The Great Reshuffling: Job Switches Across U.S. Cities & Industries

The post-COVID-19 labor market has undergone a series of significant transformations. Initially effected by the “Great Resignation,” the labor market shifted further as rising inflation rates compelled workers to actively seek higher-paying positions. Given that on-the-job raises and wage adjustments are typically small and infrequent, this economic pressure directly incentivized job switches, leading to a notable increase in job-to-job flow rates across various sectors.

The term “job-to-job flow” refers to the movement of workers directly from one employer to another without experiencing a spell of unemployment. It’s a key indicator of labor market fluidity and often reflects workers’ confidence in finding better compensation and working conditions. Of course, it’s worth mentioning that job switches might also be the result of personal needs and choices, rather than straightforward career advancement opportunities.

In any case, this study leverages comprehensive U.S. Census data to explore these dynamics through the lens of job-to-job flows across U.S. cities. Below, we provide in-depth insights into net flow data; analyze inside flow; and examine job-to-job movements across different age cohorts and specific industries to offer a granular understanding of the evolving post-pandemic labor market.

Key Findings:

- Decade-long nationwide job-to-job flows peaked in 2022, reaching 33 million switches

- Women are narrowing gap in terms of their share of national job-to-job flows

- Dallas & Houston boast highest gains in terms of net job transitions

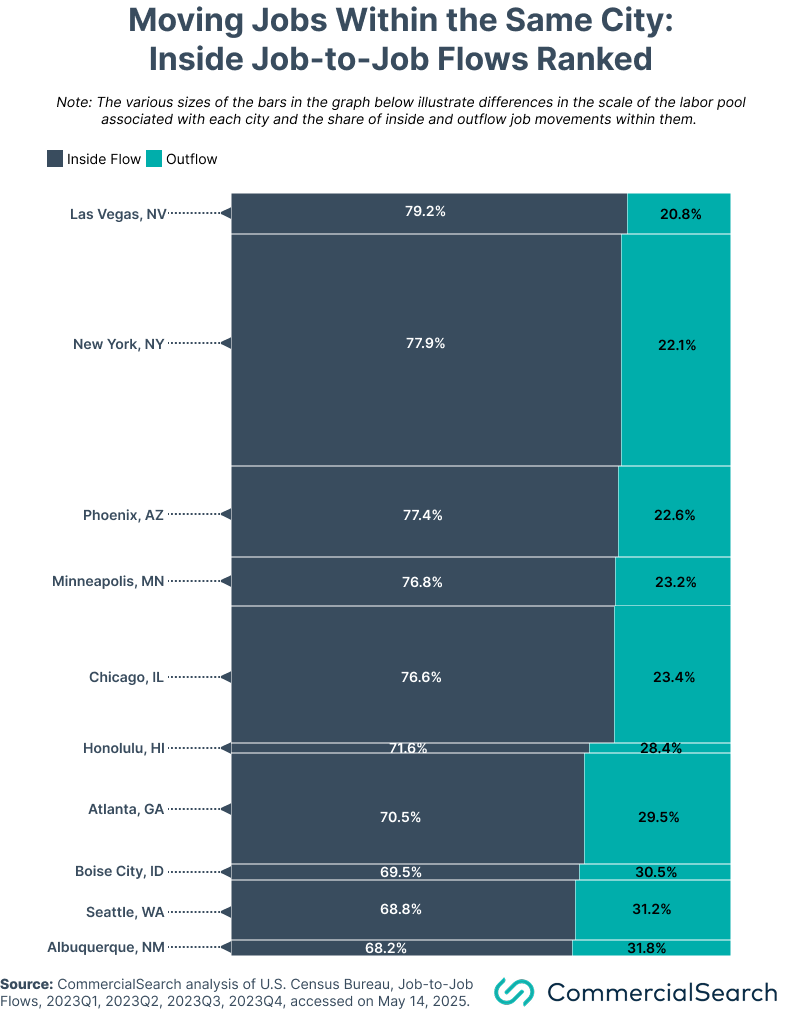

- 80% of job-to-job flows in Las Vegas & New York were internal (no relocation involved)

- Young workers make up bulk of total job switches across U.S. cities

- Double-digit job-to-job flows in healthcare, hospitality, retail & administrative services

Keep reading for more insights on worker movements and visit our methodology section for more information on the data sources of our analysis.

