Build-to-Suits: A Safe Bet for Developers, Investors

While industrial developers hit the brakes on speculative construction during the height of the COVID-19 crisis, plans for build-to-suit projects progressed.

Camp Creek 4850 is a 210,180-square-foot distribution center for Porsche Cars North America in Atlanta, developed by Duke Realty Corp. Photo courtesy of Duke Realty Corp.

While industrial developers hit the brakes on speculative construction during the height of the COVID-19 crisis this spring, plans for build-to-suit projects progressed. Duke Realty Corp. was among the major players that continued with several BTS developments.

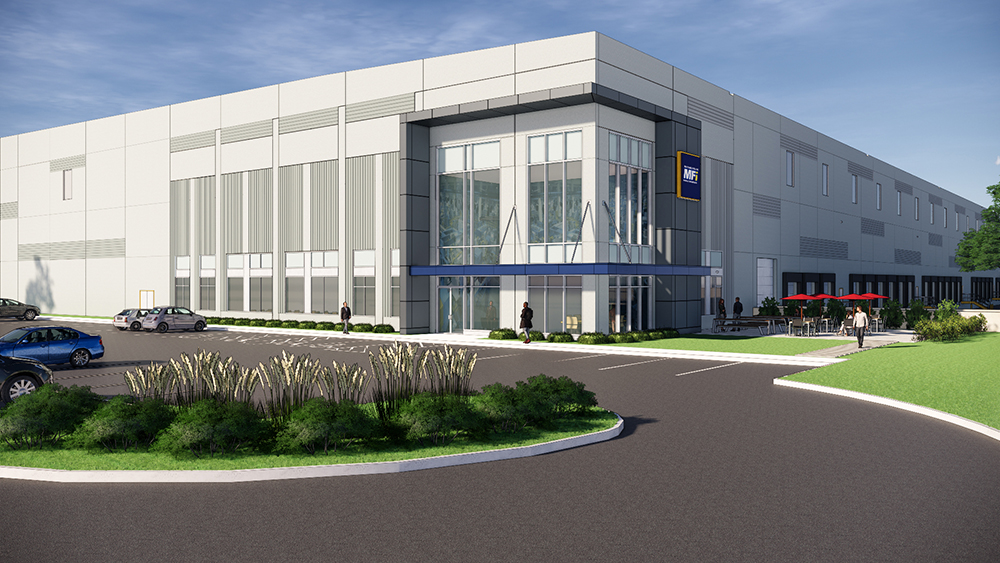

One of those projects is on Duke-owned land near interstates 81 and 78 in Pennsylvania’s Lehigh Valley—a 615,600-square-foot build-to-suit warehouse for wholesale tire distributor Max Finkelstein Inc. Located at Central Logistics Park 100 in Myerstown, Pa., the building includes 7,000 square feet of office space, and features 45-foot clear heights, a state-of-the-art fire protection system and LED lighting.

READ ALSO: CBRE Capital Markets to Act as Agent for Duke’s $800M Industrial JV

The project was completed during the pandemic and delivered in June, before the end of the second quarter, according to Steven Schnur, Duke’s executive vice president & COO, who noted that Max Finkelstein was a new client that had also been considering speculative sites.

“Ultimately they saw an advantage in getting their own building designed how they wanted and still being able to meet their timing,” Schnur said.

Other Duke BTS developments slated for delivery before the end of the third quarter include Camp Creek 4850 in Atlanta, and Steel Run Logistics Center, a 1.3 million-square-foot center for Home Depot in Perth Amboy, N.J.

Steel Run Logistics Center is a two-building redevelopment for Home Depot in Perth Amboy, N.J., developed by Duke Realty Corp. Photo courtesy of Duke Realty Corp.

Pennsylvania’s Lehigh Valley, Northern New Jersey and Atlanta are among the high-barrier-to-entry markets where Duke owns land. “We’ll continue to be active in build-to-suit in all 20 of the markets we’re in,” Schnur said.

Cost-effective alternative

Increased specialization is also driving the BTS move for many industrial tenants, explained James Koman, the CEO of ElmTree Funds, a real estate private equity firm that manages capital for institutional and private investors and is active in the industrial BTS sector.

“It’s cheaper if you have the time to do the build-to-suit rather than jump into spec space and have to shoehorn to make it work,” said Koman.

BTS industrial assets are highly sought after by institutional investors. “It’s relatively new construction, reduced risk, increased cash flow and minimum cash outlay for capital expenses and tenant improvement allowances,” said Koman.

Tenant Risk Assessment, a commercial real estate consulting firm, has worked on several BTS deals since March. “You have very good insight into the type of credit you are getting,” said CEO & Principal Bradley Tisdahl, who compares a BTS to a sale-leaseback, because it’s easier to turn those deals into a bond.

Central Logistics Park 100 is a state-of-the-art warehouse facility for Max Finkelstein Inc., near Pennsylvania’s Lehigh Valley. The Myerstown, Pa., property also features 7,000 square feet of office space. Photo courtesy of Duke Realty Corp.

“Raising the capital, whether debt or equity, into a project is much easier when you have a credit tenant in that respect,” Tisdahl said. “It’s also a very good way for a real estate company to mitigate some of the risk, and to offset some of the pressure for them to find a build-to-suit. They will be there for the long haul.”

Tisdahl said the build-to-suit deals he has seen in recent months have been in the energy and health-care and biotech sectors. Health-care and biotech deals have been active in the Boston/Cambridge market in Massachusetts and San Diego, Calif., while the energy-sector deals were taking place in Texas, Oklahoma and Denver. Koman also highlighted medical and health care suppliers, as well as home improvement, e-commerce and third-party logistics companies as those seeking BTS properties.

Sector Insights rotates among office/medical office, industrial, retail, multifamily, self storage and hotel/hospitality.

You’ll find more on this topic in the CPE-MHN 2020 Midyear Update.

You must be logged in to post a comment.