How Positivity Is Building in CRE Circles

As the recovery continues, both the CRE Finance Council Index and RCLCO Market Sentiment Index rise to levels not seen in several years.

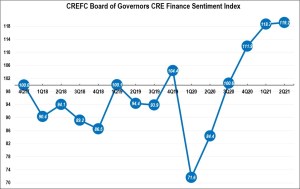

CREFC Board of Governors CRE Finance Sentiment Index. Chart courtesy of the CRE Finance Council

Against the backdrop of real progress against the pandemic and steady signs of economic recovery, new reports from both the CRE Finance Council and RCLCO show the extent of the CRE industry’s optimism about the next 12 months.

The CREFC report covers two surveys of the organization’s board of governors: A quarterly survey that has been ongoing since late 2017 and a special survey on COVID-19.

In the former, the CREFC Index has hit a record high of 119.7, in contrast to the baseline of 100 established in the fourth quarter of 2017. That’s also a slight increase from the first quarter—and overall a stunning rise from the low of 71.6 in the first quarter of last year, as the pandemic’s true effects on the CRE sector became visible.

More telling perhaps, 83 percent of the members of the board now have an overall positive sentiment for the CRE finance sector over the next 12 months, up from 72 percent in the previous quarter. Along similar lines, 85 percent expect more borrower demand for CRE debt over the next 12 months versus only 18 percent a year prior.

READ ALSO: What’s Keeping CRE Executives Up at Night

Eric Thompson, chair-elect, CRE Finance Council Board of Governors. Image courtesy of the CRE Finance Council

The second part of the CREFC report, which focuses on the pandemic’s effects, also reflects an upbeat outlook. For example, nearly one-third—or 31 percent—of board members said they’re seeing more transaction and lending activity today than before the pandemic.

Predictably, retail generates much concern (83 percent of respondents), while office assets are not far behind, with 69 percent expressing worry about post-pandemic demand.

A solid majority, or 62 percent of respondents, said they expect increases in foreclosure loans and REO assets in the months ahead but think these will be only low to moderate.

Eric Thompson, chair-elect of CREFC’s board of governors, said in a prepared statement that “foreclosure and REO assets have remained relatively low, and at levels well below those expected early in the crisis.”

Different angle, similarly upbeat

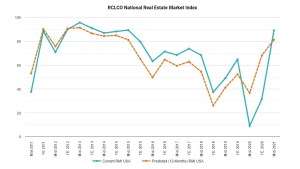

Unsurprisingly, the RCLCO Current Real Estate Market Sentiment Index (also benchmarked at 100) has been on as wild a ride as the CREFC.

The mid-year report, according to the consulting firm, “reflects strong optimism as vaccination rates approach herd immunity levels, business restrictions have been lifted, and a drop in cases nationally spurs the economy and real estate markets toward recovery.”

The RMI has surged 57.5 points in six months, from 31.6 at the end of 2020 to 89.1 in mid-2021—a high not seen since mid-2015.

Respondents—mostly C-suite individuals in their respective organizations—expect CRE market conditions to remain largely consistent in the near future, with only a modest decline to 81.3 over the next 12 months. According to the report, “This is still well above the long-term (since 2011) average of 68.8.”

One concern is construction costs. Seven of 10 respondents indicated that rising construction costs are a significant factor on CRE. Though these are likely to temper somewhat going forward, they’re nonetheless expected to still be an issue in 12 months.

In addition, looking ahead a year, most respondents see interest rates rising and capital flows to real estate increasing, though “there was less consensus over the expected performance of cap rates over the next 12 months,” the RCLCO report said.

You must be logged in to post a comment.