Inflation, Stagnating Wages & Work/Life Balance Make Job-Hopping More Prevalent

In recent years, a lot of public discourse has focused on the shift in work/life balance toward the latter — a de-emphasizing of careerism and a turn toward quality time with friends, family, and pursuit of hobbies and self-development projects. Nevertheless, as we look at the numbers throughout the entire decade, a more complex picture emerges.

While discussion around personal choices and priorities remains valid, job-to-job flow data at the national level suggests that Americans aren’t less interested in advancing their careers or position within the workplace — rather, they’re more interested.

Between 2014 and 2023, the total number of people who switched jobs continued to grow, effectively only recording a somewhat noteworthy dip at the very onset of the pandemic in 2020.

At the start of the decade, there were approximately 25 million job switches, later reaching as many as 33 million in 2022 and 30 million in 2023, according to the most recently available data. Although the Great Resignation placed some industries and employers under pressure to meet increased wage demands, salaries have not kept up with recent inflationary hikes: Having been stable at relatively low levels throughout most of the last 10 years, inflation rates shot up significantly after 2020, resulting in increased job-to-job flows.

Women are also increasingly more likely to be part of those who seek new opportunities in the labor market: The percentage of job flows that involved them increased from 46% to 49%. Of course, this is also partially due to how women were disproportionally affected during the early days of COVID-19, when many quit their jobs to handle child or elderly care duties, as previously documented by CommercialCafe.

Dallas & Houston Boast Largest Net Gains in Job-to-Job Flows

Job-to-job net flow refers to the difference between inflow (the number of workers entering a metro area for a new job) and outflow (the number of workers leaving their original metro area to take on a new position). This metric is crucial for understanding labor market dynamism, wage growth (as workers often switch for better pay) and the reallocation of talent to more productive firms.

Mapping the data, we can immediately see how the largest net gains are concentrated across the South — particularly in Dallas and Houston, as well as Phoenix, Las Vegas and Atlanta. By contrast, major coastal metropolitan areas (Los Angeles, San Francisco, New York and Miami), as well as Chicago, recorded the most significant net losses.

Notably, 2023 was a busy year for Dallas: Roughly 338,921 workers from the city took jobs that required them to move out of the metropolitan area, whereas another 353,402 moved in. That means an extra 14,481 people now work in Dallas with women making up 53% of the total number. As a result, the Texas city was the winner in terms of job-to-job net flow among the entries on our list.

Here, most of the migration was intra-state with the majority of these population movements happening between Dallas and Houston — 21% of all those moving in coming from Houston and 22% of those moving out, going to Houston. Another important city was Austin (12% of total incoming as well as outgoing moves). Meanwhile, approximately 3% of Dallas residents who left their jobs did so to move outside of Texas (New York and Chicago were the main destinations).

Next, another Texas metro landed in second place: Houston’s workforce grew by 10,384 at the end of 2023 with most of its incomings being job-seekers who moved in from Dallas; Austin, Texas; and San Antonio. In contrast to Dallas, the gender distribution across net flow numbers for Houston is in favor of men this time (54%, as compared to women’s 46%).

Then, Phoenix and Nashville, Tenn., occupy the third and fourth places, respectively, with similar net gains. Of the 9,327 residents added to Phoenix’s labor force, 62% were men. And, compared to Dallas or Houston, a larger proportion of those moving in come from outside Arizona. Specifically, inter-state relocations show Los Angeles, Chicago, Seattle and Dallas as the main contributors of inbound workers in Phoenix.

