2021 Commercial REIT Results

As of Dec. 1, office REITs had the highest average AFFO payout ratio estimate at 73.2 percent, according to S&P Global Market Intelligence.

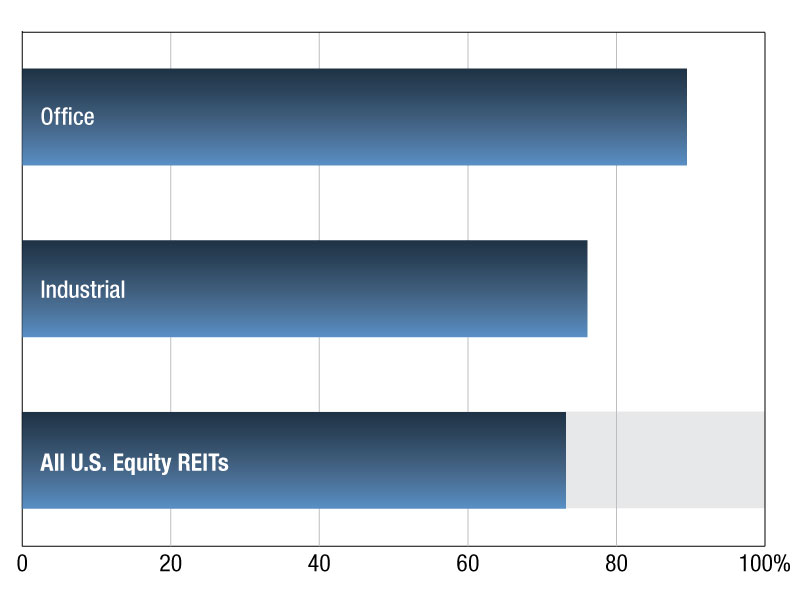

US Equity REIT Average 2021 Q3 AFFO Payout Ratio Estimate

As of Dec. 1, publicly traded U.S. equity REITs had an average 2021Q3 AFFO payout ratio estimate of 73.2 percent.

Among these sectors, office REITs had the highest average AFFO payout ratio estimate for the third quarter of 2021, at 89.5 percent. The industrial sector followed with an average AFFO payout ratio estimate of 76.1 percent.

Winzen Matamorosa is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Dec. 21, 2021

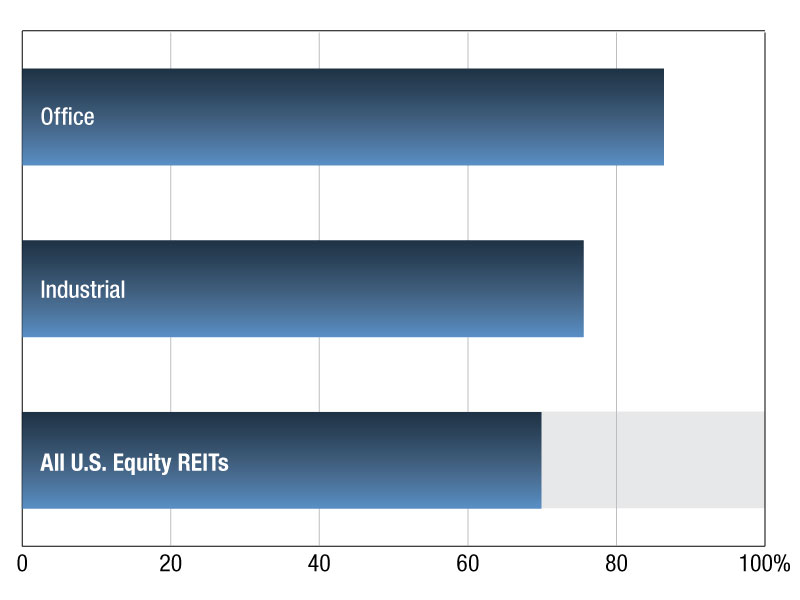

U.S. Equity REIT Average 2021 Q2 AFFO Payout Ratio

As of July 1, publicly traded U.S. equity REITs had an average 2021Q2 AFFO payout ratio estimate of 69.9 percent.

Among these sectors, office REITs had the highest average AFFO payout ratio estimate for the second quarter of 2021, at 86.4 percent. The industrial sector followed with an average AFFO payout ratio estimate of 75.6 percent.

George Ziglar is a Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Jul. 26, 2021

You must be logged in to post a comment.