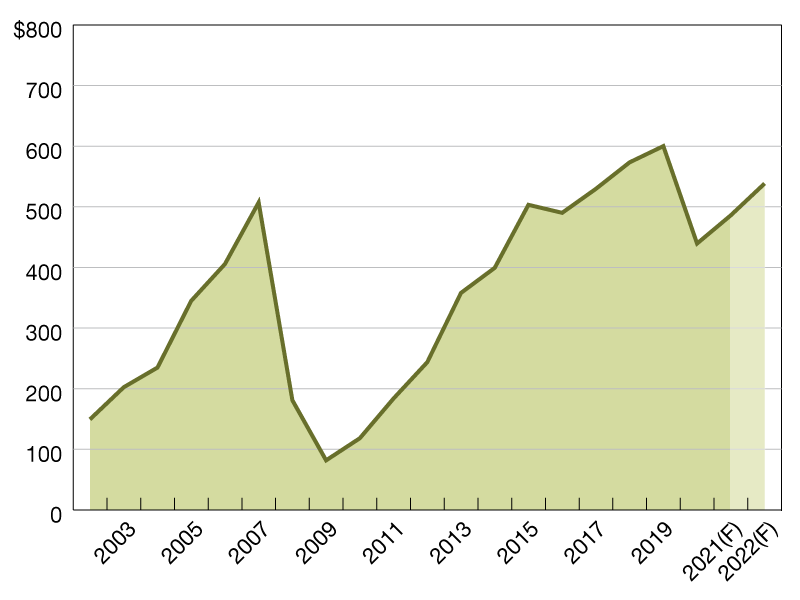

Commercial/Multifamily Lending to Increase 11% to $486 Billion in 2021

MBA is forecasting for commercial and multifamily mortgage bankers to close $486 billion of loans backed by income-producing properties in 2021.

$ in billions

It was nearly a year ago that I penned a blog post with this opening sentence: “Last week, the week of Feb. 24, 2020, financial markets recognized that the Coronavirus has arrived in the United States.”

Little did we know that now a year later, just how much the world, our lives and the commercial real estate industry has changed. The COVID-19 pandemic took a heavy toll on commercial and multifamily property sales and mortgage originations in 2020, but not equally. The impacts have varied significantly by property type and capital source–with lodging and retail feeling the greatest downward pressure. The multifamily sector held up far better, driven by refinance activity in government-backed loans.

The steep declines in mortgage borrowing and lending seen last year should partially reverse. And the economic rebound MBA anticipates in the second half of the year should bring greater stability to the markets, but with continued differentiation by property type. Ultimately, much of the path forward will depend on the virus and our confidence and ability to move past it.

What does borrowing and lending activity look like this year? MBA is forecasting for commercial and multifamily mortgage bankers to close $486 billion of loans backed by income-producing properties in 2021, an 11 percent increase from 2020’s estimated volume of $440 billion.

Total multifamily lending alone, which includes some loans made by small and midsize banks not captured in the overall total, is forecast to rise to $323 billion in 2021–a 7 percent increase from last year’s estimated total of $302 billion.

As we learned last year, unforeseen events can change market conditions at any time. The last three months of 2020 were stronger than earlier quarters for borrowing backed by commercial and multifamily properties, and with several vaccines in distribution, a “new normal” will hopefully be just around the corner.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.