Not far behind, Nashville, Tenn., had a net flow of 9,289 residents at the end of 2023 with most of the job-seekers moving in (16%) coming from small towns that aren’t part of any metropolitan areas in Tennessee. This is mainly due to the city’s more diversified economy and labor market when compared to in-state rivals like Memphis and Knoxville, which attract more specialized profiles in industries such as health care, logistics and transportation. In terms of job-to-job inflows to Nashville from other states, Atlanta, Chicago and New York are the front-runners.

Despite boasting the highest inflow numbers across the cities included in our analysis with 355,720 people moving in to start a new job, Los Angeles ended up with a negative net flow by losing some 18,882 residents throughout the surveyed period. The bulk of these movements happened within California with the main destinations for both departures and arrivals closely mirroring each other (Riverside, San Diego, San Francisco and Sacramento).

Miami also recorded negative job flows (-15,169) during the same period with most of its exits transitioning in-state to Orlando, Tampa and Jacksonville.

However, it was New York that took the biggest hit in this regard: With a net job-to-job flow of roughly -20,000, its losses ended up benefitting Philadelphia and, to a lesser extent, Trenton, N.J., as well as New York’s Albany, Buffalo and Rochester.

For details on other cities included in our analysis, use the tool below to select a location and find out more about job inflows and outflows.

Nearly 80% of Workers Who Switched Jobs in Las Vegas & New York Did So Without Relocating

“Inside job-to-job flows” track movements between jobs that do not lead to relocation outside of one’s original metropolitan area. A strong inside job flow can point to a large employer entering the local economy and hoovering up top talent or to segments of the workforce trying to switch to career paths that are seen as providing better wages and development opportunities.

Among the cities included in our analysis, Las Vegas stood out for the percentage of inside job flows across its total job-to-job flows. Here, some 79% of the people changing jobs throughout 2023 did so without moving out of the metro area. In terms of raw numbers, that translates to just more than 200,000 out of 257,529 total job switches.

As you might expect, accommodation and food services witnessed significant movements, contributing to roughly one-quarter of total job flows in Nevada. Furthermore, in 2023, Las Vegas was the scene of intense negotiations regarding workers’ salaries as the Culinary Union obtained important wage increases and contractual protections to mitigate technology’s influence on the labor force. However, job security is far from a foregone conclusion as hotel managers and industry leaders continue to push technologies that streamline operations.

In second place, New York has a similar inside flow percentage (78%), but at a much larger scale in terms of actual numbers. Throughout the surveyed period, roughly 1.1 million people switched jobs without relocating. Here, recruitment for health care and social assistance were a pivotal driver of total job-to-job flows.

Across the country, Phoenix secured third place with 77% of those who switched jobs throughout the year doing so within the city. That means a flow of some 439,373 people — nearly double the total of what was recorded in 2023 in fourth-place Minneapolis. Administrative and waste management services experienced the highest percentages of total job flows (16%) in Phoenix, whereas, in Minneapolis, it was health care and social assistance (14%).

22 Million Millennials & Gen Z Workers Changed Jobs Post-Pandemic

At the national level, around 30 million people within the major working-age cohorts switched jobs in 2023. More precisely, data shows that younger workers switch jobs more frequently. Millennials are the most active group in this regard with 14 million job transitions, followed by Gen Z with 8 million. By comparison, Gen X and Baby Boomers recorded a combined 7.5 million switches.

New York topped the list for all age cohorts for this metric with just more than half of its total of 1.4 million job flows being comprised of Millennials. One-quarter of them — an estimated 362,457 people — were Gen X and older workers making the switch.

At the same time, more than 500,000 working Millennials took on a new job in 2023 in Los Angeles and some 463,992 in Dallas to close out the top three for this age cohort. Given the South’s growth numbers in various economic metrics; its ability to both attract talent from across the state and outside; and its increased capacity to retain and nurture local talent, this is hardly a surprise. In fact, in terms of the top 20 cities for job to job flows among Millennials, Southern entries made up nearly half of the list with a total of approximately 2.1 million switches.

