AXA Investment Managers Buys Into Trophy Oakland Office

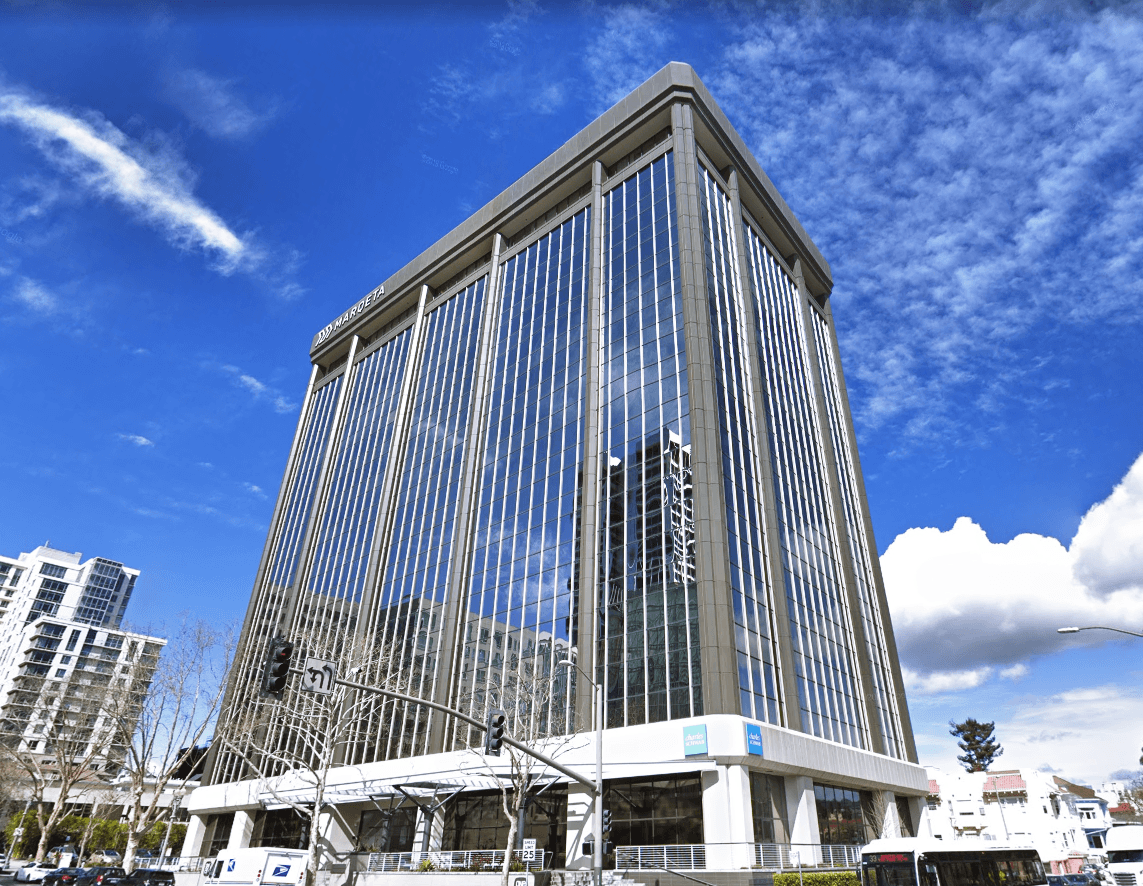

AXA IM took the majority stake in 180 Grand, a 15-story tower in downtown Oakland, in a joint venture with the previous sole owner.

AXA Investment Managers has completed, on behalf of a client, the acquisition of a 15-story, 279,000-square-foot Class A office building in downtown Oakland, Calif. The transaction was structured as a joint venture with Harvest Properties, in which AXA IM became the majority partner.

AXA IM did not reply to Commercial Property Executive’s request for additional information, including the building’s seller. However, according to Yardi Matrix, sales data indicates that Harvest Properties had purchased the property in June 2017 from Ellis Partners for $119.2 million. The information further indicates that the sale was subject to an undisclosed loan from a private lender.

READ ALSO: Bain Capital Sells Life Science Campus for $255M

Located at 180 Grand Ave., in Oakland’s Uptown District, the property provides easy access to public transit, with a dedicated BART shuttle that transports tenants in two minutes to the 19th Street BART station, connecting downtown Oakland to Richmond, Antioch and the wider Bay Area. The LEED Platinum building reportedly is almost fully leased to a range of tenants that includes Harvest Properties, which has its headquarters there.

Amenities include a tenant lounge, fitness center, conference facilities, bike storage, electric vehicle charging points, an outdoor patio and access to an adjacent 10-story, 370-space parking garage. Completed in 1981, the property has undergone refurbishment, tenant improvements and renovations since 2015.

Absorption trending more gross than net

The 180 Grand transaction follows AXA IM’ acquisition last year of 1440 Broadway, an 89,000-square-foot office building, also in Oakland, and the purchase earlier this year of a Class A industrial property in San Bernardino, Calif. In a reminder of the company’s global reach, AXA IM sold a two-building office portfolio in Munich for $194 million in January.

The big news in Oakland’s office market is Kaiser Permanente’s plan to create one of the Bay Area’s largest corporate campuses at 2100 Telegraph Ave., encompassing 1.6 million square feet. The Thrive Center will house 7,200 physicians and other employees, according to a second-quarter report from Cushman & Wakefield. The development will—unfortunately for Oakland office owners—eventually put 1.5 million square feet across five buildings back on the leasing market, as Kaiser Permanente consolidates personnel at the new campus.

Oakland’s CBD currently has an average direct vacancy of approximately 10 percent on an inventory of about 12.7 million square feet. Average asking rent for Class A space in the CBD ranges from $4.92 to $5.34, again according to Cushman & Wakefield.

You must be logged in to post a comment.