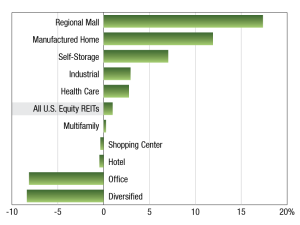

Total Return

2018 REIT Returns

As of October 31, publicly traded U.S. Equity REITs posted a 0.98 percent one-year total return.

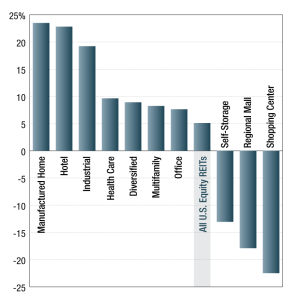

REIT Returns

As of Nov. 3, publicly traded SNL U.S. REIT Equity Index posted a 13.7 percent one-year total return.

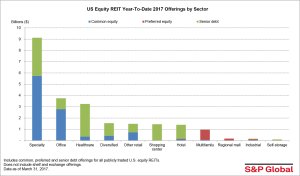

Specialty REITs Raise Most Capital Year-to-Date

The specialty sector raised $25.9 billion in capital year-to-date through Sept. 29, with communications REITs raising more than 40 percent of that total, according to S&P Global Market Intelligence data.

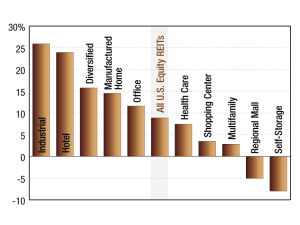

Industrial, Self-Storage REITs Performing Well

The two sectors were among the leaders of all publicly traded U.S. equity REITs in terms of the last 12 months funds from operations, according to S&P Global Market Intelligence data.

REIT Returns

Among the SNL U.S. REIT sector indexes, the manufactured homes sector recorded the highest one-year total return at 23.5 percent, beating the broader U.S. Equity REIT index by 18.4 percentage points.

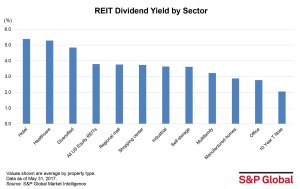

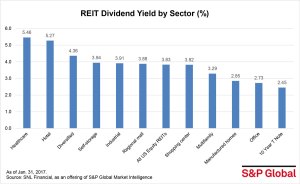

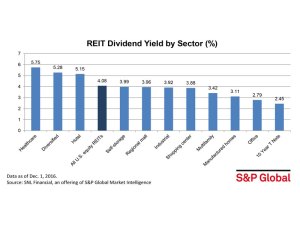

Hotels Hit Highest Dividend Yields

The hotel sector posted the highest one-year average dividend yield among all U.S. equity REIT sectors, according to S&P Global Market Intelligence data, outperforming the broader SNL U.S. REIT Equity Index.

Specialty REITs Top Capital Raising

Publicly traded U.S. REITs raised some $23.4 billion through capital offerings in the first three months of 2017, with senior debt offerings making up the majority of the capital raises.

You must be logged in to post a comment.