Gen Z has also been on the move and, once again, outside of New York City, the most significant number of movements between jobs for this age group was recorded in the South: In Dallas, some 244,816 Gen Z workers changed their workplace in 2023, outranking the likes of Chicago and Los Angeles.

Double-Digit Job-to-Job Flows in Hospitality, Health Care, Retail & Administrative Services

A handful of industry sectors stood out in terms of job-to-job transition percentages throughout 2023. For instance, accommodation and food services made up an estimated 15% of total switches as many former hospitality workers sought employment in new fields in the years following the outbreak of COVID-19.

As a matter of fact, across most U.S. cities in our list, job flow rates for this sector are in the double digits, hovering around 14% to 16%. Outliers include prime resort and leisure destinations — such as Flagstaff, Ariz. (36%); Atlantic City, N.J.; Myrtle Beach, S.C.; and Kahului, Hawaii (each with 31%) — as well as Las Vegas with nearly one-quarter of the total job-to-job switches happening in the accommodation and food services industry. At the other end of the spectrum, in Trenton, N.J., less than 10% of job flows occurred in this sector.

Otherwise, approximately 13% of job transitions across the U.S. were tied to retail trade, in addition to health care and social assistance and administrative services. High turnovers, low barriers to entry, and the seasonal nature of many of these jobs explain some of the movements we’re seeing, but there’s also the fact that demanding and stressful working conditions for relatively modest wages means that there’s increased difficulty in recruiting workers for these roles.

The health care industry, in particular, experienced significant job growth in 2023, outpacing other industries. This was partly due to increased demand for services and the need to replace workers who left due to burnout or other reasons during the pandemic. Remarkably, Rochester, Minn., witnessed more than double the national flow rate for this sector with 29% of the city’s total job transitions happening across health care and social assistance — with the Mayo Clinic being a significant driver of job demand the region. Not to be outdone, McAllen, Texas — whose Rio Grande Regional Hospital was named as one of the best places to work in health care in 2023 — and Springfield, Mass. (a city with an aging population in which the sector is one of the most significant employers) also stood out with 22% of total job transitions within this field.

At the same time, an estimated 40% of total job-to-job flows in Pinehurst, N.C., happened within the administrative services sector. For reference, that translates to 1,152 people changing jobs in 2023 in a city with an overall civilian labor force that totals just more than 7,000. Clearly, the demand for administrative and support staff generated by the city and wider metropolitan area’s growing health care sector likely offered both new employment, as well as advancement prospects for professionals in this field.

Meanwhile, for retail workers, inflationary costs have exacerbated their needs for higher incomes. Given the limited options for advancement to higher-paid positions within the industry, this often leads people to new opportunities outside these sectors. Partially as a response to these movements in the labor pool, retail and food service operators have also started implementing automation into their workplaces to mitigate recruitment issues.

Methodology

“Job-to-job flow” refers to the total number of job switches that involve a change of employer. The metric involves both internal movements, as well as relocations across metro areas for a new position.

“Inside flow” refers to the number of workers who changed jobs within the same metro area, meaning both origin and destination jobs are in the same metro.

“Outflow” refers to the number of workers who left jobs in the origin metro area and took new jobs in a different metro area.

“Inflow” refers to the number of workers who left jobs in other metro areas and took new jobs in the destination metro area.

“Net job-to-job flow” refers to the difference between the number of workers entering a metro area for a new job (inflow) and those leaving the metro area for a job elsewhere (outflow).

Notes:

*The numbers represent the total job-to-job flows summed across all four quarters of calendar year 2023.

**If an individual changed jobs multiple times across different metro areas within the year, they are counted each time a transition occurs.

***Metro areas analyzed: 369.